MARKET ETHOS - Fundamentals – The good & the bad

by Craig Basinger, CFA, Connected Wealth, RichardsonGMP

Markets calmed down last week after seeing a brief return of volatility that certainly raised some eyebrows. One aspect that has provided stability despite higher geopolitical risks has been the underlying company fundamentals. We are coming off one of the better Earnings Seasons for the S&P 500 that we have seen in some time. While valuations do remain elevated, solid earnings growth can go a long way to sooth valuation concerns. In this edition of Market Ethos, we are going to dive into earnings and valuations, from a few different perspectives.

Q2 2017 Earnings Season was a hit

With 98% of the S&P 500 members having reported 2nd quarter results, this one is pretty much in the books. Compared to the same quarter a year ago, earnings expanded by 9.4% and sales grew by 5.3%. And this growth was relatively broad based. 79% of companies grew sales and 73% grew earnings. All 11 sectors, except for Utilities, enjoyed positive earnings growth with the biggest gainers being Energy and Information Technology.

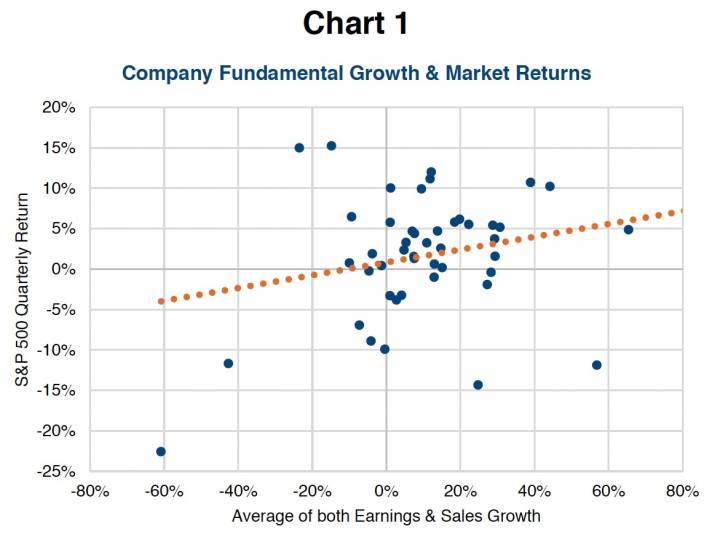

Earnings and Sales growth are certainly good things for an equity market. Chart 1 covers the past twelve years of quarterly Earnings Season and there is a relationship between company fundamental growth and overall market return (orange line). The vertical axis is the S&P 500 return while the horizontal axis is the average of earnings and sales growth. While clearly there are some outliers, there is a relationship between positive company growth and positive market returns. We also found a stronger relationship for earnings compared to sales growth, when charted in isolation.

The good news takeaway from this relationship is earnings and sales appear to be set to grow for the next few quarters at least. Economic data has been good, profit margins are healthy, energy prices are lower and somewhat stable plus the weaker U.S. dollar is a boost for many members of the S&P 500. When they account for overseas profits, a weaker dollar results in better translation back to their income statement. So we certainly have a healthy fundamental growth environment.

Valuations – The grey lining to our silver cloud

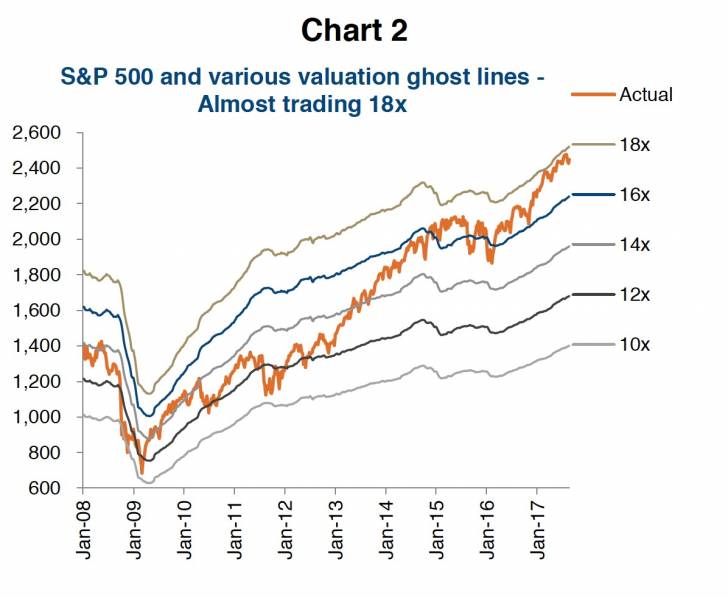

Despite growing earnings and top line sales, the S&P 500 is not cheap and, depending on how you look at it, may be rather expensive. Chart 2 is the S&P 500 (thick orange line) along with various earnings multiple ghost lines. The thinner ghost lines are calculated using a constant price-to-earnings ratio (PE) over time and changing earnings. As you can see, the S&P 500 is almost touching the 18x line, or 18x earnings, which is the most expensive we have seen since the tech bust in 2001/2002.

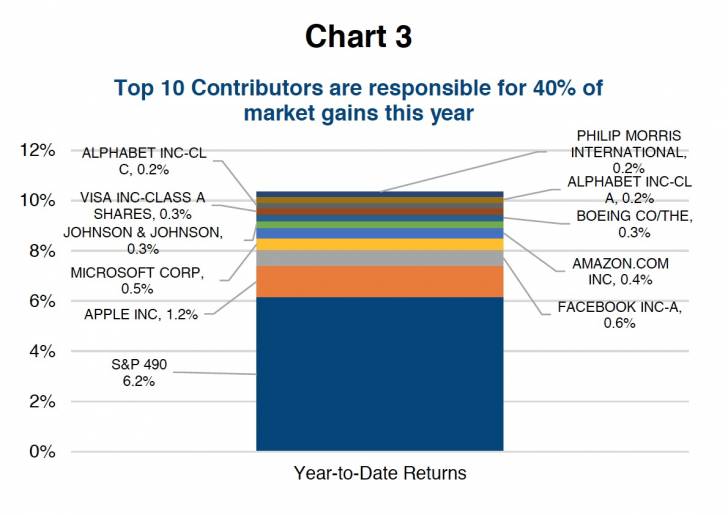

It may actually be worse than the aggregate price-to-earnings multiple for the S&P 500 implies. One might think that the current 17.6 is a bit rich but nothing compared to the valuations we saw in the late 1990s. True, the aggregate PE ratio reached over 25x in 1999 (Man, those were fun times!), and at 25x from today’s earnings would equate to an S&P 500 of 3,500!!! That isn’t going to happen this cycle. In the late 1990s tech bubble, a large portion of the market had no earnings, which based on the aggregate calculation inflates the overall PE level for the index. Today’s market leaders, while dominated by Technology again, at least make money for the most part. Chart 3 includes the top 10 contributors to the S&P 500 year-to-date rise of 10.4%. The top 10 make up about 40% of this gain so far this year with the remaining 490 members of the S&P 500 responsible for the rest. This is narrow market leadership which is a common characteristic of the late stages of a bull market cycle.

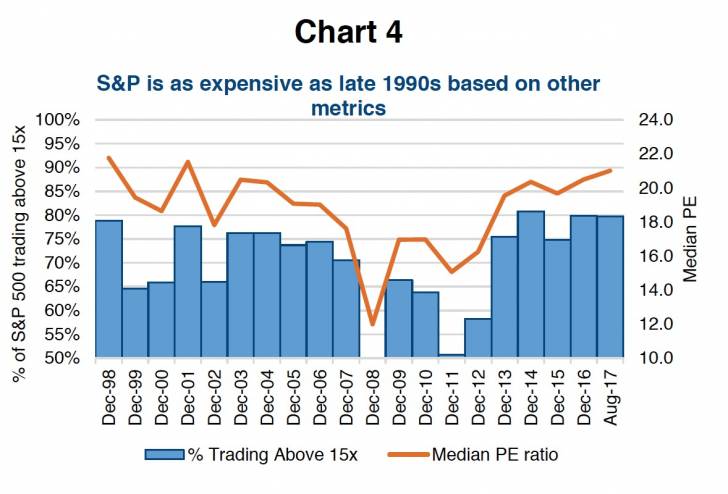

In Chart 4, we slice up valuations from a few different perspectives. The blue bars are the percentage of companies trading above a 15x earnings multiple. At 80%, this is the most expensive we have seen in the past twenty years. Alternatively, the orange line is the median PE for the S&P 500. Median is the middle company, aka the 250th ranked in order of PE. Again, this is just about as expensive as the late 1990s in the tech bubble.

Conclusion

The U.S. equity market is expensive and it isn’t just a few companies making the index look rich. It is rather pervasive which means finding companies trading at a low multiple much harder. On the positive, earnings are growing and this does help alleviate valuation concerns. But should growth falter or bond yields rise, which would put downward pressure on the earnings multiples, this could cause a market decline.

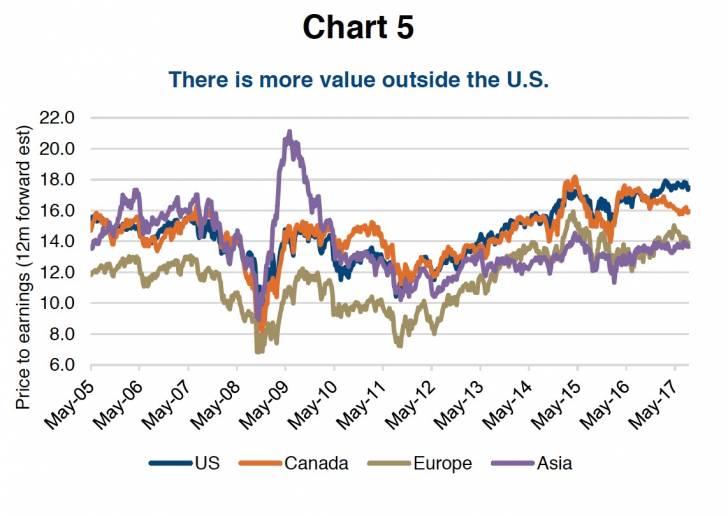

One other positive is other markets are not nearly as expensive. Europe and Asia are both trading below 14x and close to home Canada is 16x (Chart 5). If you are a value oriented investor, reducing U.S. and allocating to other developed markets may be prudent.

*****

Charts are sourced to Bloomberg unless otherwise noted.

This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of securities mentioned herein. Past performance may not be repeated. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. However, neither the author nor Richardson GMP Limited makes any representation or warranty, expressed or implied, in respect thereof, or takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use or reliance on this report or its contents. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.