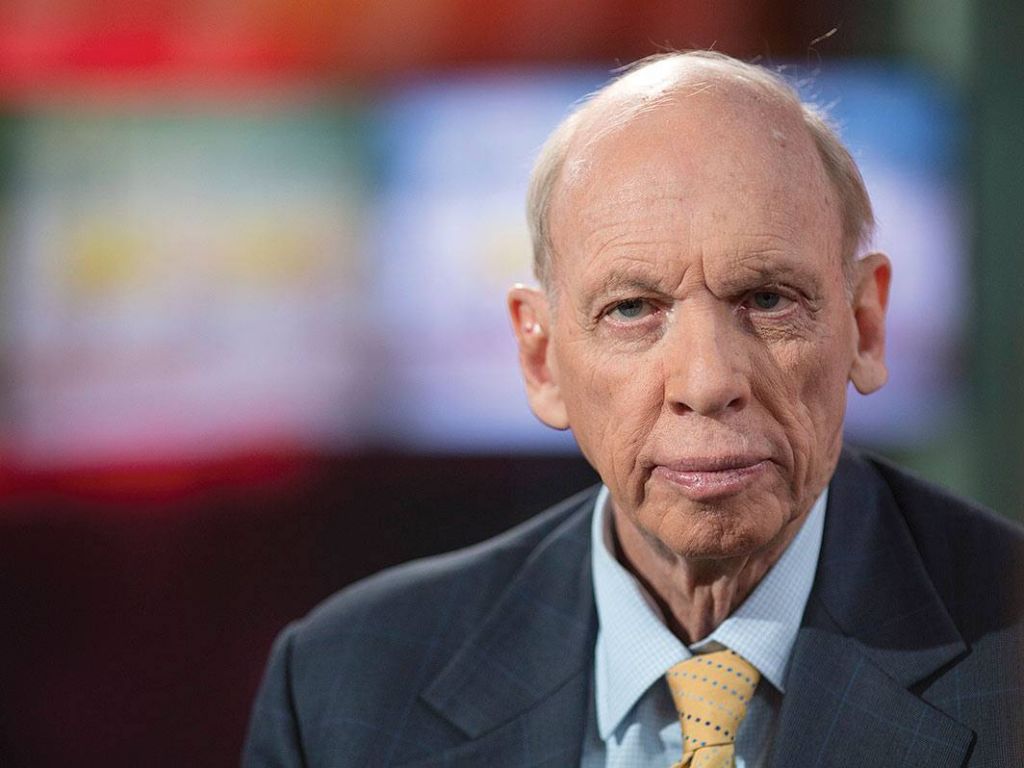

by Chuck Carnevale, F.A.S.T. Graphs

This is the third in a series of articles where I will cover popular and/or high profile stocks. The primary objective of this series will be to put a spotlight on the importance of forecasting future growth prior to making an investment decision. I elaborated on the importance of forecasting future growth in part 1 of this series found here. The central idea is to determine whether or not a reasonable forecast of future growth warrants consideration for investment relative to how the market is currently valuing a given stock.

Furthermore, I believe it’s imperative for long-term success that investors apply their best efforts towards determining the intrinsic value of any stock they are interested in. This is especially true for long-term oriented investors. If you overpay for even a great business, you are very likely to be disappointed with your long-term results.

Alphabet (GOOGL): Long business description courtesy S&P Capital IQ

Although most every reader is familiar with Google (Alphabet) the following long business description summarizes the scope of the company:

“Alphabet Inc., through its subsidiaries, provides online advertising services.

Segments

The company operates through Google and Other Bets segments.

This segment includes the company’s primary Internet products, such as Search, Ads, Commerce, Maps, YouTube, Google Cloud, Android, Chrome, and Google Play, as well as its hardware initiatives. The company’s technical infrastructure and efforts, such as virtual reality are also included in Google. Google primarily focuses on advertising, the sales of digital content, apps and cloud offerings, and sales of hardware products.

Other Bets

This segment includes businesses, such as Access, Calico, CapitalG, GV, Nest, Verily, Waymo, and X. Other Bets also engages in the sales of Internet and TV services through Google Fiber, sales of Nest products and services, and licensing and R and D services through Verily.

The company primarily delivers both performance advertising and brand advertising.

Performance Advertising

Performance advertising creates and delivers relevant ads that users would click, leading to direct engagement with advertisers. Majority of its performance advertisers pay the company when a user engages in their ads. Performance advertising lets its advertisers connect with users while driving measurable results.

For performance advertisers, AdWords, the company’s primary auction-based advertising program, helps create simple text-based ads that appear on Google properties and the properties of Google Network Members. In addition, Google Network Members use its AdSense program to display relevant ads on their properties, generating revenues when site visitors view or click on the ads. The company engages in investing in its advertising programs and make significant upgrades.

Brand advertising

Brand advertising helps improve users’ awareness of and affinity with advertisers’ products and services, through videos, text, images, and other interactive ads that run across various devices. The company helps brand advertisers deliver digital videos and other types of ads to specific audiences for their brand-building marketing campaigns.

Seasonality

The company’s business is affected by seasonal fluctuations in Internet usage, advertising expenditures, and underlying business trends, such as traditional retail seasonality (such as, commercial queries typically increase in the fourth quarter of each year (for the year ended December 31, 2016).

Competition

The company faces competition from general purpose search engines and information services, such as Microsoft’s Bing, Yahoo, Yandex, Baidu, Naver, and Seznam; vertical search engines and e-commerce Websites, such as Amazon and eBay (e-commerce), Kayak (travel queries), LinkedIn (job queries), and WebMD (health queries); social networks, such as Facebook and Twitter; other online advertising platforms and networks, including Facebook, Criteo, and AppNexus; providers of digital video services, such as Facebook, Netflix, Amazon, and Hulu; providers of enterprise cloud services, including Amazon and Microsoft; and digital assistant providers, such as Apple, Amazon, Facebook, and Microsoft.

Significant Events

In March 2017, Trifacta announced it has collaborated with Google to build Google Cloud Dataprep. Google Cloud Dataprep embeds Trifacta’s intelligent, user-friendly interface and Photon Compute Framework, and natively integrates Google Cloud Dataflow for server less, auto-scaling execution of data preparation recipes with record performance and optimal resource utilization. Google Cloud Dataprep provides analysts with the ability to intuitively explore and prepare diverse datasets within Google Cloud Platform for various downstream uses, including analytics and machine learning.

In May 2017, Volvo Cars had announced a close partnership with Google to develop the next generation of its in-car infotainment and connectivity solution based on Android, offering access to an array of apps and services.

History

Alphabet Inc. was founded in 1998. The company was incorporated in California in 1998 and re-incorporated in the state of Delaware in 2003.”

Alphabet’s Valuation: EBIDTA versus Operating Cash Flow

Is EBIDTA or operating cash flow the better metric to utilize when attempting to value a stock?

The following discussion on EBIDTA courtesy of InvestingAnswers financial dictionary found here provides insights into the value of utilizing EBIDTA as a valuation reference:

“WHAT IT IS:

Earnings before interest, tax, depreciation and amortization (EBITDA) is a measure of a company’s operating performance. Essentially, it’s a way to evaluate a company’s performance without having to factor in financing decisions, accounting decisions or tax environments.

EBITDA is calculated by adding back the non-cash expenses of depreciation and amortization to a firm’s operating income.

Alternatively, you can also calculate EBITDA by taking a company’s net income and adding back interest, taxes, depreciation, and amortization.

WHY IT MATTERS:

EBITDA is one of the operating measures most commonly used by financial analysts.

EBIDTA allows analysts to focus on the outcome of operating decisions while excluding the impacts of non-operating decisions like interest expenses (a financing decision), tax rates (a governmental decision), or large non-cash items like depreciation and amortization (an accounting decision).

By minimizing the non-operating effects that are unique to each company, EBITDA allows investors to focus on operating profitability as a singular measure of performance. Such analysis is particularly important when comparing similar companies across a single industry, or companies operating in different tax brackets.

However, EBITDA can also be deceptive when applied incorrectly. It is especially unsuitable for firms saddled with high debt loads or those that must frequently upgrade costly equipment. Furthermore, EBITDA can be trumpeted by companies with low net income in an effort to “window-dress” their profitability. EBITDA will almost always be higher than reported net income.

Also, because EBITDA isn’t regulated by GAAP, investors are at the discretion of the company to decide what is, and is not, included in the calculation. There’s also the possibility that a company may choose to include different items in their calculation from one reporting period to the next.

Therefore, when analyzing a firm’s EBITDA, it is best to do so in conjunction with other factors such as capital expenditures, changes in working capital requirements, debt payments, and, of course, net income.”

INVESTOPEDIA provides a different perspective on the value of utilizing EBIDTA as a valuation reference. Here are a few key excerpts to read the full presentation follow this link:

“EBIDTA has a bad rap in the financial world, but does this financial measure really deserve the investor distaste? EBITDA, an acronym for “earnings before interest, taxes, depreciation and amortization,” is an often-used measure of the value of a business. But critics of this value often point out that it is a dangerous and misleading number, due to the fact that it is often confused with cash flow. In this article we’ll show you how this number can actually help investors create an apples-to-apples comparison, without leaving a bitter aftertaste.”

The article also suggests that many analysts favor valuing the business based on operating cash flow:

“operating cash flow is a better measure of how much cash a company is generating because it adds non-cash charges (depreciation and amortization) back to net income and includes the changes in working capital that also use or provide cash (such as changes in receivables, payables and inventories). These working capital factors are the key to determining how much cash a company is generating. If investors do not include changes in working capital in their analysis and rely solely on EBITDA, they will miss clues that indicate whether a company is losing money because it isn’t making any sales.”

The Conclusion

EBITDA doesn’t exist in a vacuum. The measure’s bad reputation is more a result of overexposure and improper use than anything else. Just as a shovel is effective for digging holes, but wouldn’t be the best tool for tightening screws or inflating tires, so EBITDA shouldn’t be used as a one-size-fits-all, stand-alone tool for evaluating corporate profitability. This is a particularly valid point when one considers that EBITDA calculations do not conform to generally accepted accounting principles (GAAPs).

Like any other measure, EBITDA is only a single indicator. To develop a full picture of the health of any given firm, a multitude of measures must be taken into consideration. If identifying great companies was as simple a checking a single number, everybody would be checking that number and professional analysts would cease to exist.”

FAST Graphs Fundamental Review on Alphabet: Forecasting EBIDTA and/or Cash Flows

Since a picture’s worth 1,000 words and a video worth many more, I offer the following FAST Graphs fundamental analysis on Alphabet (GOOGL) with a focus on forecasting. This is the third in a series of videos I plan to offer on high profile and popular stocks:

Summary and Conclusions

Alphabet has been one of the great growth stocks of modern times. But most importantly, and in spite of its enormous size, growth is estimated to continue at high rates into the foreseeable future. As it is with most high profile stocks, there will be zealous advocates and distractors. However, I prefer to focus on and favor facts over opinions. Therefore, when analyzing Alphabet by the numbers, the growth thesis remains intact as I illustrated in the above video. Fundamentally speaking, Alphabet remains a power house.

On the other hand, Google is a tech stock as most high profile stocks are. Consequently, intelligent investors should always be cognizant of the risk associated with investing in technology stocks. Technology is continuously evolving; however, established technology giants like Alphabet enjoy the advantage of the enormous resources at their disposal. Nevertheless, investors in growth stocks should remain ever diligent.

Disclosure: No position at the time of writing.