by Lance Roberts, Clarity Financial

I have been getting a tremendous number of emails as of late asking if the latest rally in oil prices, and related energy stocks, is sustainable or is it another “trap” as has been witnessed previously.

With geopolitical turmoil mounting, for North Korea to Iran, and as natural disasters have rocked the refinery capital of the world (Houston,) the question is not surprising.

As regular readers know, we exited oil and gas stocks back in mid-2014 and have remained out of the sector for technical and fundamental reasons for the duration. While there have been some opportunistic trading setups, the technical backdrop has remained decidedly bearish.

Today, I am going to review the fundamental supply/demand backdrop, as well as the technical price setup, as things have improved enough to warrant some attention. As a portfolio manager, I am interested in setups that potentially have long-term tailwinds to support the investment thesis. The goal today is to determine if such an environment exists or if the latest bounce is simply just that.

Let’s get to it.

With OPEC discussing the extension of oil production cuts into 2018, the question is whether such actions have made any headway in reducing the current imbalances between supply and demand? This is an important consideration if we are going to see sustainable higher prices in “black gold.”

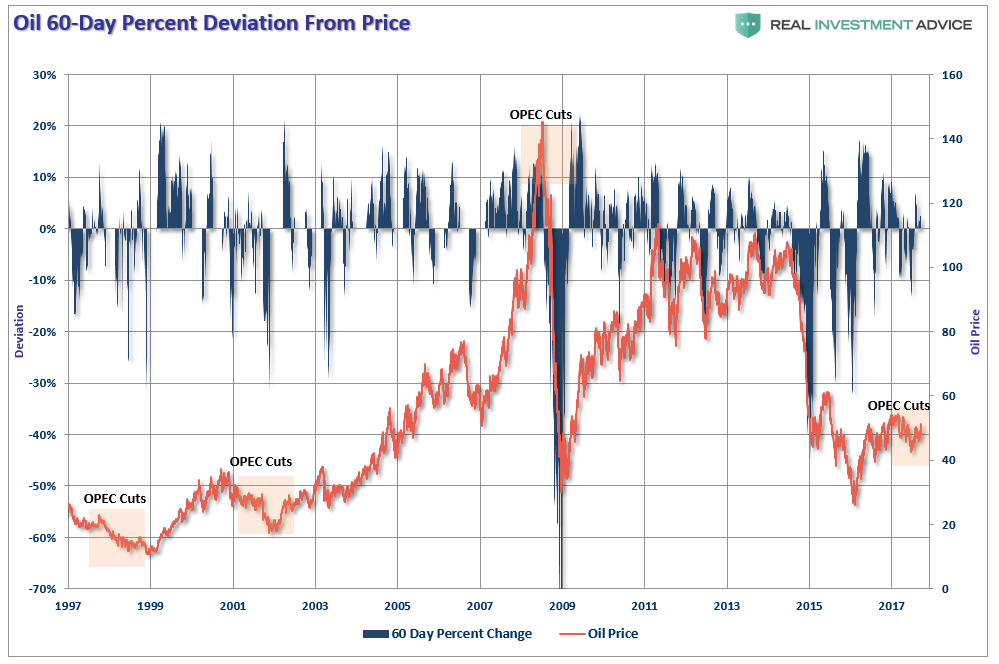

With respect to the oil cuts, the current cut is the 4th by OPEC since the turn of the century. These cuts in production did not last long, generally speaking, but tend to occur at price peaks, rather than price bottoms, as shown below.

Despite the occasional rally, it’s hard to see that the outlook for oil is encouraging on both fundamental and technical levels. The charts for WTI remain bearish, while the fundamentals seem to be saying Economics 101: too much supply, too little demand. The parallel with 2014 is there if you want to see it.

The current levels of supply potentially creates a longer-term issue for prices globally particularly in the face of weaker global demand due to demographics, energy efficiencies, and debt.

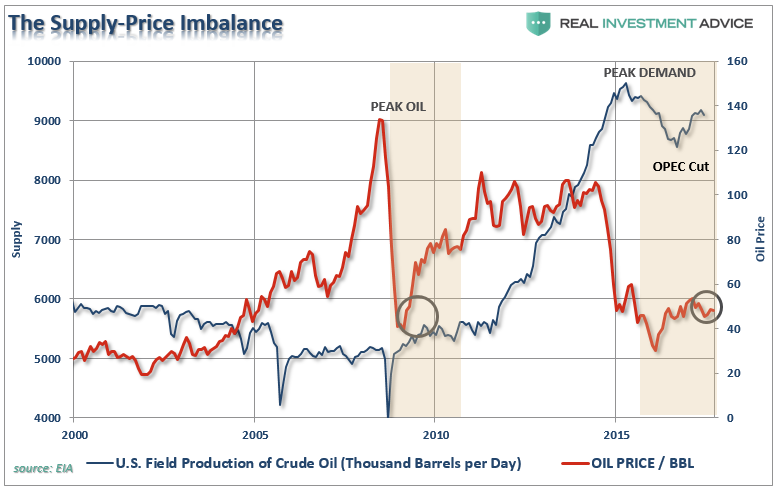

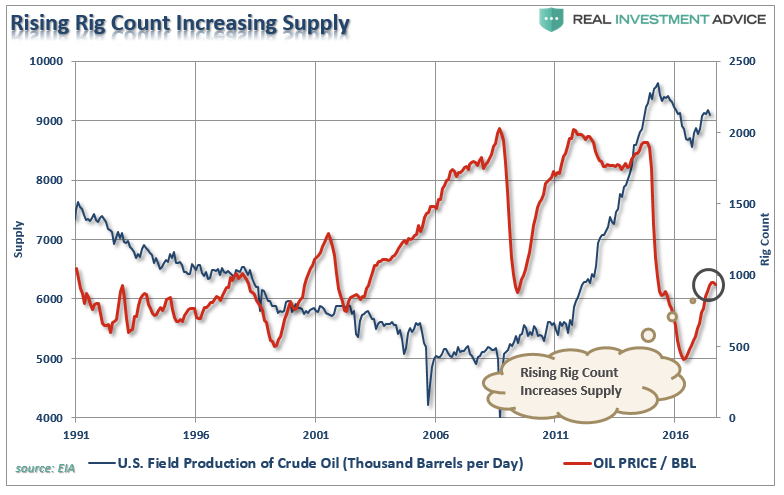

Many point to the 2008 commodity crash as THE example as to why oil prices are destined to rise in the near term. The clear issue remains supply as it relates to the price of any commodity. With drilling in the Permian Basin expanding currently, any “cuts” by OPEC have already been offset by increased domestic production. Furthermore, any rise in oil prices towards $55/bbl will likely make the OPEC “cuts” very short-lived.

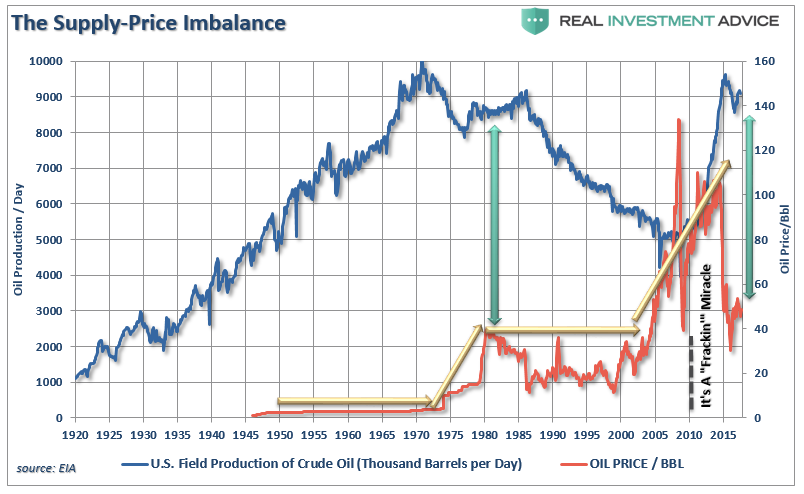

As noted in the chart above, the difference between 2008 and today is that previously the world was fearful of “running out” of oil versus worries about an “oil glut” today.

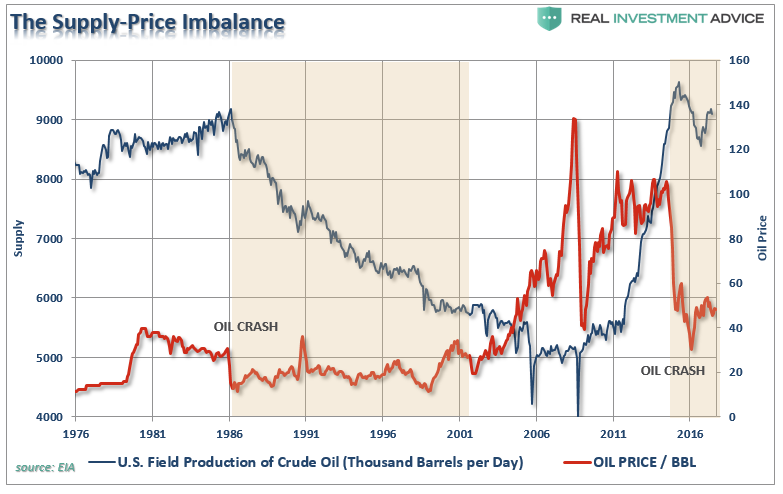

The issues of supply versus price becomes clearer if we look further back in history to the last crash in commodity prices which marked an extremely long period of oil price suppression.

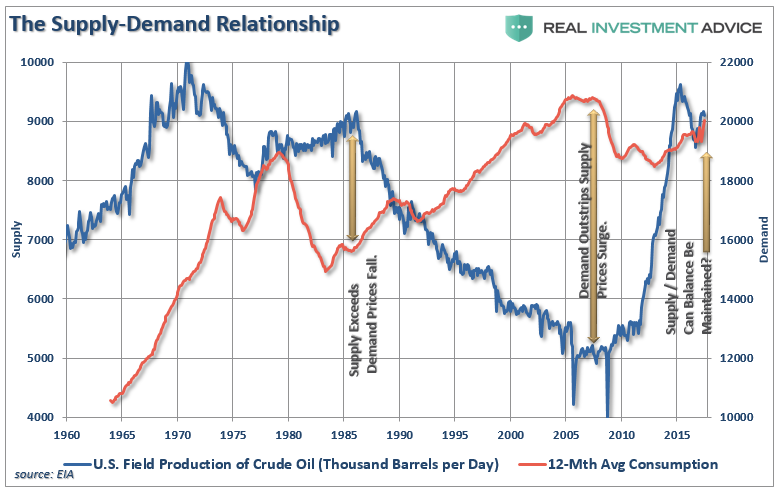

Despite the rising exuberance as money chases the “beaten up” energy stocks on a sector rotation basis, ultimately, it always comes down to supply and demand.

Reviewing History

In 2008, when prices crashed, the supply of into the marketplace had hit an all-time low while global demand was at an all-time high. Remember, the fears of “peak oil” was rampant in news headlines and in the financial markets. Of course, the financial crisis took hold and quickly realigned prices with demand.

Of course, the supply-demand imbalance, combined with suppressed commodity prices in 2008, was the perfect cocktail for a surge in prices as the “fracking miracle” came into focus. The surge of supply alleviated the fears of oil company stability and investors rushed back into energy-related companies to “feast” on the buffet of accelerating profitability into the infinite future.

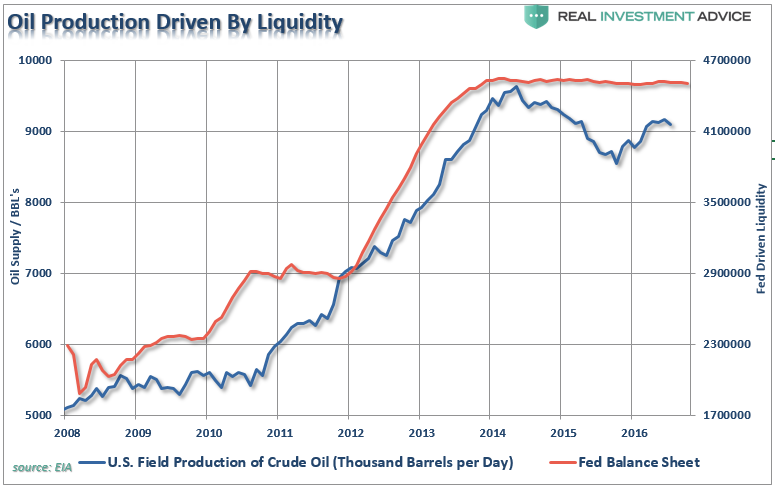

Banks also saw the advantages and were all too ready to lend out money for drilling of speculative wells which was fostered by Federal Reserve liquidity.

As investors gobbled up equity shares, the oil companies chased every potential shale field in the U.S. in hopes to push stock prices higher. It worked…for a while.

Of course, lessons have not been learned as of yet, as banks and investors once again begin to chase speculative “shale” flooding capital into the Eagleford and Permian Basin fields as prices have finally risen to more profitable levels. Furthermore, the Fed is now talking about “extracting” liquidity from the markets as they continue hiking rates. Neither of those prospects are good longer-term from energy prices or stocks.

The problem currently, and as of yet not fully recognized, is the supply-demand imbalance has reverted. With supply now back at levels not seen since the 1970’s, and global demand growth weak due to a rolling debt-cycle driven global deflationary cycle, the dynamics for a repeat of the pre-2008 surge in prices is unlikely.

The supply-demand problem is not likely to be resolved over the course of a few months. The current dynamics of the financial markets, global economies and the current level of supply is more akin to that of the early-1980’s. Even is OPEC does continue to reduce output, it is unlikely to rapidly reduce the level of supply currently as shale field production increases.

Since oil production, at any price, is the major part of the revenue streams of energy-related companies, it is unlikely they will dramatically gut their production in the short-term. The important backdrop is extraction from shale continues to become cheaper and more efficient all the time. In turn, this lowers the price point where production becomes profitable increases the supply coming to market.

Then there is the demand side of the equation.

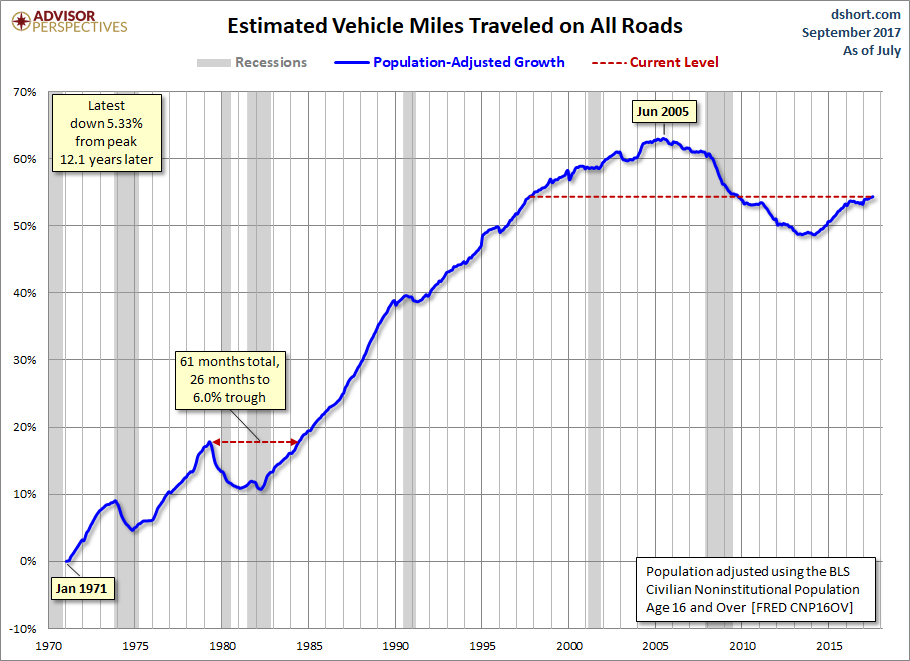

For example, my friend Jill Mislinski discussed the issue of a weak economic backdrop.

“There are profound behavioral issues apart from gasoline prices that are influencing miles traveled. These would include the demographics of an aging population in which older people drive less, continuing high unemployment, the ever-growing ability to work remote in the era of the Internet and the use of ever-growing communication technologies as a partial substitute for face-to-face interaction.”

The problem with dropping demand, of course, is the potential for the creation of a “supply glut” that leads to a continued suppression in oil prices.

Couple the weak economic backdrop with the slow and steady growth of renewable/alternative sources of energy as well as technological improvements in energy storage and transfer. Add to those issues that over the next few years EVERY major auto supplier will be continuously rolling out more efficient automobiles including larger offerings of Hybrid and fully electric vehicles.

All this boils down to a long-term, structurally bearish story.

Technical Set-Up Still Bearish

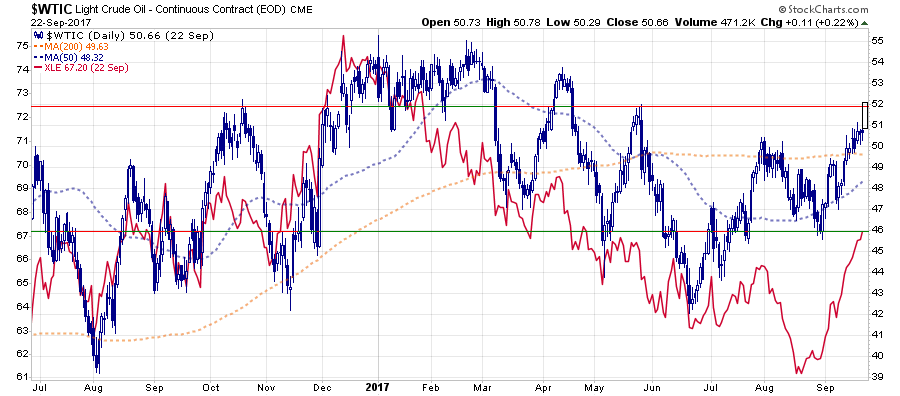

In the short-term, the recent rally in oil prices and energy stocks has been exciting. As shown below, that rally has pushed oil prices back above the 200-dma and is attempting to breakout above $52. This puts the old highs of $55/bbl back into focus. I have added XLE (the energy-sector exchange-traded fund) as a proxy for energy stocks to show the high correlation between oil prices and the underlying companies.

The rally following hurricanes “Harvey” and “Irma,” is derived from the imbalances in gasoline and oil supply. Those imbalances will be short-lived and we will begin to get a mean reversion very soon. It is where that next mean reversion settles that will determine the intermediate-term outlook for the commodity and sectors.

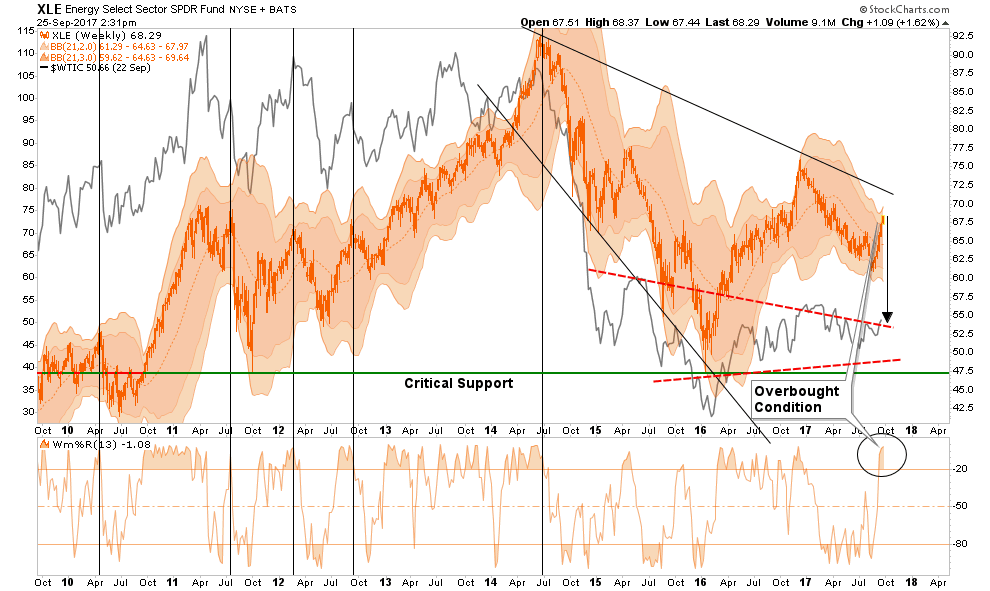

While the short-term backdrop is indeed bullish, the longer-term dynamics still remain decidedly bearish. Currently, prices of Energy stocks have been pushed into extremely overbought levels (3-standard deviations above their longer-term mean), but remain in a longer-term bearish trend.

While investors have chased energy stocks on expectations of continued production cuts from OPEC, little has been done to resolve the fundamental valuation problems which face a majority of these companies. Revenues, while improved, will remain suppressed as leverage in many of these companies have risen sharply. The negative trends of both oil and energy stocks keeps downward pressure on stocks in the intermediate term.

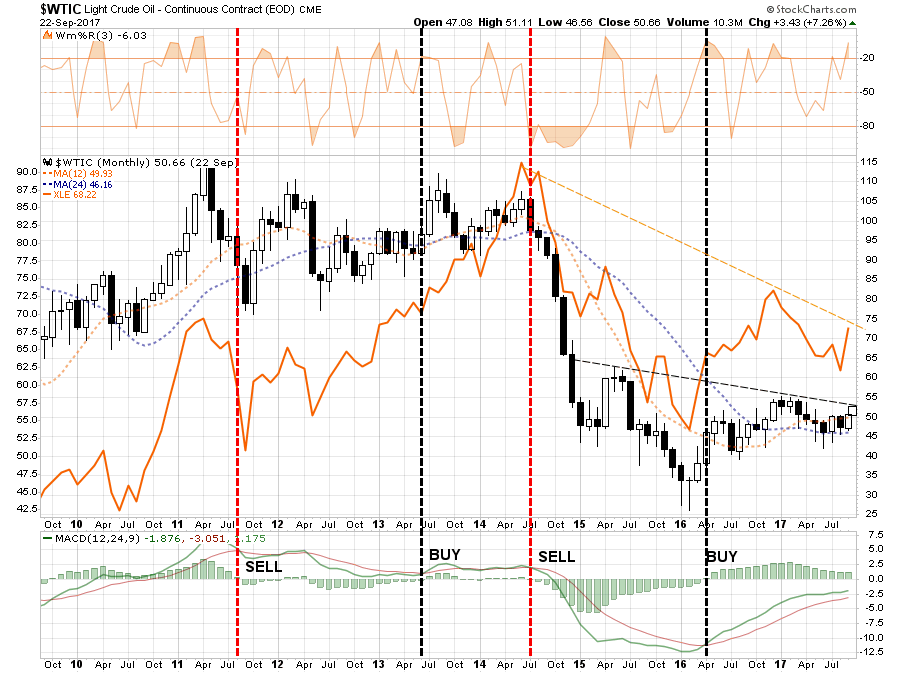

Importantly, note the monthly “buy signal” (vertical dashed black line) for oil. That signal occurred in conjunction with the initial oil production cuts announced by OPEC. While there is hope the production cuts will continue into 2018, a bulk of the current price gain has likely already been priced in. With oil prices once again overbought on a monthly basis, the risk of disappointment is substantial.

With respect to investors, the argument can be made that oil prices have likely found a long-term bottom in the $40 range. However, the fundamental tailwinds for substantially higher prices are still vacant. OPEC won’t keep cutting production forever, the global economy remains weak, efficiencies are suppressing demand.

Furthermore, given the length of the current economic expansion, the onset of the next recession is likely closer than not. A recession will negatively impact oil prices (which are driven by commodity traders) and energy investments as the proverbial “baby is thrown out with the bathwater.” This is where we will be looking for long-term bargains in the space.

Sure, this could certainly be the start of the next great bull-market for energy shares. However, after having missed the bulk of the decline to start with, I am more than happy to wait for a clearer opportunity to become aggressive in the sector again. Currently, I can’t make that case.

Just something to consider.

Copyright © Clarity Financial