by Doug Drabik, Fixed Income, Raymond James

Our thoughts and prayers are with those directly and indirectly effected by our recent hurricanes in both Texas and Florida.

Borrowing from the well-known real estate mantra “location, location, location”, it seems appropriate to remind investors why it holds up. You can make all kinds of upgrades to a house and throw stacks of money into improvements but in the end, the land on which it sits will dictate much of its value. You can throw all kinds of risk and money into growth assets but in the end, it is how much money you keep that determines one’s ease of retirement. An investment portfolio’s allocation may be thought of as its foundation, dictating the stability of its end value.

While interest rates have continually declined, the inclination is to transform your portfolio into a quest for unattainables, most oftentimes at risks with difficult consequences. A reach for yield may net more yield or may fail, declining the value of the overall portfolio and making recovery even more improbable. There is purpose behind appropriate allocation, a division between money placed to grow assets and money positioned to maintain assets. Neither division of assets can suitably substitute for one another.

Balance of a portfolio permits assets that counter each other or are non-correlated to coexist. For example, if one part of the portfolio is losing market value, you want another part of the portfolio maintaining or growing in value. If equity securities are dropping in value via a market correction, it is imperative that fixed income securities maintain their value. The more negatively-correlated two assets are, the more likely this is to occur. Longer duration fixed income assets are negatively-correlated to equities or in other words, offer more protection of a portfolio’s worth when growth assets such as equities are falling in value. The contrary holds as well. Although fixed income assets have appreciated significantly during falling interest rates, they do not possess the structure to grow wealth like MLPs, equities, real estate or other such assets.

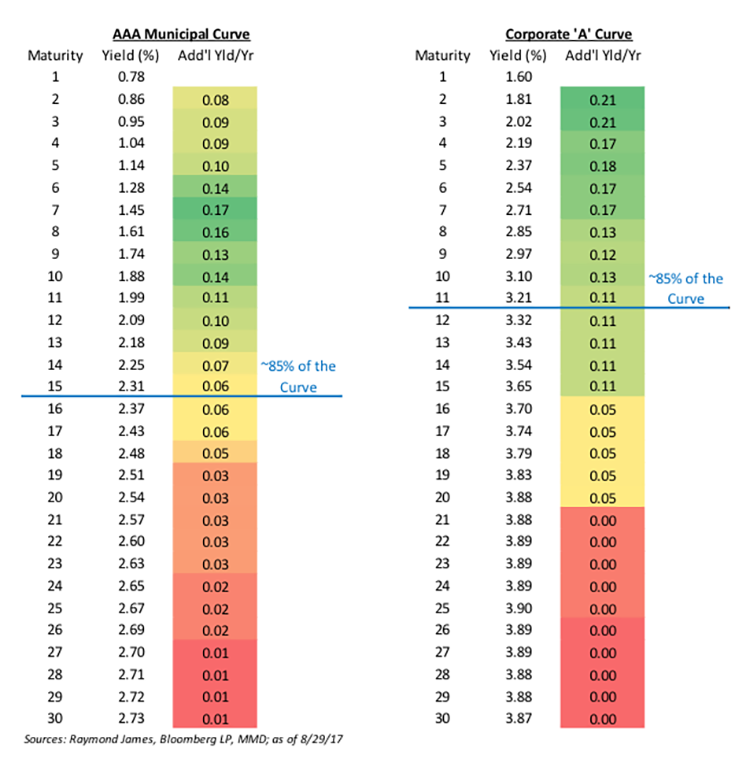

(Fixed income value lines for corporate and municipal bonds are graphed on the left.)

The temptation to “double down” in this low rate environment is heightened but the takeaway is uncomplicated and requires a reminder that allocation, allocation, allocation provides the greatest means to growing assets and maintaining wealth for most investors.

*****

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Copyright © Raymond James