by Ryan Detrick, LPL Research

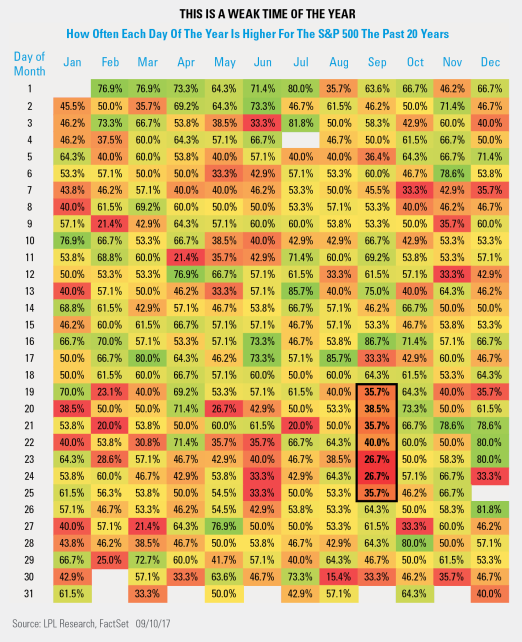

As we noted in Is It Time for That September Weakness?, the second half of September can be troublesome from a historical standpoint. Below is a popular chart we’ve shared before that shows how late-September can be weak, but in a different fashion. It illustrates how often each day of the year has been positive for the S&P 500 Index over the past 20 years. As you can see, we are in the heart of one of the least likely times of the year to expect equity strength.

Per Ryan Detrick, Senior Market Strategist, “Although seasonality is something we watch, in the end, fundamentals, technicals, and valuations matter more. Still, given that the S&P 500 has gone 10 months without so much as a 3% correction, which is the second longest streak ever, it is important to remember to pay attention to the calendar and be ready for any potential volatility.”

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-645949 (Exp. 09/18)

Copyright © LPL Research