by Carl Tannenbaum, Northern Trust

During our annual summer sojourn in Wisconsin, we typically spend an afternoon parasailing. It’s nice to be out on the water, and the view of Green Bay from 300 feet up is spectacular. My wife is not allowed to join us; she might be tempted to cut the cord connecting the boat and the parachute and send me off to Canada.

On this year’s excursion, we were joined by a college-aged couple. It was the young man’s first time parasailing, and it became apparent during our conversation that his girlfriend had talked him into the experience. As luck would have it, it was a windy day and the seas were choppy. By the end of the trip, this fellow was as green as his girlfriend’s sun dress. I am not sure the relationship survived the evening.

As the story illustrates, people often make poor choices. In that regard, the parasailing excursion dovetailed with a book I read on this summer’s vacation: “Misbehaving,” by Richard Thaler. Thaler is a behavioral economist, a designation once met with ridicule within our discipline. But the influence these scientists have had over our profession and public policy during the past twenty years is hard to overstate.

We would do well to heed the teaching of behavioralists as we craft solutions to some of today’s thorniest problems. In areas such as finance and health care, there is compelling evidence that relying completely on free choice leads to poor results for both individuals and societies. In these cases, subtle intervention can improve market function and market outcomes.

At the University of Chicago, my freshman economics course was based on the suppositions that people behave rationally, process information well and can be trusted to make individual choices that aggregate to the collective good. I recall being curious about this progression, having witnessed plenty of less-than-intelligent behavior (some of it my own). But these assumptions were used as the basis for models of how markets work. And as a newcomer to the subject, I was not going to argue with my professor during the first week of class.

Thaler, among others, has found serious cracks in these essential foundations. He uses two prototypes to make his case: Econs (who always behave efficiently and rationally), and Humans (who act as you and I often do). Thaler’s experiments skillfully demonstrate that most of us are not strictly rational. Consider:

-

- Humans feel guilty if they don’t attend a performance for which they bought a ticket, or if they fail to use a health club membership they have purchased. From the perspective of an Econ, these are known as “sunk costs,” which should have little bearing on future decisions. Yet these situations provide evidence of the “mental accounting” that leads Humans away from the utility theory depicted in classic economic models.

-

- Humans exhibit “anchoring” in the way they assess things. As an example, survey subjects were shown a random number and then asked to estimate the percentage of African countries in the United Nations. The higher the random number they were shown, the higher their estimates.

-

- Humans are loss-averse, preferring certainty even if taking risk will produce a higher expected return. Humans also place different mental values on gains based on how wealthy they are to begin with.

-

- Humans are influenced by the way choices are “framed.” Experiments show that they view a ten-cent surcharge on a $1.00 cost differently than a ten-cent discount on a $1.20 cost, even though an Econ will note that the two situations lead to at the same net result.

These examples of Humanness are interesting, but largely harmless. In other situations, though, the boundaries of our rationality can be much more costly.

Many households make poor decisions about saving money. Creating a nest egg requires self-control: the act of saving defers consumption from today until tomorrow. Classical theory posits that we have some mental exchange rate between the present and the future that governs this tradeoff. Milton Friedman suggested that people calibrate their current

Many households make poor decisions about saving money. Creating a nest egg requires self-control: the act of saving defers consumption from today until tomorrow. Classical theory posits that we have some mental exchange rate between the present and the future that governs this tradeoff. Milton Friedman suggested that people calibrate their current

consumption to their “permanent income.” The process seems very formulaic and clairvoyant.

However, behavioral scientists have shown conclusively that Humans are not that calculating. Econs may have an infinite ability to analyze problems across lots of scenarios to arrive at efficient decisions. But Humans do not have this capacity, and tend to reduce complicated problems to overly simple ones that they can solve. This practice (called “heuristics”) ignores important complexities and leads to poor choices.

Humans also habitually underestimate long-term benefits and costs, and our myopia increases if the consequences are further off into the future. This creates big problems for financial planning, which requires estimations of longevity, costs of living and long-term asset returns (among other variables). It is challenging for professionals, let alone the general public, to assemble these components correctly.

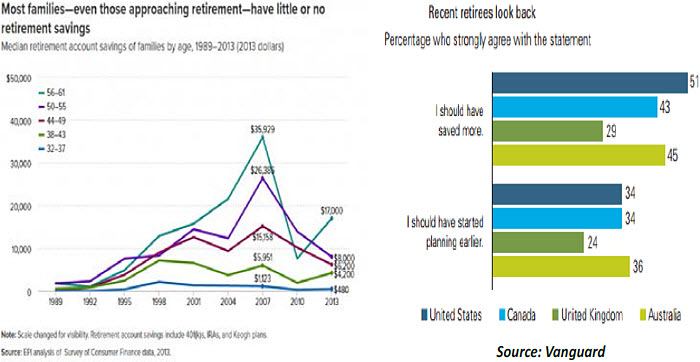

Given this backdrop, the chronic under-saving within many segments of many societies is not surprising.

The consequences of being ill-prepared financially are felt both by the individual and by the surrounding community. Families facing a retirement shortfall will have to live more modestly and work longer. And the burden on public retirement programs increases when citizens have not taken proper steps for themselves.

As an aside, an Econ would likely take a dim view of public retirement systems (such as Social Security in the U.S.), which mandate contributions and limit the freedom of individuals to choose how much to set aside. And they can create moral hazard, since the presence of a retirement backstop may blunt private initiative to save and invest properly. But in Thaler’s experiments, individuals consistently ascribe value to actions that are good for the collective even if they are not optimal for the individual.

In light of these theories, the public and private sectors have become more aggressive in mandating or incenting better saving behavior. Australia implemented compulsory retirement accounts (superannuation) 25 years ago. Automatic enrollment, default contribution rates and standardized asset allocations have become common features of defined contribution retirement plans. More certainly needs to be done, but these steps are a constructive start.

Cognitive limitations are also apparent in health care. Consider:

-

- Individuals have a difficult time calculating the impact of current actions on future well-being. Choices about diet, exercise and high-risk behavior are often made without a clear appreciation of long-term consequences. The incidence of obesity is rising throughout the developed world, which will be costly for individuals and health care systems.

-

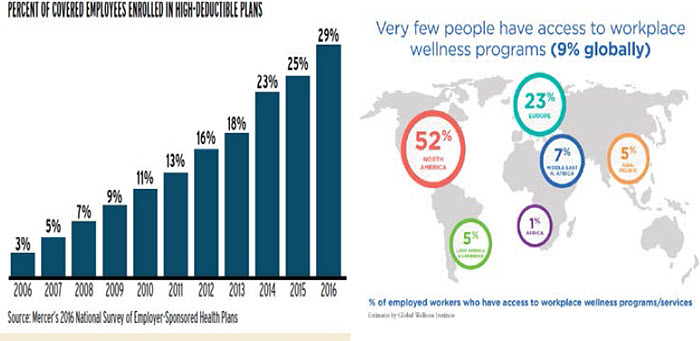

- People often make poor choices when they purchase health insurance coverage as well. Many sign up for high-deductible plans because they carry the lowest premiums. But these plans can be very costly if the patient has a series of minor medical issues. Assigning a probability and a cost to getting sick or breaking a bone is certainly beyond the capacity of most of our mental calculators.

-

- Most laypeople have little understanding of medical conditions and therapies. Asking them to become more deeply involved in decisions about care may be asking too much.

Given these limitations, a health care system based on consumer choice seems doomed to fail. Market solutions work best when information is readily available to consumers and when consumers are in a good position to analyze it. Neither is the case in health care.

To help, “wellness” programs have become an increasingly common feature of corporate benefit programs; employees are offered incentives to take steps that improve their health (and consequently reduce costs for insurance providers). But the availability and utilization of these programs varies significantly from place to place.

To help, “wellness” programs have become an increasingly common feature of corporate benefit programs; employees are offered incentives to take steps that improve their health (and consequently reduce costs for insurance providers). But the availability and utilization of these programs varies significantly from place to place.

Thaler concludes that “in our increasingly complicated world people cannot be expected to have the expertise to make anything close to optimal decisions in all the domains in which they are forced to choose.” To correct for this, Thaler advocates subtle influences (“nudges”) as the basis of a system he calls “libertarian paternalism.” To critics, though, having outside agents appoint themselves arbiters of what is good or bad for us sets on a dangerous and slippery slope.

When I was an undergraduate, opposing free choice was heresy on our campus. Milton Friedman and the principals he espoused in Free to Choose were in the ascendance; restrictions on the operation of markets were viewed dimly. But in my old age, I am beginning to think that choice isn’t all it was cracked up to be. Everyone needs a nudge now and then.

northerntrust.com

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2017 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.