by Jesse Felder, The Felder Report

There’s been a lot of attention paid to the amount of equity that has been removed from the markets by corporate takeovers and buyback programs. Bloomberg recently put the number at about $5.5 trillion. While it’s true this does reduce the supply of corporate equities in the markets it’s only half of the story. The other half of the story is about how those buybacks and takeovers were funded.

Share buybacks and M&A have shrunk the stock market by $5.5 trillion in the last 20 years. https://t.co/dkYLihYwWA @chrismbryant

— Lisa Abramowicz (@lisaabramowicz1) August 29, 2017

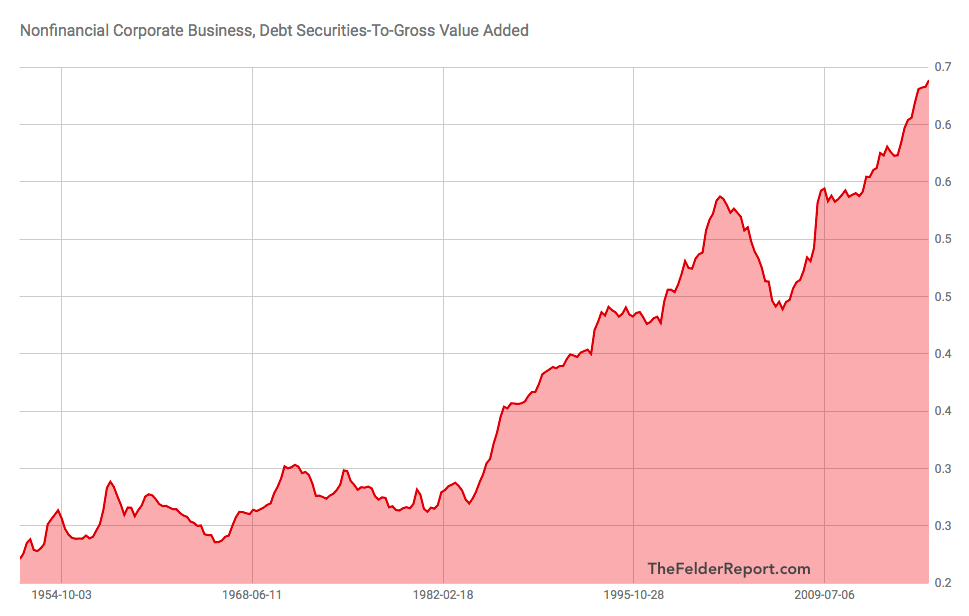

At the same time that $5.5 trillion in equity was being removed from the markets a nearly commensurate amount of corporate debt was being issued. Essentially, what we have seen then is a massive swap of equity liabilities for debt liabilities leaving corporations much more highly leveraged than they have ever been in the past.

It may be true that this trend towards “de-equitization” is largely responsible for the massive rise in share prices over the better part of the past decade. However, while it may help to explain the phenomenon it’s important to note that it doesn’t justify higher equity valuations. In fact, it should be just the opposite.

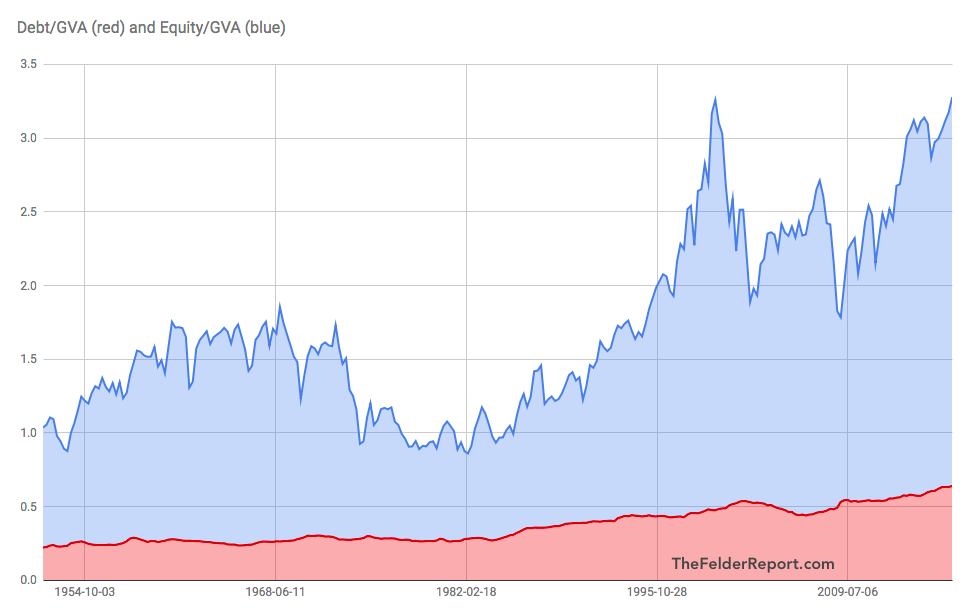

Imagine two identical companies. The only difference between them is one is financed entirely with equity; it has no debt. The other is financed partly with equity but also with a large heaping of debt. Should the equity of both enterprises be valued equally? Or should the leveraged company’s equity valuation be reduced by the amount of net debt on its books?

I believe the latter is the correct answer. And if you think of equity valuations as a potential acquirer of an business does this is the only approach that makes sense. Because when you buy a company in its entirety, you must assume the net debt on that company’s balance sheet as a sort of premium to the price you pay for its equity. This is essentially just the concept of “enterprise value.”

When we look at the broad stock market this way, it’s instantly clear that its current “enterprise value” relative to its “gross value added” is the highest on record. In other words, corporate valuations have never been higher nor balance sheets more highly leveraged than they are today.

This has worked fine for companies so long as the economy has remained relatively strong and interest rates have remained low. However, should we enter another recession or a period of rising interest rates this may change. A economic slowdown or another pop in interest rates (or both, a phenomenon called “stagflation”) could precipitate a reversal in this trend towards “de-equitization” in which companies are forced into debt-for-equity swaps in order to meet these new and growing fixed obligations.

Either way, simply reducing equity liability by increasing debt liability doesn’t change the overall liability and thus the valuation. It just changes the structure of those liabilities. The ‘great shrinking stock market’ is almost exactly offset by the ‘massive growing corporate bond market’ and the end result is a sharp increase in corporate leverage. I have no doubt that investors celebrating all of these leveraged buybacks and takeovers today will reconsider this gleeful response during the next bear market.