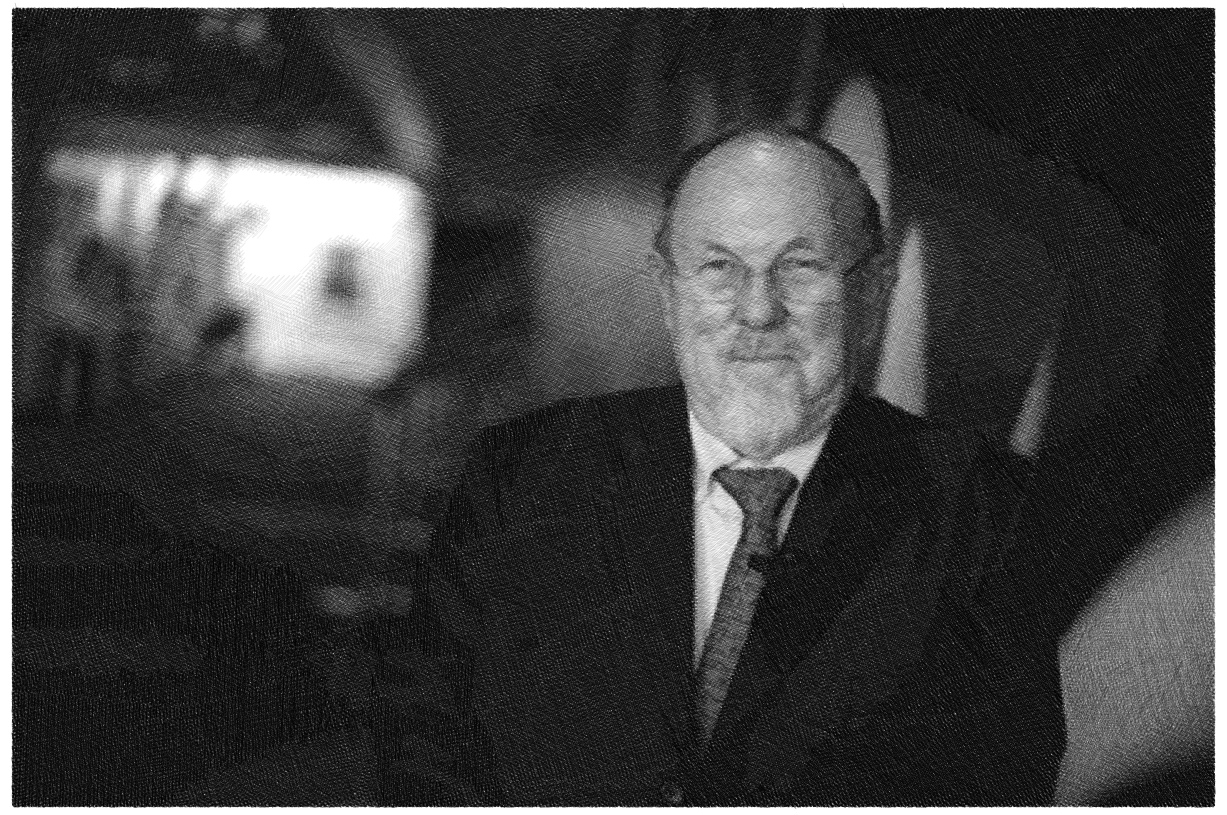

Bloomberg View columnist Barry Ritholtz interviews William F. Sharpe, creator of the Capital Asset Pricing Model, the Sharpe Ratio, and other measures of risk, the STANCO 25 professor of finance, emeritus, at Stanford University’s Graduate School of Business. Sharpe is a past president of the American Finance Association and received the Nobel Prize in Economic Sciences in 1990. This interview aired on Bloomberg Radio.

Interview with William Sharpe (Masters in Business)