by Liz Ann Sonders, Brad Sorensen, Jeffrey Kleintop, Charles Schwab & Company

Key Points

- Along with new records being set by stocks, investor sentiment measures are showing widespread optimism; yet households’ exposure to equities is not at an extreme. We believe the bull market will continue, and suggest investors remain at their target allocations, but worry a bit about complacency.

- Third quarter earnings season has been solid so far and economic growth has picked up. But the pick of the next Fed chair could cause an uptick in volatility.

- Globally earnings have been strong as well and are helping to support stocks, but geopolitical and trade issues could cause some consternation.

There’s nothing to fear but…

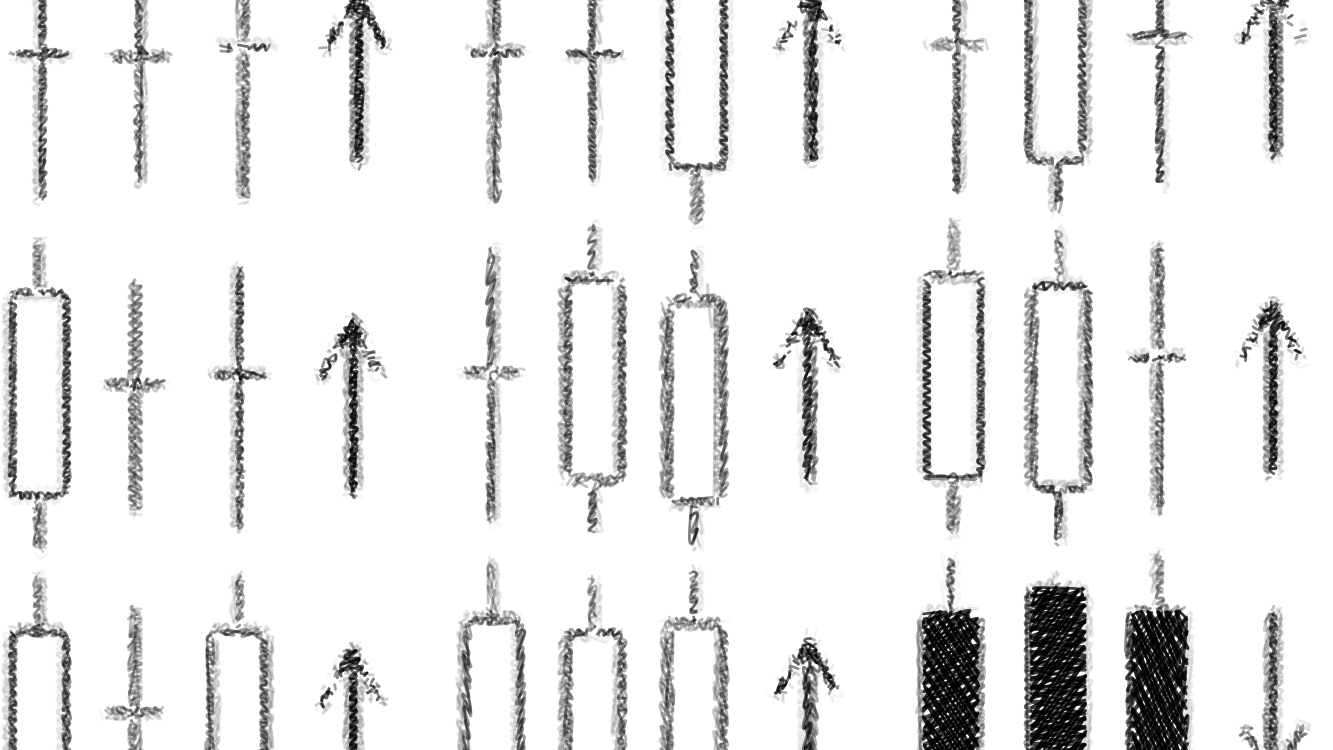

The ongoing uptrend in stocks has only recently seemed to capture the hearts and minds of investors. The recent lack of volatility and “Teflon” nature of the stock market has boosted investor optimism; but may have also bred complacency about ongoing risks. We expect more upticks in volatility.

Lack of fear causing fear?

Source: FactSet, Chicago Board Options Exchange. As of Oct. 24, 2017.

But stocks continue to surge

Source: FactSet, Standard & Poor's. As of Oct. 24, 2017. Past performance is no guarantee of future results.

As noted, most measures of investor sentiment have moved firmly into optimistic territory; with the Investors Intelligence survey showing a high in newsletter writer optimism not seen since 1987. But behavioral measures of sentiment don’t yet match that optimism: flows into domestic equity mutual funds and exchange-traded funds (ETFs) continue to be flat-to-negative on a cumulative basis. As we’ve been highlighting, it’s easy to argue that we are in the latter innings of the market cycle; even though past performance does not indicate future results that phase often ushers in strong performance.

Gains typically accelerate in the final innings of a bull market as investors become more confident and push more money into the equity pot. As John Templeton’s famous quote says, “Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria.” This bull market has fed off skepticism for much of its duration—only recently displaying optimism, but not yet euphoria. We believe the current bull market will ultimately be followed by a traditional bear market—at a point of either excess tightening by the Federal Reserve and/or the anticipation of an economic recession. Neither is in our sights; although there are enough risks that a pullback could occur with even a minor catalyst.

Who’s afraid of the big bad wolf?

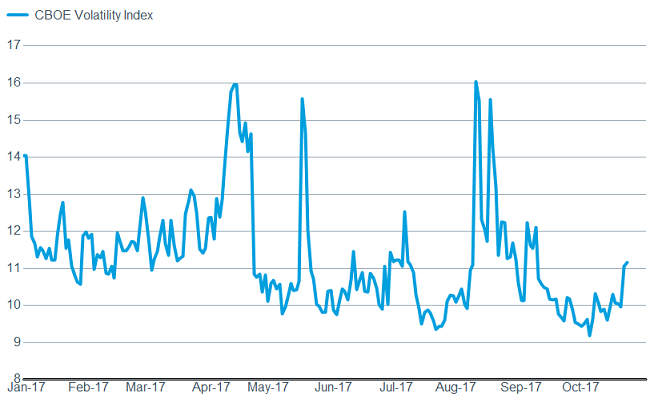

Although there will always be worries that an economic “wolf” is waiting around the corner, dressed up as grandma, waiting to devour unsuspecting bulls—the current economic expansion looks to be more a case of Goldilocks than Red Riding Hood to us. Inflation has picked up modestly, with the Consumer Price Index (CPI) posting a still-benign 1.7% gain year-over-year in the most recent reading. But a new broader measure of inflation put out by the NY Fed—called the Underlying Inflation Gauge (UIG)—shows a loftier 2.7% year-over-year increase. Last month, retail sales posted a robust 1.6% gain month-over-month, although some of that was likely hurricane related; while both the Empire Manufacturing Index and the Philly Fed Index helped confirm the boom-level Institute of Supply Management (ISM) readings. Additionally, we are in the midst of a period of synchronized global growth; with all 45 OECD (Organization for Economic Cooperation and Development) countries in expansion mode; and with confirmations from indicators such as copper, lumber, and the Baltic Dry Index (measuring shipping rates).

Global growth indicators are rising

Source: FactSet, Dow Jones & Co. As of Oct. 24, 2017.

Source: FactSet, CME Group. As of Oct. 24, 2017.

Source: FactSet, Baltic Exchange. As of Oct. 24, 2017.

Is it haunted?

Although some scary things can come out of Washington at times, we don’t think some of the investor fear is justified. Partisan conflict is high—both among and within parties—but it’s not something we fret to a significant degree. In fact, the Philadelphia Fed keeps a “Partisan Conflict Index,” and historically stocks tend to perform well when conflict is in its highest zone. We have been inundated lately by questions about the prospects for tax reform and the implications for stocks. Treasury Secretary Mnuchin recently told Fox News that the stock market would “see a reversal of a significant amount” if the tax deal the administration is pushing doesn’t get passed. While the lack of a deal would likely be disappointing, we don’t believe economists or analysts have yet built the expectation for tax reform into forward-looking estimates; so the effect is likely to be more psychological than numerical

Likewise, the nomination of the next Fed chair (and possibly vice chair as well) is expected any day. Candidates John Taylor and Kevin Warsh are perceived to be on the more hawkish end of the spectrum; while Jerome Powell and current chair Janet Yellen are seen as more dovish. This could have implications for short-term market volatility, but none of the candidates to this point are likely to make a kneejerk direction change monetary policy.

Earnings treats or geopolitical tricks in the future?

Earnings per share growth for global companies for the year ending in the third quarter were up 17% from a year ago for companies in the MSCI World index reporting through October 25, according to data from FactSet. The strong earnings outlook is important to where stocks are headed; but other developments may affect global markets in the weeks ahead, including: post-vote European economic data, the announcement by the European Central Bank (ECB) to taper asset purchases next year, and North American Free Trade Agreement (NAFTA) negotiations.

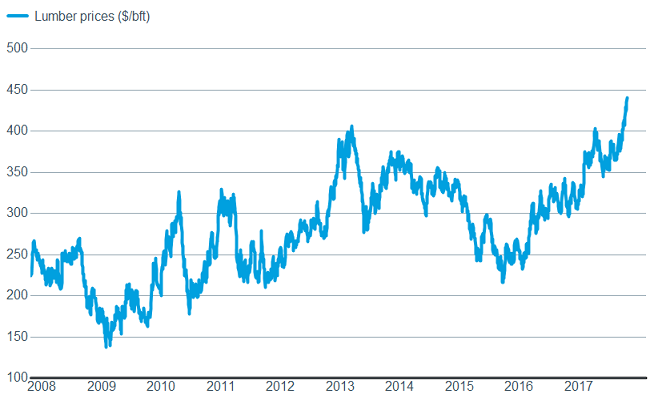

After a series of recent votes in Europe among regions seeking more autonomy from their national governments—including those in Spain and Italy—investors may be on watch for any signs of disruption in Europe's strong economic momentum. Fortunately, the widely-followed IFO business survey in Germany suggests further acceleration in the engine of the Eurozone economy, as you can see in the chart below. In October, the IFO's German business confidence index surged to its highest ever level in the 27-year history of the index.

German business leaders see improving conditions

Source: Charles Schwab, Bloomberg data as of 10/24/2017.

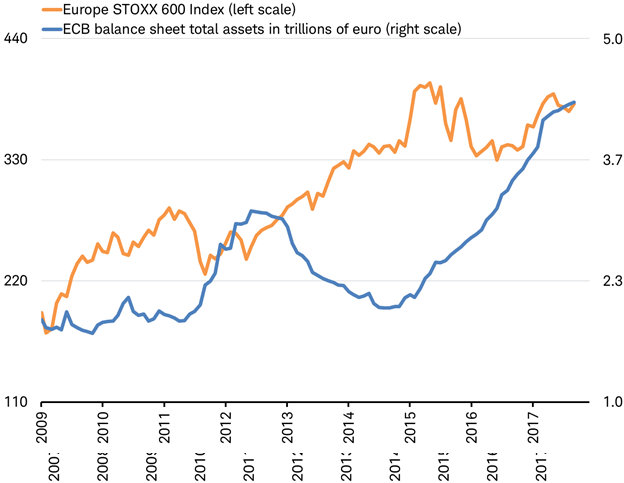

The ECB announced a plan this week to taper its asset purchases starting next year, from 60 billion euros a month to 30, slowing the growth of its balance sheet. However, Europe's stocks are unlikely to react negatively to the slower pace. As you can see in the chart below, during those years of slower growth or a shrinking balance sheet, stocks tended to post gains as earnings growth improved. In fact, there appears to be an inverse relationship between the size of the ECB’s balance sheet and the performance of the stock market on a near-term basis. Perhaps this is because the ECB has only felt confident enough to trim the balance sheet when growth was solid, as it is today. (For more on this subject see the recent article: How the Shift by Central Banks May Affect the Stock Market)

No relationship: the ECB balance sheet and Europe's stock market

Source: Charles Schwab, Bloomberg data as of 10/24/2017.

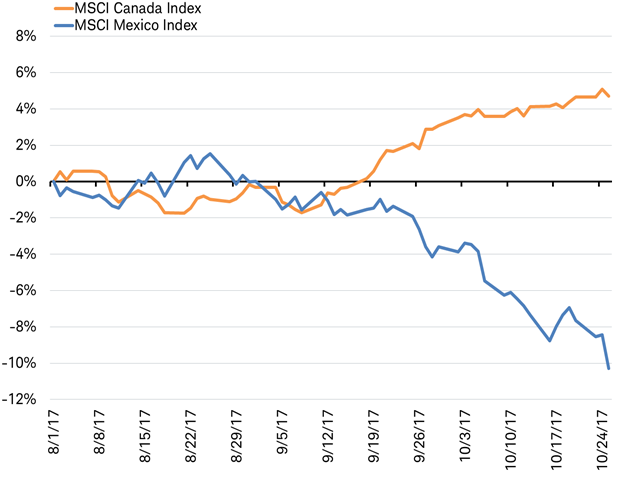

NAFTA negotiations hit a snag in October, with the Trump administration making demands to which Canada and Mexico would not agree (the U.S. Congress might not either, for that matter). It is too early to determine whether this is a negotiating tactic or a pivot to a new direction on trade policy. Those who are highlighting the risks point to the October trade tension coinciding with losses for Mexican stocks—yet the Canadian stock market has posted gains this month. Mexico's stock market slide is unlikely to have been solely about NAFTA talks; stocks have also been reacting to massive earthquakes and slowing economic momentum driven by fiscal and monetary policy tightening. Likewise, Canada's stock market gains were likely more a reaction to higher oil prices, which have historically driven its stock market, than trade talks. All parties have agreed to further talks as they seek a revised trade agreement by year end.

Snag in NAFTA negotiations driving stocks of member countries?

Source: Charles Schwab, Bloomberg data as of 10/25/2017. Past performance is no guarantee of future results.

So what?

Global and domestic economic growth, along with a solid earnings picture and a potential tax reform tailwind, suggest investors should remain at their target equity allocations. Pullbacks are possible but a recession doesn’t appear to be in the cards in the near term, which historically has meant the risk of a pullback turning into a bear market is low.

Copyright © Charles Schwab & Company