Currency outlook: Global growth, eurozone elections continue

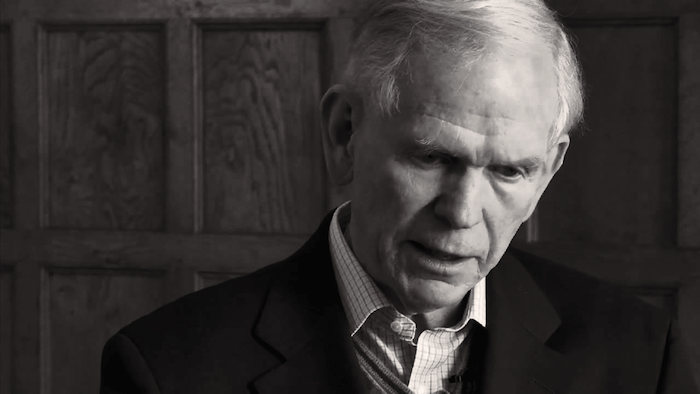

by Ray Uy, Senior Portfolio Manager, Head of Macro Research and Global Multi-Sector Portfolio Management, Invesco Canada

Canadian dollar strength has faded recently despite stronger economic data. Weakness in oil prices has been responsible for some of the reversal. The Bank of Canada has, at least temporarily, dropped its dovish tilt, but appears content to leave the overnight rate target at 0.50% for the foreseeable future.1 The Canadian dollar continues to remain overvalued, in our view.

Below is the latest outlook for other key world currencies, from the Invesco Fixed Income team.

U.S. dollar

We continue to expect mixed U.S. dollar performance in the near-to medium term. Emerging-markets currencies should be supported versus the dollar if our positive global growth view plays out. Investors will likely seek higher yields in countries of robust growth. However, the picture is less clear for developed market currencies, as the Fed remains benign and the non-U.S. global growth picture brightens.

Euro

Our outlook for the euro remains constructive over the medium term. European economic activity continues to improve and should eventually allow the European Central Bank to pivot on quantitative easing (QE) and embark on tapering. We expect the euro to appreciate in this environment and this will likely unfold in Q2/Q3 this year. In general we believe QE has approached its conclusion and policy adjustments going forward are likely to be skewed toward supporting longer-term euro strength.

Chinese renminbi

We expect the CNY and CNH currencies to trade on the stronger side of the 6.80-6.99 range in the month ahead. Softening in the U.S. dollar is expected to continue to support the renminbi. Capital outflows have stabilized and we expect foreign exchange reserves to ratchet higher in the coming months. In particular, tighter controls over corporate overseas investment and measures recently announced to encourage capital inflows should boost reserves.

Japanese yen

Japanese economic data have surprised to the upside of late. However, positive moves in the yen can be attributed to non-domestic drivers (for example, disappointment with implementation of Trump policies, increased geopolitical concerns, etc.) and these drivers’ potential impact on global growth. We see no obvious catalyst for a reversal in the recent trend, particularly given President Trump’s attention to outright currency levels. However, we do not rule out a short-term correction.

British pound sterling

Brexit discussions are unlikely to make significant progress until the 2017 eurozone elections have reached a conclusion (autumn). The U.K. Prime Minister, Theresa May, is likely to have an increased majority in the U.K. parliament by that time, paving the way for her to take a far more diplomatic approach to the talks than previously envisaged. Given current valuations and positioning, we believe sterling would appreciate quite meaningfully under such a scenario (our base case).

Australian dollar

The recent March employment report was stronger than expected, but the unemployment rate remained unchanged and stubbornly high. This result plus the Reserve Bank of Australia’s apparent satisfaction with the current trading range of the Australian dollar suggests that it will likely maintain its current cash target rate at 1.50% for an extended period of time.2 We remain neutral on the Australia dollar.

With contributions from James Ong, Senior Macro Strategist, Brian Schneider, Head of North American Rates, Sean Connery, Portfolio Manager, Scott Case, Portfolio Manager and Alex Schwiersch, Portfolio Manager.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog