by Jeffrey Saut, Chief Investment Strategist, Raymond James

One of the good things about traveling is one gets the chance to read, think, and reflect on events that have taken place. To that point, while traveling last week I had the chance to read the transcript of ex-FBI director Comey’s testimony to the Senate intel committee; if I was him I would be retaining a defense attorney! As for the stock market’s reaction to said testimony, stocks marginally fell as Comey’s testimony began, but then rallied as he testified President Trump did not attempt to stop the Russia investigation and that Loretta Lynch had pressured him to lie in regards to the Hillary Clinton email server investigation. Some of the striking lines from Comey’s testimony were: 1) "Did any individual working for this administration’s ask you to stop the Russian investigation?" Comey: "No;" 2) (Loretta Lynch) "instructed me not to call (the Hillary email case) an investigation – she instructed me to call it a matter;" 3) Comey says decisions around the Clinton email probe were influenced in part by AG Lynch’s tarmac meeting with Bill Clinton; 4) The White House attacks on the FBI and Comey were “lies, plain and simple;” and the list goes on. Alan Dershowitz responded: “Comey confirms that I'm right – and all the Democratic commentators are wrong!”

Following Comey’s testimony President Trump’s attorney (Kasowitz) stated:

Today, Mr. Comey admitted that he unilaterally and surreptitiously made unauthorized disclosures to the press of privileged communications with the President. The leaks of this privileged information began no later than March 2017 when friends of Mr. Comey have stated he disclosed to them the conversations he had with the President during their January 27, 2017 dinner and February 14, 2017 White House meeting. Today, Mr. Comey admitted that he leaked to friends his purported memos of these privileged conversations, one of which he testified was classified. He also testified that immediately after he was terminated he authorized his friends to leak the contents of these memos to the press in order to "prompt the appointment of a special counsel.” . . . We will leave it the appropriate authorities to determine whether these leaks should be investigated along with all those others being investigated . . .

Given those events, stocks surged around midday when Comey admitted he had orchestrated a leak to The New York Times in an attempt to procure the appointment of a special prosecutor, which clearly taints Mueller’s investigation. That caused one savvy seer to lament, “What a mess!” Following the completion of his testimony, stocks fell again, but then the last hour manipulators showed up, leaving the senior index better by nearly 90 points on the closing bell. So, the flat line strategy worked for four sessions last week versus three sessions the week before. Yet the fact of the matter is the S&P 500 (SPX/2431.77) was trading around 2420 on May 25 and at last Friday’s low was changing hands around 2416, so the flat line strategy has been a pretty decent call. The flat lining, however, should end this week with a jittery market into the Fed’s Tuesday/Wednesday confab. As I write, the futures are pricing in a nearly 100% chance of a rate hike, so that is likely already baked into the market at this point. Following Yellen’s Wednesday press conference, the new energy mix should take over and subsequently dictate the near-term direction of the various markets. Andrew and I think it will likely be on the upside.

The other event that may have a marginal impact on our markets is the stunning U.K. general election results, where Theresa May’s flawed strategy cost the conservatives 12 seats in Parliament. Conservatives, therefore, do not have enough seats to form a majority and are going to be forced into a coalition. While many pundits state that you need 326 seats to form a majority that is not really the case. The math goes like this – there are 650 available seats in Parliament, but Northern Ireland’s Sinn Fein party does not take its seats in Parliament (the Sinn Fein has seven seats). The result is that instead of the 326 seats representing a majority, a party really only needs 322 seats for a majority. With 318 seats, the Conservative party is four seats short of that majority. This implies a weakened U.K. government with consternation building for an orderly Brexit.

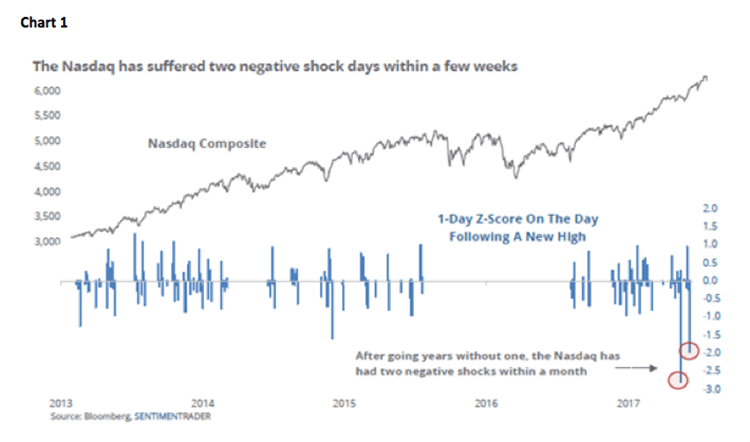

Speaking to last Friday’s action, many of the year-to-date technology darlings looked to have reversed in Friday’s trading, with the most notable being the NASDAQ (-1.8%) and the Philadelphia Semiconductor Index (- 4.23%), as can be seen in the attendant chart on page 3. As one wise old Wall Street wag wrote me over the weekend:

I think there was a genuine reversal in the bubble stocks yesterday, but not the entire stock market. This bubble has occurred because big companies like Goldman Sachs and Fidelity have justified them. Now Goldman has changed its opinion and speculators playing momentum and trends will be caught off-guard. On the positive side, the diplomatic pressure put on Qatar is good and appropriate. This is an important development if there is to be peace in Syria. The emir of Qatar spent about one billion dollars to hire mercenaries to attack Assad’s government and military forces. Those mercenaries have to be eliminated for any peace to work in Syria! The U.S. has a big airbase in Qatar with about 9,000 personnel. You know Lt. Col. Jim Booker (retired) has flown B-1s into Qatar. There is some risk there, but the emir wants and needs our rental money.

Last week we experienced some lukewarm economic reports. This week, in addition to the expected 25 basis point hike in the Fed Funds rate at the Federal Reserve meeting (from 0.75 – 1.00% to 1.00 – 1.25%), there are a large number of “core” economic releases. The major ones would be: inflation readings; industrial production numbers; retail sales, and housing data. Any big move in any one of those reports could be a market-moving event.

Turning to individual stocks, we looked at the stocks from the Raymond James research universe that have the highest number of Wall Street analysts’ “buy ratings,” have positive ratings from our own fundamental analysts, and screen positively using our proprietary algorithm model. The names for your potential buy list include (in no particular order): UnitedHealth Group (UNH/$181.46/Strong Buy); LKQ Corporation (LKQ/$31.97/Outperform); American Tower (AMT/$130.28/Outperform); Marathon Petroleum (MPC/$54.71/Strong Buy); Facebook (FB/$149.60/Strong Buy); Salesforce (CRM/$87.27/Strong Buy); and Newell Brands (NWL/$53.24/Strong Buy).

The call for this week: Last week I spent time in Philadelphia seeing portfolio managers, visiting Raymond James’ branches, and speaking at various events for our financial advisors and their clients. The weekend was spent in Richmond, Virginia, attending our 50th high school reunion. Today I am in Milwaukee to speak at the opening ceremonies of the U.S. Open golf tournament followed by a flight to Nashville to do many of the same things I did last week in Philly. If past is prelude, anytime I have been away for two consecutive weeks there has been a tendency for something big to happen in the markets. I doubt if this week will be any different. And to all of you that emailed me the article about Jim Rogers predicting the biggest crash in the stock market of his lifetime, all I can say is that he has been pretty bearish for a long, long time. Moreover, he is giving his prediction the wide timeframe of late this year or sometime in 2018. Andrew and I would note that history suggests it is one crash to a generation and we have already seen ours. In fact, I was in the September 21, 1987 edition of Barron’s suggesting a “waterfall decline” was coming and recommending selling stocks, or hedging stocks, which got me fired from Wheat First Securities. Evidently, you were not supposed to use the dreaded four letter word “S-E-L-L” at Wheat. Fortunately, Raymond James does not have that same mindset, for we have used the word “sell” many times over the past number of years.

P.S.: I am writing this, and recording this, Sunday night because I have a 7:00 a.m. flight to Milwaukee.

Copyright © Raymond James