by Frank Holmes, CIO, CEO, U.S. Global Investors

I think most of you reading this right now are aware that gold is unlike any other metal, certainly any other element. It doesn’t play by the same rules as iron or tin or aluminum, and its value has nothing to do with its utility—or lack thereof. People valued the yellow metal for its beauty and malleability eons before they knew of its usefulness in conducting electricity or its chemical inertness.

That gold is so chemically “boring,” though, is one of the main reasons why it’s so highly valued, even today.

This is the conclusion of Andrea Sella, distinguished professor of chemistry at University College London. In 2013, Sella spoke with Justin Rowlatt of the BBC World Service, walking him through all 118 elements of the periodic table.

Gold, according to Sella, is the best possible candidate for a currency of any value.

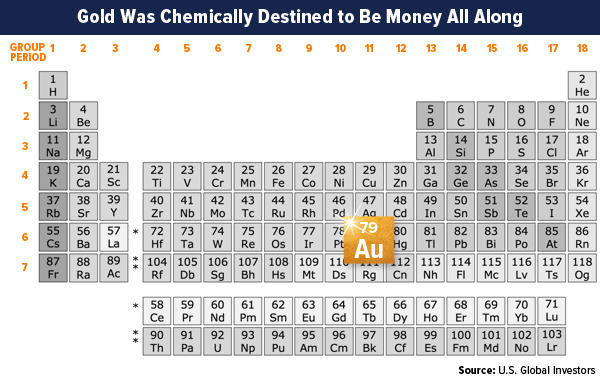

As he points out, we can automatically eliminate whole swaths of the periodic table for various reasons. We can cross out gases, halogens and liquids such as helium, fluorine and mercury. No one wants to carry around vials of a colorless gas or, in the case of mercury and bromine, a poisonous substance.

We can then rule out alkaline earth metals such as magnesium and barium for being too reactive and explosive. Carcinogenic, radioactive elements such as uranium and plutonium are too impractical, as are synthetic elements that exist only momentarily in lab experiments—seaborgium and einsteinium, for example.

That leaves us with the 49 transition and post-transition metals: titanium, nickel, tin, lead, aluminum and more.

But many of these pose problems that should immediately exclude them from consideration as a currency. Most are too hard to smelt (titanium), too flimsy for coinage (aluminum), too corrosive (copper) and/or too plentiful (iron).

We are now left with just eight candidates, the noble metals: platinum, palladium, rhodium, iridium, osmium, ruthenium, silver and gold. These are all attractive as currencies, but except for silver and gold, they’re simply too rare.

So: silver and gold.

What gives gold the edge over silver, however, is—once again—its chemical inertness. Unlike its white cousin, gold doesn’t tarnish. It’s nonreactive to air and water. Add to this its softness, and it easily emerges as the perfect currency. Ancient peoples recognized this, and I don’t think anyone now would have any problem coming to the same conclusion either.

“I view gold as the primary global currency.”

Those are the words of former Fed Chairman Alan Greenspan, speaking to the World Gold Council for the 2017 winter edition of its Gold Investor publication.

“It is the only currency, along with silver, that does not require a counterparty signature. Gold, however, has always been far more valuable per ounce than silver. No one refuses gold as payment to discharge an obligation. Credit instruments and fiat currency depend on the credit worthiness of a counterparty. Gold, along with silver, is one of the only currencies that has an intrinsic value. It has always been that way. No one questions its value, and it has always been a valuable commodity, first coined in Asia Minor in 600 BC.”

Right now, for the first time in human history, world currencies are free-floating, meaning they’re not backed by anything tangible.

It’s largely because of this that world debt has been allowed to soar to astronomical highs in recent years, threatening the stability of the global economy. As we’ve seen in Zimbabwe, Venezuela and elsewhere, a nation’s currency can rapidly lose its value and become worthless. Families and individuals who didn’t have a portion of their wealth stored in a real asset such as gold lost everything.

This is why I always recommend a 10 percent weighting in gold, with 5 percent in physical gold (coins, bars and jewelry) and the other 5 percent in high-quality gold stocks, mutual funds and ETFs.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors