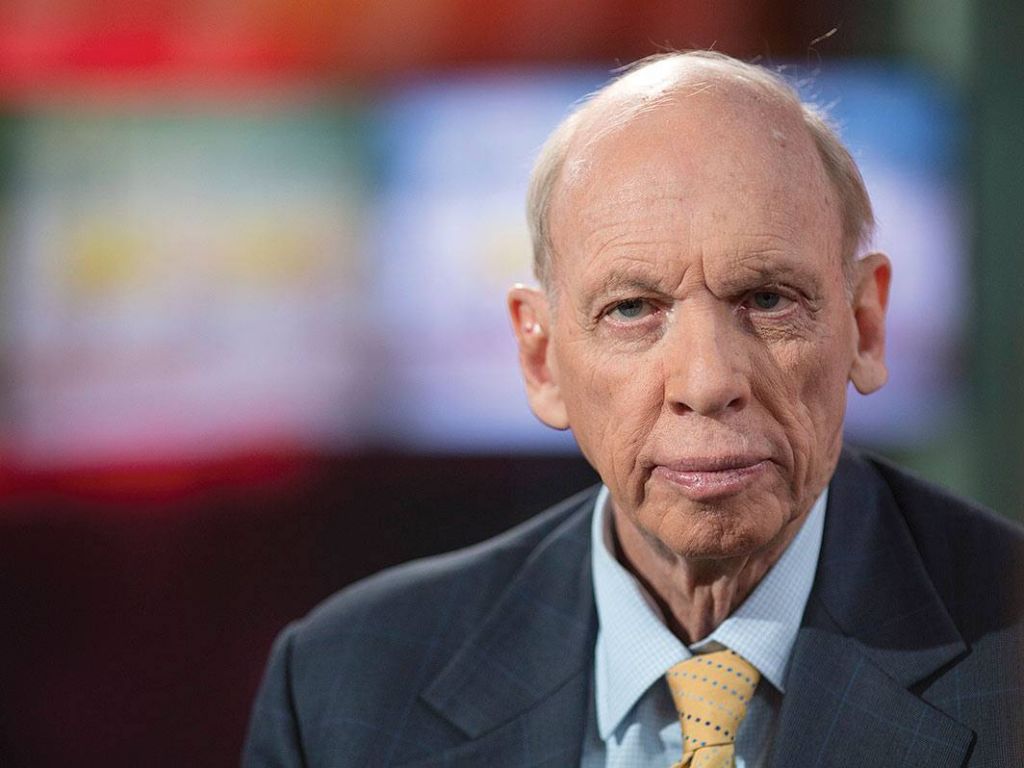

by Sammy Suzuki, Fixed Income, AllianceBernstein

What’s exciting about emerging-market investing is that the opportunity keeps on changing, and you don’t only find opportunities in the conventional places like China and India. Sometimes they come from really unexpected places.

One example might be a Mexican tortilla maker. Americans are now eating more Mexican food. This is a robust trend—I call this the “globalization of the American palate.” Another example might be, there was a period where Dubai was going through a lot of stress. But we noticed that there was a certain point in time when traffic through the Dubai airport was continuing to rise [in the] double digits. You had real estate prices continuing to rise. And if you look at the 100-mile radius within Dubai, there aren’t a lot of places to get some R&R. You have to go to Dubai. And that’s what we capitalize on.

Today we find opportunities in central Europe. These economies are tied to the German manufacturing engine that is doing quite well. In Czech, Poland, Hungary, these countries are almost at full employment, and very few people know about this. And most importantly, we can find good companies here. Good banks, that have come through the financial crisis from a few years ago, and they’re much stronger, they’re much more stable. And they’re still trading at reasonable valuations with plenty of upside.

What’s also interesting is that central Europe is less than 2% of the broad benchmark, so if you have a benchmark-sensitive strategy, it really just won’t move the needle for your portfolio. But if you have a benchmark-agnostic strategy, you can take full advantage of these insights.

By definition it’s emerging markets. Right? There are new trends developing, and you have to find these trends early—earlier than everybody else.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

This post was first published at the AllianceBernstein blog

Copyright © AllianceBernstein