by Mawer Investment Management, via The Art of Boring Blog

This month we are hosting a live webcast on finding opportunities in a time of higher interest rates, fuller valuations, and increased risk; reminding ourselves to focus on focusing more effectively; learning about the unintended consequences of innovation; exploring what the current state of malls may mean for property investors; and are intrigued by Howard Marks’ follow-up memo to his memo, “There They Go Again…Again”.

Mawer – Finding opportunities in a time of higher interest rates, fuller valuations, and increased risk

Please join us Wednesday, November 1st as Kara Lilly, CFA, Investment Strategist, and Christian Deckart, CFA, Portfolio Manager, Global Small Cap and Global Equity Strategies, discuss our approach for finding opportunities in this environment and how we are positioning our portfolios for success.

You can register by clicking here.

NPR Hidden Brain Podcast – You 2.0: Deep Work

While we all recognize our concentration and attention spans have suffered in this digital age, the cost of these constant distractions is much higher than we might think. Our digital distractions (in the form of texts, emails, and social media) may be impairing our ability to focus and do quality, immersive work.

This insightful podcast covers why it’s imperative that we re-cultivate deep attention.

A Wealth of Common Sense – The Unintended Consequences of Innovation

We found the anecdote referencing the 1982 cult-hit film classic Bladerunner to be a great example of how the most significant impacts in tech may not necessarily come from the ones we’re focused on now—e.g., A.I., block chain, or autonomous vehicles—but rather, are more likely to come from innovations we can’t even imagine.

In short, “forecasting the future of technology has always been an entertaining but fruitless game.”

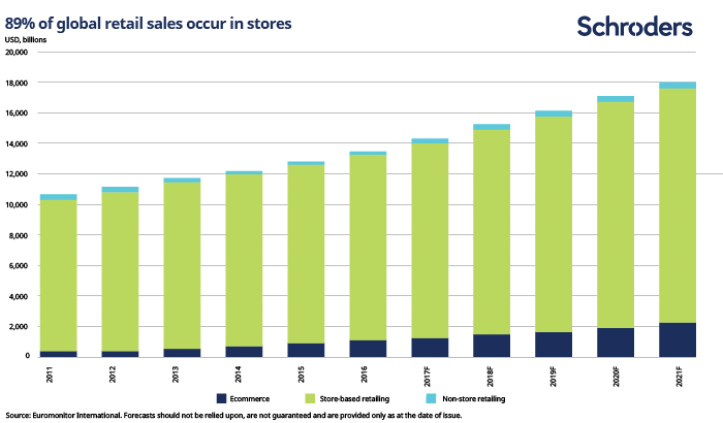

Schroders – The future of shopping malls and what it means for property investors

An interesting insight from Schroders on the real-estate market. There appears to still be a lot of room for growth in the online shopping space.

Sneak peek:

“The vast majority of the world’s purchases – 89% of the total – are still made in a store. Online sales have been growing rapidly for the past decade, even if growth slowed last year.”

Oaktree Capital – Memo from Howard Marks – Yet Again?

While Mr. Mark’s tone may seem a bit more defensive than usual, we are always intrigued when this email hits our inbox. There are some interesting points to contemplate—such as his two-category approach to things an investor can do to achieve above average performance; along with criticism he addresses—for example, “perhaps Mr. Marks is focusing more on media coverage and book sales than client assets.”

This post was originally published at Mawer Investment Management