by Ryan Detrick, LPL Research

The Federal Reserve’s (Fed) policymaking arm, the Federal Open Market Committee (FOMC), released the minutes from its June 13-14, 2017 meeting today, but the release did not offer many surprises. After the June FOMC meeting statement, which we discussed in another blog post, markets were looking for any details regarding the reasons the Fed felt the slowdown in inflation readings is temporary, the timing of its balance sheet reduction, and whether the balance sheet program would have any impact on the path of rate hikes.

On those fronts, the minutes revealed the following:

- Inflation expectations: Most FOMC members felt that inflation readings would move toward the committee’s 2% goal over the medium term. Some participants believed that a tight labor market would lead to wage inflation over time, while others said falling prices in specific areas, such as wireless telephone services and prescription drugs, were acting as a temporary drag that would eventually fade.

- Balance sheet normalization: The balance sheet normalization program was clearly a major topic of discussion, though few additional details were to be found. The minutes did not specify an exact start date, though they did indicate that most participants expected the program to begin in 2017. We continue to believe that a September start date is likely.

- Path of future rate hikes: As shown in the dot plots from the June meeting, the FOMC participants’ opinions are mixed on the future path of rates, with the median forecast being one additional rate hike in 2017. Market expectations are slightly lower, with fed funds futures pricing in a 63% chance of another rate hike by December 2017, and the Fed minutes did little to change the market’s opinion.

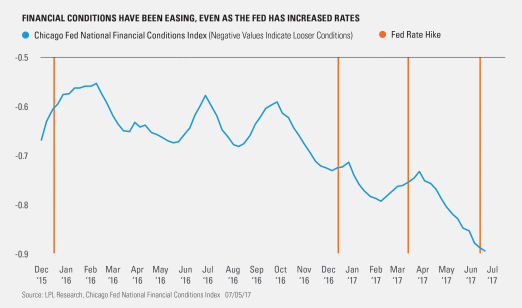

Additionally, some participants are concerned that financial conditions – based on financial indicators that tend to influence economic activity – have eased in recent months, though they would normally be expected to tighten as the Fed increases interest rates. FOMC members mentioned that factors such as heightened equity valuations and low bond yields may be contributing to this. Though the Fed’s dual mandate is focused on the labor market and inflation, the mention of financial conditions in the minutes, and also in several recent Fed speeches, may make it another area worth watching as an indicator of future Fed policy.

*****