by Blaine Rollins, CFA, 361 Capital

Early corporate earnings have arrived and the reception is positive. Some big moves to the upside in IBM, Grainger, United Healthcare, Danaher and PayPal more than offset the disappointments in United Airlines, Genuine Parts and Procter & Gamble. The big surprise was at IBM where the company finally posted an upside revenue beat and forecast for acceleration, which was broad-based across divisions. This sent the perennial shorts scrambling to cover their positions and likely caused some long only tech money to finally shift into the name. No more kicking sand in Watson’s face.

This week will give us even more earnings data points to look through and evaluate. As we raise the bar for earnings expectations given last week’s results, there are a few other important items to keep an eye on. Over the weekend, Abe showed Theresa May how to win a super-majority as his party solidified their power within the Japanese government. Their stock market rewarded 14 straight days of gains with a 15th day. In the U.S., Congress will be legislating over tax reform while the POTUS makes his final decision on the next Fed Chair. It looks like a Powell/Taylor/Yellen decision but with the situation so fluid, maybe another name will emerge this week. Expect the bond market to be on edge for a final decision. Bond investors seem to be frightened of Taylor and like Powell. If it were up to me, I’d stand pat with Yellen. She has done a good job and the markets have rewarded. There is no way that I could fire any woman with the tidal wave of ‘girl power’ that has just washed over the globe. I would be very, very long the Wonder Woman ETF right now.

To receive this weekly briefing directly to your inbox, subscribe now.

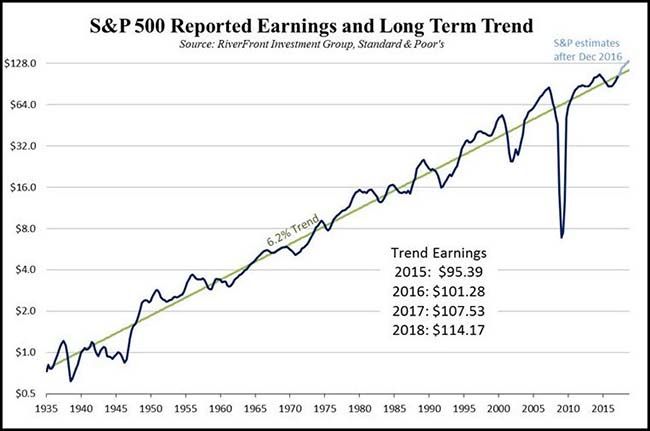

Why earnings are important to the market…

@HayekAndKeynes: Some perspective on the magnitude of the earnings collapse during the financial crisis & why this bull market has had such a strong recovery

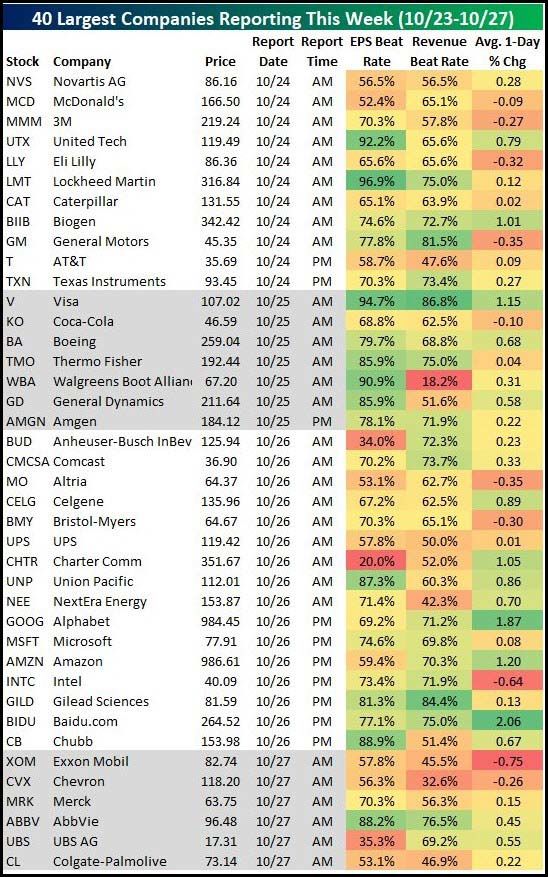

Corporate Earnings and Revenues beat rates are mixed with last quarter, but the post earnings stock movement has been much better than three months ago…

@bespokeinvest: From this week’s Bespoke Report, note how much better companies have been performing on earnings so far this season compared to last:

This will be another big week of earnings releases…

Bespoke has this good cheat sheet for you.

(@bespokeinvest)

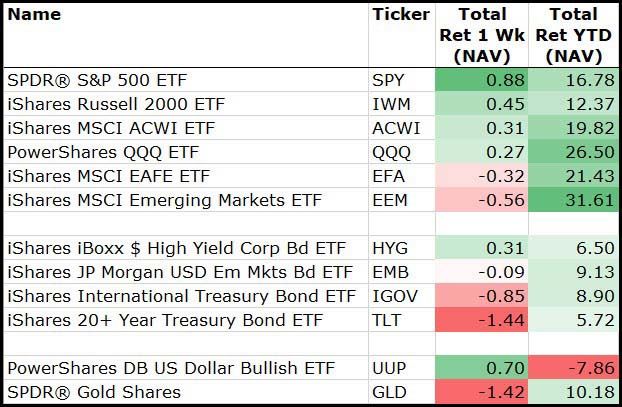

It was a risk-on week for the markets last week…

Bonds and Gold were lower, while Equities and JunkBonds were higher. The U.S. Dollar strength held back International assets.

(10/20/2017)

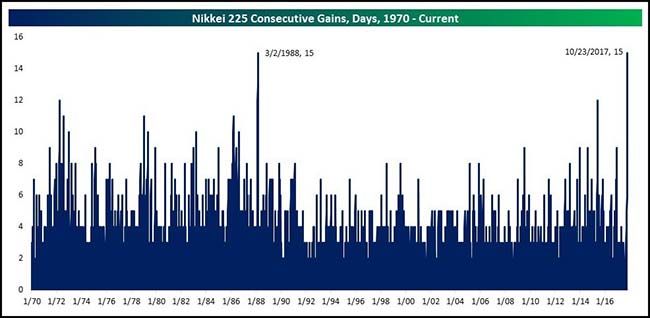

Within the International Markets, check out this run in Japan…

15 straight days of gains ties their record. Economic data points and politics seem to be all headed in the right direction. No question about whether or not to own the market. Your main decision is do you go long the currency or hedge it out.

(@bespokeinvest)

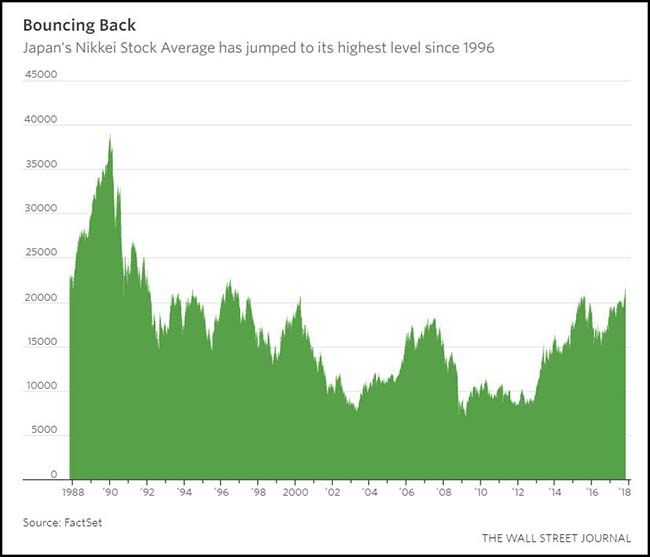

Just recovering back to levels from 21 years ago…

The Nikkei is up 13% this year, nearly all of it since early September after having vastly underperformed most global equity markets in 2017.

The market’s recent move higher has come in spite of the yen’s overall strength against the U.S. dollar: In the past, Japanese stocks have tended to perform well when the yen is weak, as that helps the profits of the country’s big exporting companies.

Analysts and investors cite strengthening domestic corporate earnings and signs of a strengthening economy as catalysts for the Japanese market’s recent surge to its highest level since 1996. It isn’t overly expensive, either. The Nikkei trades at about 17 times projected earnings over the next 12 months, roughly around its five-year average, according to FactSet. By comparison, many other markets, including the U.S., sport valuations that are much higher than average.

(WSJ)

I wonder if any stock brokers have stayed put for 28 years?

…the Nikkei has been stuck in a bear market for nearly 28 years, a long time compared with the U.S., where cycles are shorter, says MKM technical analyst Jonathan Krinsky. But it’s pretty normal for Japan. The Nikkei had a 28-year bear market from 1920 to 1948, before embarking on an extended bull market. Could Japan’s market be ready for a similar run? “There is an entire generation that has not witnessed a secular bull market for Japanese equities,” Krinsky says. “The fact that Japan is breaking above a 25-plus-year secular trading range should not be taken lightly.”

(Barron’s)

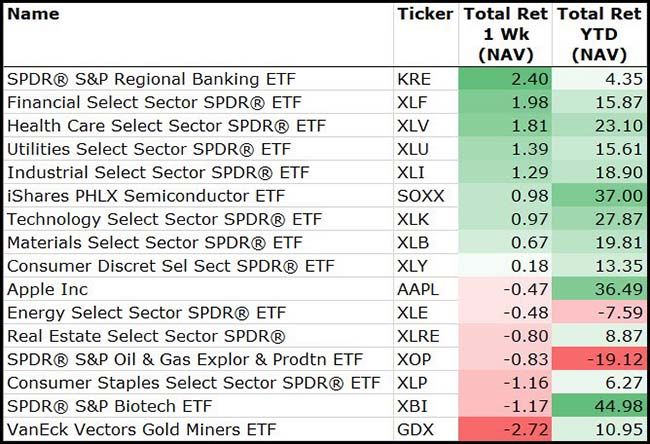

Among the sectors, last week also showed risk-on moves…

Staples and REITs finished lower, while Financials, Technology and Industrials moved higher.

(10/20/2017)

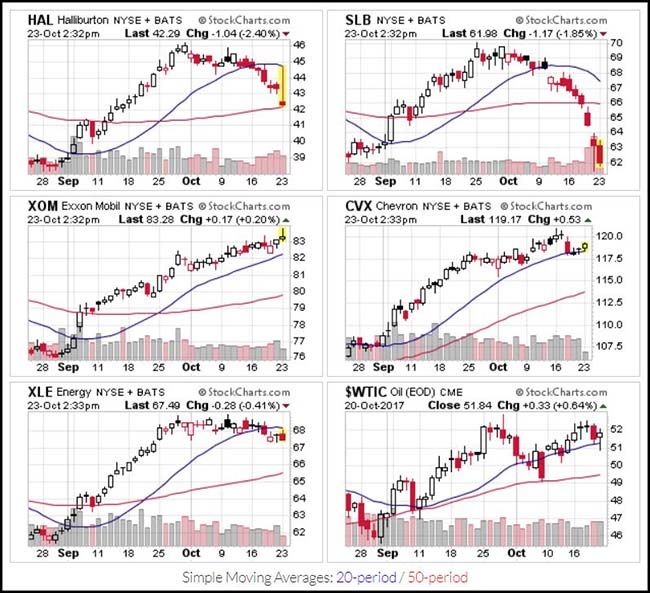

The energy sector is developing a split personality…

While the oil commodity and energy sector have trended flat in October after a solid gain in September. If you look down into the XLE components, you will see a major fracture among the returns. The oil service components (see Halliburton and Schlumberger) have fallen 10% while the major oil components (see Exxon and Chevron) have gained slightly. Why the difference? The major oils are more diversified and their activities are not weighted toward one business like the oil service industry, which is heavily weighted toward Energy capex. It also seems that sentiment is shifting toward the majors using less cash flow to invest in capex and instead return to shareholders (via dividend or stock repurchase). So, if you are looking to invest in the space be careful of going passive because there likely is a better way to invest.

The Treasury Secretary believes that the market will get hit if tax reform is not completed…

“There is no question that the rally in the stock market has baked into it reasonably high expectations of us getting tax cuts and tax reform done,” Mnuchin said in the interview. “To the extent we get the tax deal done, the stock market will go up higher. But there’s no question in my mind that if we don’t get it done you’re going to see a reversal of a significant amount of these gains.”

(Politico)

Goldman agrees that it could be a swing factor…

Tax reform remains the key potential upside and downside risk to equity markets. Our political economist sees a 65% probability that tax cuts are passed in early 2018. We estimate tax cuts could lift 2018 EPS by 7% to $148, suggesting that tax reform optimism has contributed to the 5% S&P 500 rally since late August. If developments in Washington lift the odds of tax reform closer to 100%, or hint at larger cuts than we currently expect, S&P 500 could continue to rise toward 2650. On the other hand, a collapse in expectations would likely mean the reversal of the market’s recent 5% rally.

(Goldman Sachs)

Looking at the economy, the consumers are ramping their spending…

“Consumers are spending, whether it is checks written, cash taken out of the ATM’s, P2P payments, and all the debit and credit cards, 5% more through the first nine months of 2017 than they did in the first nine months of 2016. That’s a faster growth rate than it has been in prior years.” –Bank of America CEO Brian Moynihan (Bank)

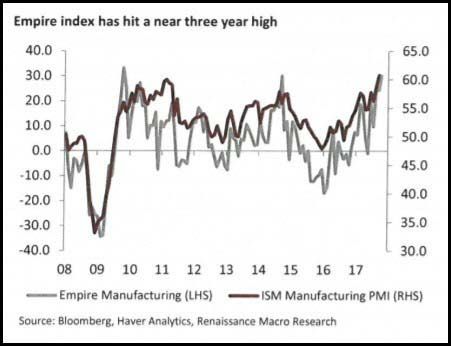

And the New York manufacturing index is breaking out to new highs…

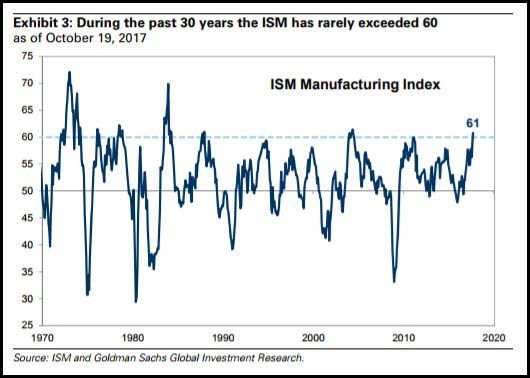

The broader ISM manufacturing index is also moving to highs…

Over in Europe, Junk Bonds are being upgraded at an amazing rate…

A blockbuster bond buyback by Tesco comes at a pivotal moment for fund managers owning European high-yield debt, with more cash chasing fewer bonds as bellwether companies vacate the speculative-rated debt universe. The shrinking of the European junk bond market reflects an increase in groups reclaiming a stronger credit rating, with their outstanding bonds leaving junk bond indexes and entering high-grade baskets. Anglo American exited Bank of America Merrill Lynch’s widely followed euro high-yield bond index at the end of August. Telecom Italia is just on the cusp of becoming another “rising star”, a term used for companies that return to investment grade. “As much as 8 to 10 per cent of the benchmark could leave us in the next six months and it’s hard to see a similar amount of fallen angel candidates compensating for the loss,” said Peter Aspbury, a portfolio manager at JPMorgan Asset Management.

A very large, contrarian, short bet against Italy by Bridgewater…

They obviously do not subscribe to the rule of betting with the 200-day moving average…

Bridgewater Associates is adding to its billion-dollar short against the Italian economy. The world’s largest hedge fund disclosed a $300 million bet against Eni SpA, Italy’s oil and gas giant, data compiled by Bloomberg show.

Bloomberg previously reported that Ray Dalio’s firm had wagered more than $1.1 billion against shares of six Italian financial institutions and two other companies. This latest bet is the hedge fund’s second-largest against an Italian company, trailing only the $310 million against Enel SpA, the country’s largest utility.

Bridgewater might have better success betting against the United Kingdom…

It is going to be difficult to replace all of the economic activity that Goldman Sachs and other exiting U.K. investment houses generate.

Looks like Third Point is enjoying these highly uncorrelated financial markets…

We have climbed over the market’s wall of worry this year by focusing on data and facts, adhering to our process, and avoiding emotional reactions to news headlines and sentiment shifts. Backed by an understanding of the favorable global economic backdrop, we have generated profits this year through stock picking, where opportunities have been plentiful across sectors and on both the long and short sides. While our long book has been the standout, single name shorts, which account for almost 20% of equity exposure, have generated substantial alpha. Our credit exposure – in corporate, structured, and government – is modest, and we are committed to being disciplined in this asset class, particularly when equities are this compelling. This is one of the benefits of having a bottom-up process of asset allocation.

…and they aren’t overly concerned about current valuations…

Supported by strong global GDP growth and the prospect for tax reform, S&P 500 earnings prospects are solid. Bottom-up estimates imply ~12% earnings growth next year ($146 for 2018) which would still be ~7% after the typical 5% haircut that such estimates experience as the year unfolds. This is not unrealistic considering that a variety of macro indicators like the ISM and consumer confidence are consistent with double-digit forward earnings growth. While the outcome of tax reform is uncertain, it could conservatively add 5% to EPS which would put 2018 earnings growth in the double-digit zone. While the implied ~17.5x forward price-to-earnings ratio is high by historical standards, low interest rates coupled with still solid earnings growth suggest valuations can remain high amid a tame business cycle, absent an exogenous shock.

Need a market with less volatility?

Finally…