by Eric Winograd, Senior Economist—United States, AllianceBernstein

The long-anticipated unwinding of quantitative easing (QE) in the US is set to begin, just as the Fed’s leadership faces a wave of turnover. We think a strong foundation should keep steady US economic growth on track.

The Start of Reverse QE Is Here

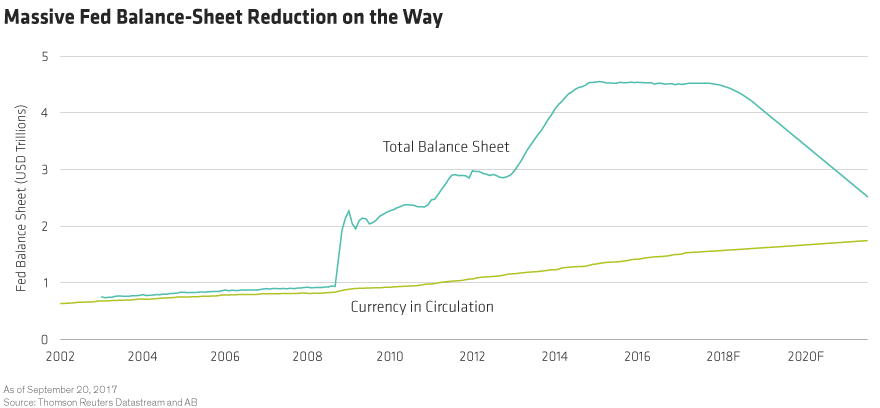

As the September meeting of the Federal Open Market Committee (FOMC) ended today, the committee announced the start of its balance-sheet reduction program. Over the next few years, the Fed’s massive holdings are expected to shrink by more than a trillion dollars (Display), and official interest rates will be nudged steadily upward.

The unwinding of QE is a major milestone on the central bank’s path toward normalizing monetary policy. For years, the Fed delivered extraordinary support to a US economy that was recovering from the global financial crisis of nearly a decade ago.

We don’t think balance-sheet reduction will be disruptive, despite the staggering amount of money being removed from the system. Why? The outlook for the US economy is brighter than it’s been in some time, which should allow the Fed to walk back policy accommodation without upsetting the applecart.

The Economy Maintains Its Steady Stride

The pain and suffering Hurricanes Harvey and Irma caused will be lasting, and rebuilding will take time. But historically, the economic dislocations caused by natural disasters in affected regions have been brief. Within a few months, rebuilding activity has typically kicked in, returning economic growth to normal—or maybe even a little higher than normal.

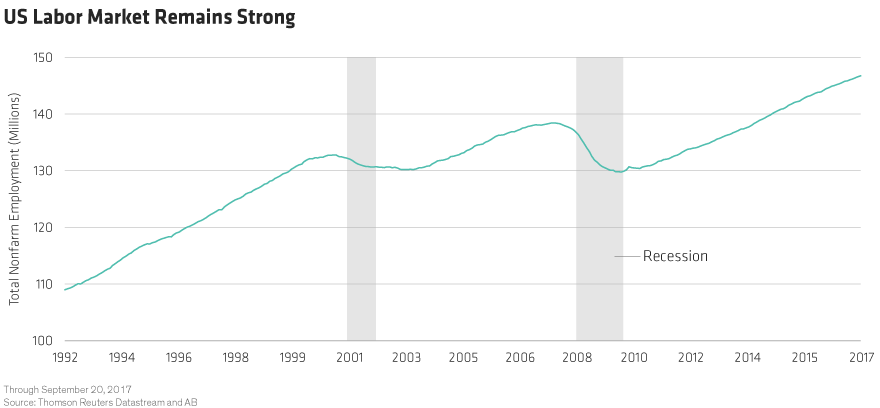

So, despite the storms, we’re still confident the US economy will keep its momentum, because the foundations are sound. Consumption remains the main driver—household expenditures are nearly two-thirds of gross domestic product (GDP). A resilient labor market (Display) gives households plenty of income to fuel consumption. And confidence is near cyclical highs, so it seems likely that households will keep the money flowing for the next few quarters.

Business investment has started to rebound, and we expect a modest boost later this year and into 2018, as Texas and Florida invest in rebuilding from the storms. Other factors are also promising. The dollar has weakened by approximately 10% this year. A weaker dollar provides tailwinds for exporters and manufacturers—reflected in a surge in survey-based measures of manufacturing activity. Stock prices are up and bond yields are low, giving businesses and consumers access to low-cost financing to fund investment and consumption.

The Global Growth Picture Is Bright, Too

The positive economic outlook extends beyond the US; globally, the picture looks brighter than it has in some time. GDP is stable or rising in the developed world, and major emerging markets—including China—are also running at a good clip.

Policymakers around the world have grown more confident that they’re on the cusp of paring back accommodative monetary policies. With so many major central banks moving in the same direction, there’s less risk of friction between economies. That’s in contrast with earlier in this cycle, when the Fed was raising rates when other countries were still easing policy. This proved to be disruptive; the improved global economy greatly reduces that risk.

Upside Risks: Infrastructure, Tax Reform, Rebuilding

As always, there are risks to the positive economic outlook, but right now those risks seem to be balanced—some could bolster economic growth and some could dampen it.

In terms of the upside, there’s the potential for more infrastructure spending, particularly if the impact of Hurricanes Harvey and Irma prompts Congress to fast-track broader projects nationally. Tax reform is still on the political agenda; if some type of comprehensive package is put together and approved, it will also boost GDP.

Downside Risks: Policy Disruption, Fed Transition, Geopolitics

Downside risks include the possibility that the Fed’s balance-sheet reduction will be more disruptive than we anticipate, pushing bond yields up and/or the equity market down. Either of these developments could impact broader financial conditions.

Also, the upcoming transition at the Fed could unsettle things. President Trump is likely to appoint five or six new members to the Federal Reserve Board within the next year—including a chair. New leadership always brings new uncertainty. Finally, geopolitical issues loom; North Korea is among those with the potential to be most disruptive.

Overall though, the US economic outlook is brighter than it’s been for quite a while as we head into the fourth quarter. We think the improved landscape will allow the FOMC to step back from the market while keeping the US economy on track.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein