by Frank Holmes, CIO, CEO, U.S. Global Investors

Last year, the Federal Register—the U.S. government’s depository of rules and regulations—hit an all-time high of 81,640 pages. Among the industries that bear the greatest regulatory oversight is financials, which has seen a disproportionate amount of scrutiny in recent years, especially following the 9/11 attacks and subprime mortgage crisis.

Although I agree with the need to have and play by the rules, financial regulations have become so onerous that they render all but the largest firms noncompetitive. It’s a game whose rules are continually shifting, and there often seems to be more referees than players. A recent Thomson Reuters survey found that more than a third of all financial firms spend at least a whole work day every week tracking and analyzing regulatory changes. This is an obligation most companies simply can’t afford in the long term.

It serves no one, least of all investors and borrowers, to have fewer options in the capital markets. But this is precisely what the most recent regulations have contributed to. In the last 20 years, the number of listed companies has been cut in half, and since 2008, one in four regional banks has disappeared.

President Donald Trump and the Republican-controlled Congress are actively working to alleviate any additional regulatory pressure. In January, the House passed a bill requiring securities officials to conduct a cost-benefit analysis of any new rule—something that should have been done in the first place—and in February the president signed an executive order requiring the elimination of two federal regulations for every new one that’s adopted.

As for when those that are already in place can be lifted, in whole or in part, is a different matter.

Having said that, I want to share with you a timeline of the five costliest financial regulations of the past 20 years. Please note that when I say “costly,” I’m referring not only to dollar figures but also additional workload and compliance hours.

October 2001: International Money Laundering Abatement and Financial Anti-Terrorism Act of 2001

Passed in October 2001 as part of the USA PATRIOT Act, this particular act aims to prevent black money from being used to finance terrorist activities. It actually reforms two previous anti-money laundering (AML) laws, the Bank Secrecy Act of 1970 and the Money Laundering Control Act of 1986.

Although I think most of us would agree that catching terrorists is an admirable mission, the AML rules come at a very high cost to financial institutions. According to a 2016 study conducted by the Heritage Foundation, the current rules cost the U.S. economy between $4.8 billion and $8 billion annually. And with so few money laundering cases opened and investigated every year, each conviction since the law went into effect carries an estimated $7 million price tag.

Consequently, many banks, facing strict penalties and compliance costs, have cancelled thousands of “high-risk” accounts, including those belonging to money-transfer firms and humanitarian organizations.

July 2002: Sarbanes-Oxley Act of 2002 (SOX)

Enacted in July 2002, Sarbanes-Oxley, or SOX, was intended to prevent large-scale corporate and accounting fraud that led to the demise of Enron, WorldCom and others. It set in place new requirements for public companies.

The most burdensome of these is Section 404, which requires external auditors to report on the adequacy of a firm’s “internal controls.” Since such auditing is so complex and costly—sometimes quadruple the normal amount—many smaller companies have found it prohibitively difficult to raise capital in the public markets. Before SOX, there were an average 528 initial public offerings (IPOs) a year, according to Dealogic data. Since it was enacted, that number has fallen to 135, a decline of nearly 75 percent.

This has resulted in the rise of private capital and has locked retail investors out of high-growth investment opportunities.

Speaking to the Detroit Economic Club in 2013, Home Depot founder and former CEO Bernie Marcus said that, had SOX existed when he helped conceive the company in the late 1970s, he wouldn’t have been able to get it off the ground, let alone take it public. This would have been a shame, as Home Depot is now one of the largest employers in the U.S. and has among the highest market caps, standing at nearly $188 billion. A $5,000 investment in the company when it first IPOed in September 1981 would today be worth well over $27 million. In its current form, SOX threatens to put an end to such high-growth opportunities.

March 2010: Foreign Account Tax Compliance Act (FATCA)

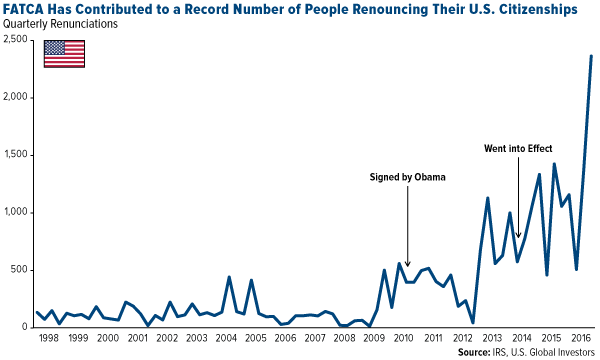

Signed by then-President Barack Obama, the Foreign Account Tax Compliance Act (FATCA) allegedly aims to clamp down on tax evasion by requiring participating foreign financial institutions (FFIs) to provide the Internal Revenue Service (IRS) with names, addresses and account details of all American accountholders living abroad with assets over $50,000.

As I wrote back in 2014, the law’s mandates would be felt hardest “not by wealthy ‘fat cat’ tax dodgers but hardworking Americans who have no intentions of cheating the U.S. tax system.”

I’m not alone here. The IRS, of all groups, has come out on the side of taxpayers, writing in 2015 that “the IRS’s approach to FATCA implementation has created significant compliance burdens and risk exposures to a variety of impacted parties.” The rule’s underlying assumption, it says, is that “all such taxpayers should be suspected of fraudulent activity, unless proven otherwise.”

Until the law is reformed, the IRS adds, its efforts “will continue to be unsystematic, unjustified and unsuccessful.”

Many others apparently agree—especially those FATCA targets. The number of overseas individuals renouncing their U.S. citizenship crossed above 5,000 in 2016, an all-time high, with 2,300 expatriating in the final quarter alone.

July 2010: Dodd-Frank Wall Street Reform and Consumer Protection Act

The most sweeping reform of the U.S. financial services industry since the Great Depression, the Dodd-Frank Act was signed into law July 2010, creating some 400 new rules and mandates as well as several new councils, bureaus and agencies. Standing at more than 22,000 pages, Dodd-Frank is such a behemoth piece of legislation that it’s impossible to discuss it comprehensively in such a short space.

Suffice it to say, though, that since it went into effect, a startling number of community banks have gone under, giving borrowers fewer options. Lower-income customers are disproportionately at a loss, as many banks have done away with free checking.

Both former Federal Reserve Chair Alan Greenspan and billionaire investor Warren Buffett have suggested Dodd-Frank needs to go, with Greenspan saying he’d love to see the 2010 law “disappear.” Buffett, meanwhile, commented that the U.S. is “less well equipped to handle a financial crisis today than we were in 2008. Dodd-Frank has taken away the Federal Reserve’s ability to act in a crisis.”

Reforming Dodd-Frank is supposedly near the top of President Trump’s priorities, and a 600-page replacement called the Financial Choice Act 2.0 has already been drafted. If passed, the legislation would relax some of Dodd-Frank’s more restrictive rules and limit the powers of the Consumer Financial Protection Bureau (CFPB) and Securities and Exchange Commission (SEC). It would also roll back the so-called Volcker Rule, named for former Federal Reserve Chair Paul Volcker, which effectively bans banks from making speculative investments that don’t directly benefit their customers.

April 2016: Department of Labor (DOL) Fiduciary Rule

On its surface, the Department of Labor’s Fiduciary Rule sounds like something everyone can get behind. It mandates that all who serve as fiduciaries—broker-dealers, investment advisors, insurance agents and the like—must act in the best interest of their clients. Fine. But how the rule will be interpreted and applied could have negative consequences in the securities markets.

What’s naturally going to happen is financial professionals, in an effort to remain compliant with the rule, will recommend only the least expensive products, regardless of whether they’re a good fit for their clients. Many mutual funds—which might be better performing but have higher expenses than other investment vehicles—will fall off brokerage firms’ platforms.

It would be like the DOL telling consumers they can only shop at Walmart and buy their coffee from Dunkin’ Donuts because anything more expensive—Target or Starbucks, say—is “riskier,” even though it’s of higher quality.

Issued in April 2016, the rule was delayed for 60 days by the Trump administration and is now scheduled to go into effect early next month. It’s already had disruptive consequences. Investment Company Institute (ICI) President and CEO Paul Schott Stevens, speaking this month to ICI members, stated the rule was “causing great harm,” adding that brokers are “simply resigning from small accounts en masse” to avoid legal and regulatory risk.

It might be difficult for Trump and Congress to provide relief from these and other financial regulations—especially now that the multiple investigations into the Trump campaign threaten to sideline such efforts—but I still have faith.

For expert insight and intelligence on gold, emerging markets and natural resources, subscribe to our weekly, award-winning Investor Alert!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 3/31/2017.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors