by Matt Sommer, Janus Henderson Investments

Did you know that $41 trillion in assets are expected to transfer by the year 2052*? With the stakes this high, it is imperative to put in place a plan that will ensure the successful transition of wealth to your clients’ family members. But what do King Lear and Tony Soprano have to do with this situation, you ask? Besides being cultural treasures, they both can teach us some lessons about preparing for wealth transfer.

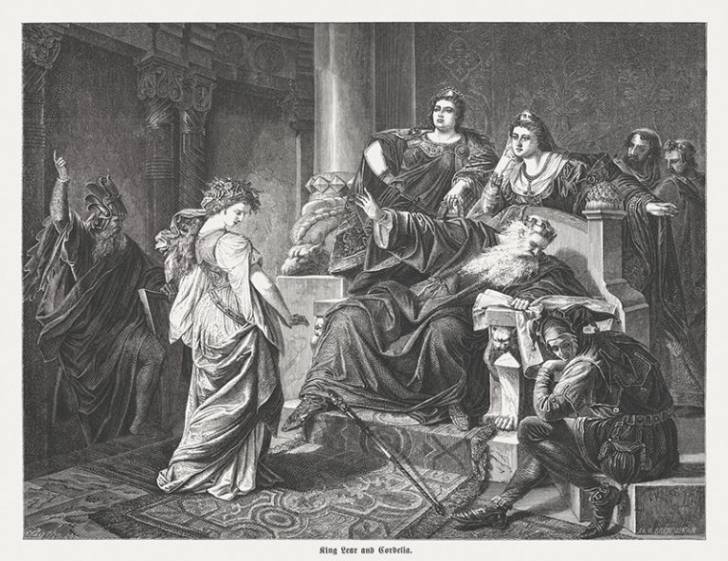

Our first case study is Shakespeare’s King Lear. The play opens with the king declaring that he does not want any strife after he dies, so he is prepared to divide his kingdom equally among his three daughters – Goneril, Regan and Cordelia. But first, he asks each daughter to profess their love for him in the best way she knows how. The evil sisters Goneril and Regan, who do not really love their father, delve into expressions of adoration for him. Conversely, the virtuous Cordelia, who really does love her father, remains speechless, saying that words cannot express her love. The king takes offense, launches into a rage and disowns Cordelia, dividing his kingdom between his two other daughters. So, that’s the king’s wealth transfer plan. How do you think it ends?

By the end of the play, all involved end up dead or with eyes gouged out. The king goes insane, in large part due to his family’s dysfunction, and dies a lonely death with no heirs.

Not all examples of poorly written estate plans end with this much violence. Let’s take a look at a different example – this time actor James Gandolfini, better known to most as Tony Soprano, who died in 2013 while vacationing in Italy.

His $70 million fortune was split among various loved ones, but some experts claim that his estate plan was a disaster. Had the fortune been left to his wife, instead of split among the family, the whopping estate tax would have been deferred until her death. But his goal was to leave some property to his sisters at the time of his death. To many, taxes aren’t everything, and I suspect that he was willing to accept this trade‐off to ensure his wealth was split among family members at the right time.

What could he have done differently?

- If he had used a simple instrument called a revocable living trust instead of a will, his affairs would have been kept private, and we would be talking about a different celebrity.

- He could have reconsidered logistics related to foreign holdings. His property included a villa in Italy, to be split between his two children when the youngest child turned 25. The problem is that Italy has a law that requires a portion of real property to go to the spouse. That issue may easily be disputed in the courts for years to come. There is also the issue of upkeep. It is not clear what arrangements, if any, have been made to maintain the property.

- He could have left more money to his family with a different tax strategy. His wife received 20% of the estate after taxes were paid. So her share was 20% of $40 million instead of 40% of $70 million. Remember that spouses do not pay estate taxes on an inheritance in the U.S. So why would he make her chip in for taxes, rather than let her take 20% of $70 million and let the other beneficiaries pay the taxes and divide up the balance? Was this intentional?

So what did we learn? In the first case study, while there were no taxes, we can see how spur-of-the-moment emotional planning can have undesirable results. In the second case study, taxes applied, but it appears that other goals and objectives took a higher priority. While important, taxes are generally not, nor should they be, the driver of how wealth is transferred. And it is possible that some of you may not even have to worry about taxes – but that, of course, does not mean there isn’t some work to be done.

*Source: Boston College’s Center for Wealth and Philanthropy

The information contained herein is for educational purposes only and should not be construed as financial, legal or tax advice. Circumstances may change over time so it may be appropriate to evaluate strategy with the assistance of a professional advisor. Federal and state laws and regulations are complex and subject to change. Laws of a particular state or laws that may be applicable to a particular situation may have an impact on the applicability, accuracy, or completeness of the information provided. Janus Henderson does not have information related to and does not review or verify particular financial or tax situations, and is not liable for use of, or any position taken in reliance on, such information.

Copyright © Janus Henderson Investments