by Michael Batnick, The Irrelevant Investor

Nobody can actually buy low and sell high. Not consistently anyway. Successful traders typically buy high and sell higher, and successful investors buy low and sell rarely. But if you are tempted to catch bottoms, to be the investor who can recognize treasure where others find trash, there are some broad rules that I suggest you follow.

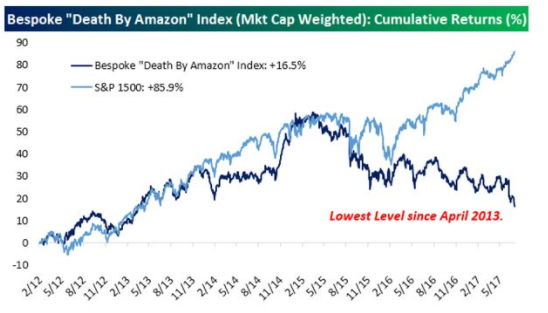

The obvious area of the market that falls in the pile of “other’s trash” these days are retailers. A group of 54 of these names that Bespoke calls the “Death By Amazon” Index is down 20% this year and is at its lowest levels since April 2013. Let’s drill down and use Macy’s as an example.

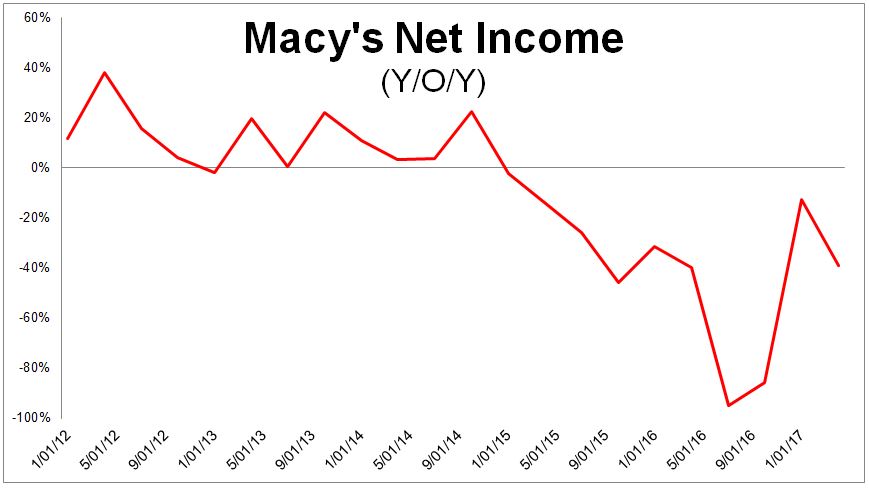

Macy’s is in big trouble. Its y/o/y net income has decreased for the last ten quarters and earnings per share (TTM) are down 56% from the same time two years ago.

Macy’s is in big trouble. Its y/o/y net income has decreased for the last ten quarters and earnings per share (TTM) are down 56% from the same time two years ago.

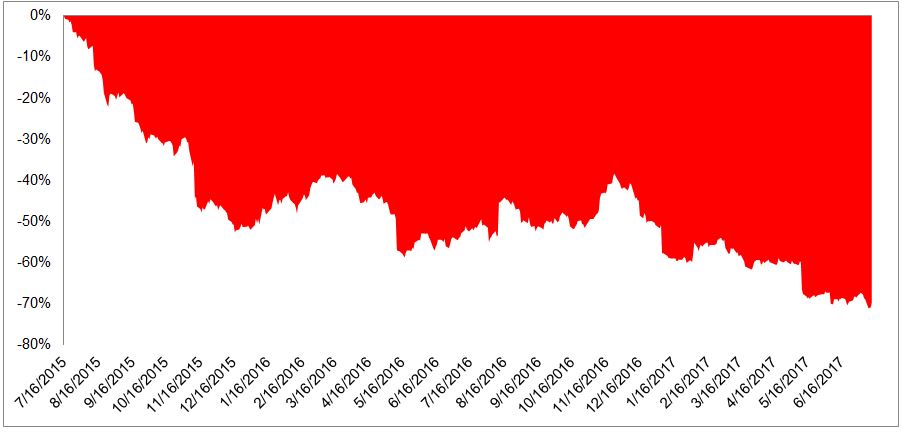

This trouble has manifested itself in a much lower share price. Over the last two years it has experienced a 71% crash. Not that a 71% massacre needs context, but the only time the United States stock market fell this much was in The Great Depression.

This trouble has manifested itself in a much lower share price. Over the last two years it has experienced a 71% crash. Not that a 71% massacre needs context, but the only time the United States stock market fell this much was in The Great Depression.

When brand names crash, people are tempted to step in and buy primarily for two reasons:

When brand names crash, people are tempted to step in and buy primarily for two reasons:

- It’s hard to imagine that something as well-known as Macy’s can get cut in half in just 86 days. But from July to November 2015, that’s exactly what happened. And since then, it shed another 45%.

- Few things in investing are more satisfying than making money where others couldn’t.

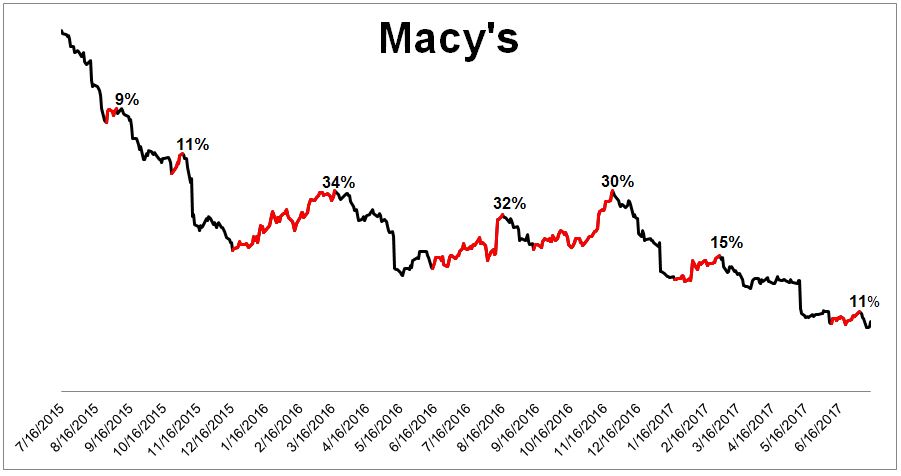

The first rule of catching a bottom is don’t try to catch a bottom. It’s one of the hardest things to do in all of investing. Macy’s has experienced three separate 30% rallies on its way to a 70% decline. None of them stuck. Quick traders made money. Bottom-fishing investors got filleted.

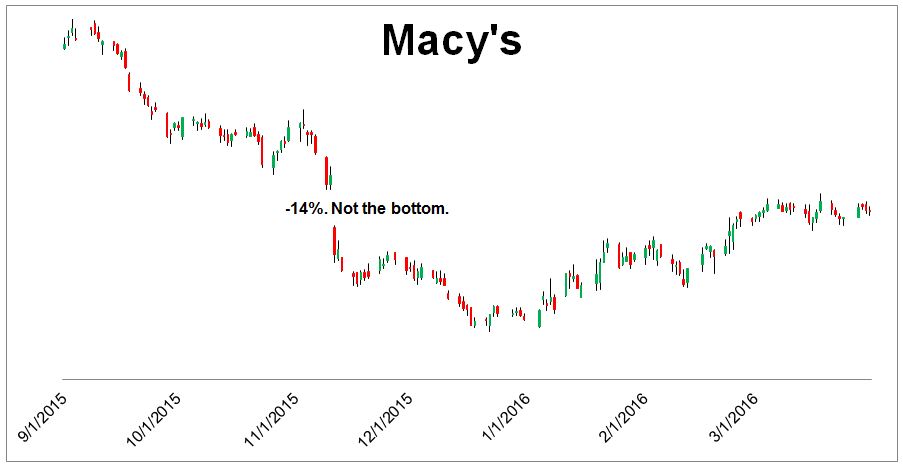

Rule #2: Don’t rush into buy after a massive down day. You don’t have to take the other side of everything. The stock market is not perfectly efficient, but when a $15 billion company falls by double-digits in a single day, it’s usually for a good reason. On November 11, 2015, Macy’s fell 14%, and over the next few weeks it fell an additional 12%.

Rule #2: Don’t rush into buy after a massive down day. You don’t have to take the other side of everything. The stock market is not perfectly efficient, but when a $15 billion company falls by double-digits in a single day, it’s usually for a good reason. On November 11, 2015, Macy’s fell 14%, and over the next few weeks it fell an additional 12%.

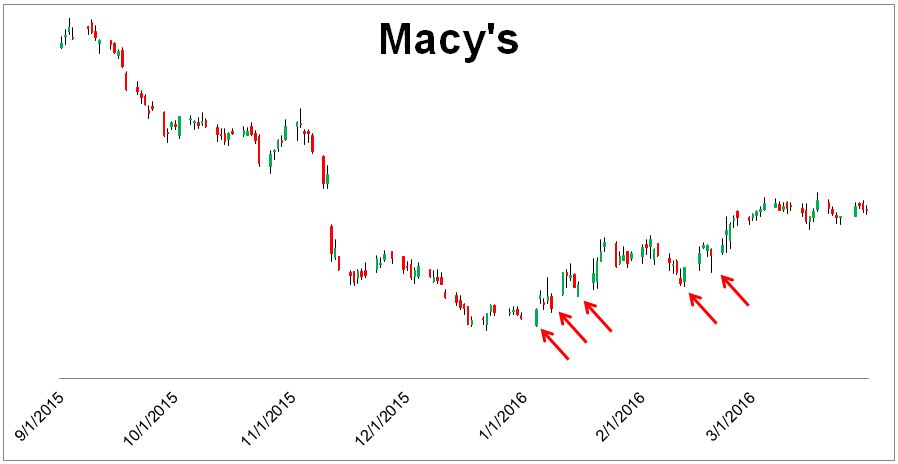

Rule #3: Wait for a higher low. Higher lows doesn’t mean the bottom is in, but every actual bottom will experience these.

Rule #3: Wait for a higher low. Higher lows doesn’t mean the bottom is in, but every actual bottom will experience these.

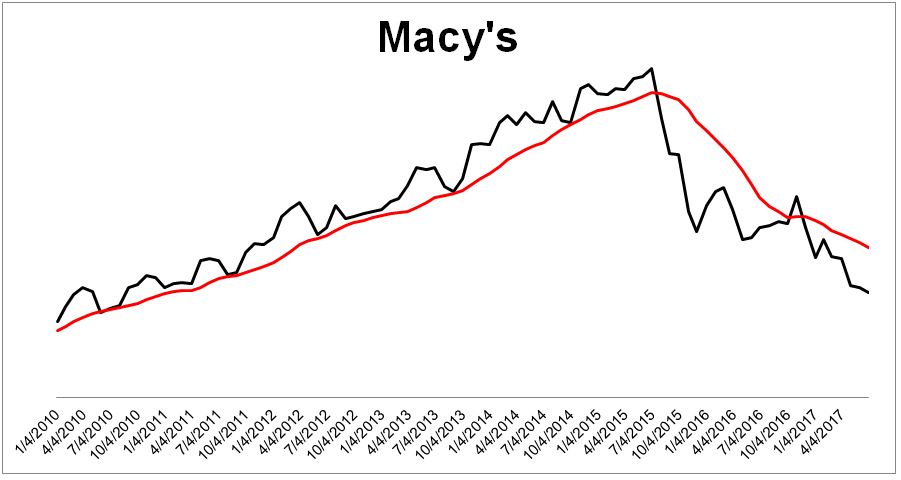

Rule #4: Wait for a longer-term moving average to stabilize. Macy’s twelve-month moving-average, for example, is still crashing. If you wait for a long-term moving average to stabilize, you won’t buy at the bottom, but better safe than sorry. Falling knives are guilty until proven innocent.

Rule #4: Wait for a longer-term moving average to stabilize. Macy’s twelve-month moving-average, for example, is still crashing. If you wait for a long-term moving average to stabilize, you won’t buy at the bottom, but better safe than sorry. Falling knives are guilty until proven innocent.

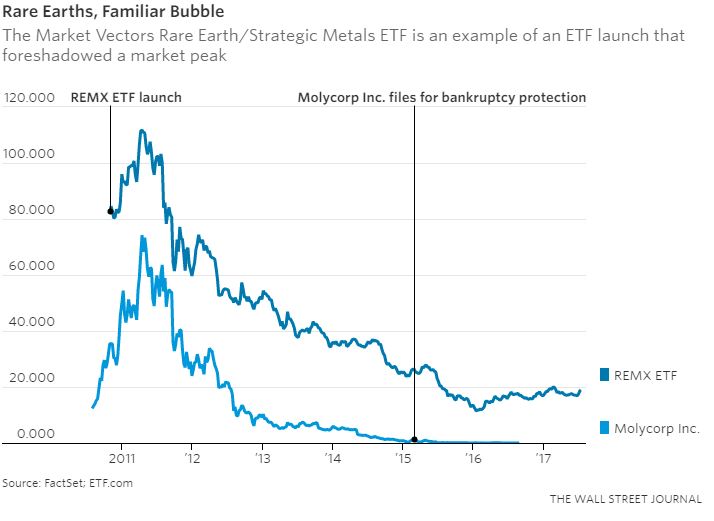

Rule #5: Wait for an ETF to be created. ProShares just filed for double and triple-levered ETFs for retail stocks. These filings only occur after major moves, and should have all bottom catchers licking their chops. New ETFs are the new magazine indicators.

Rule #6: Use a stop loss. Pick a dollar amount, or percentage amount that you’re willing to lose, and stick to it.

Rule #6: Use a stop loss. Pick a dollar amount, or percentage amount that you’re willing to lose, and stick to it.

Rule #7: Keep your trades small. Prepare as if everyone who sold before you is right and you are wrong. Risk no more than 1% of capital.

Rule #8: Don’t tell anybody. Battling your own emotions is hard enough, and when you tell others what you’re doing, pride and ego cloud your judgment and you’re less likely to admit defeat and move on.

Rule #9: Lengthen your time horizon. It’s rare that something gets cut in half and rebounds in two weeks. Bottoms tend to take a while, so make sure that you understand what you’re getting yourself into. When hunting for value, frustration abounds.

Rule #10: If you’re committed to the name (good luck) step in slowly. It’s unlikely that you’re going to buy the bottom, so make a plan, and spread it out. For example, buy 1/8 of the total amount that you want to purchase every two weeks for the next four months.

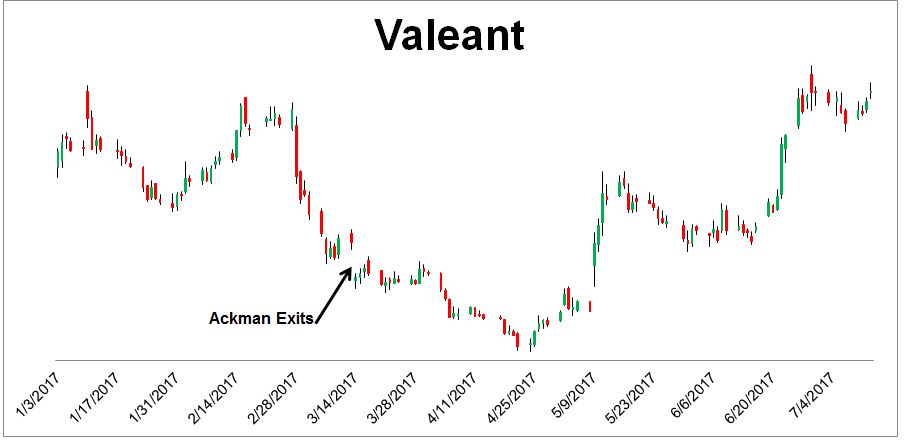

Bonus rule: Wait for a big-name investor to get out. Valeant, for example, is up 43% since Ackman announced that he sold his shares. But it’s never really that easy. Valeant fell another 30% in the first few weeks after this news came out. So anybody who saw Ackman’s exit as the “all-clear” was sorely mistaken.

Catching bottoms are extraordinarily tough to do, but nobody can convince you not to do it. The only way you’ll learn that it’s an expensive waste of time is by trying it out for yourself. So hopefully some of these rules will help you the next time you try to catch a falling knife.

Catching bottoms are extraordinarily tough to do, but nobody can convince you not to do it. The only way you’ll learn that it’s an expensive waste of time is by trying it out for yourself. So hopefully some of these rules will help you the next time you try to catch a falling knife.

Copyright © The Irrelevant Investor