by Blaine Rollins, CFA, 361 Capital

The French President semi-finals were over the weekend and the vote went about as positive as they could have for the markets. While LePen won the first round, it is unlikely that she will be able to gather enough support to upset Macron in the final tour. As a result, the European markets decided to pop the champagne today as risk of a Euro exiting France has fallen into the Seine. Euro up, Euro stocks up, risky Euro credit up. Vive la France.

Back here in the United States, we have been promised a Healthcare vote, a ‘massive’ Tax Reform package, a Budget extension which will include spending on a Mexican border wall and a decision on how to settle North Korea. It will be a very busy first week back for Congress. Some members of Congress and the administration have been surprised by the aggressive schedule of the POTUS. But the markets didn’t flinch last week and instead rewarded investors with gains in many of the Trump-trade assets (Small Caps, Financials & Industrials). Now we will watch to see if the gains will stick this week as Washington has its busiest legislative week in decades. Besides politics, it was a mixed week of earnings with many big moves in the underlying stocks. Earnings calls were cautious with several comments about Washington’s next moves. Among economic data, the week’s numbers were soft with shortfalls in the Philly Fed, Markit Mfg/Serv PMIs, Housing Starts, Empire & Dallas Fed Mfg.

Best summary comment from Corporate America on Washington came from the CFO of GE…

Mr. Bornstein said the sentiment among US businesses was that tax reform had to come this year.

“The longer we go on [without an agreement on reform], the more troublesome this might feel,” he said. “One way or the other, this has to be resolved.”

There were plenty of comments about Washington on the earnings calls this week…

“The first quarter was an interesting one, as we entered it with a lot of optimism about what the new administration might do to further improve the economy. As the quarter continued, some of this optimism has slowed and now companies are more cautious or skeptical about what shape some of the programs, including tax reform, infrastructure projects and ACA reform will take and when they might actually take effect, if at all.” (Brown and Brown)

“During the first quarter of 2017, commercial loan growth was sluggish across the industry. Our large corporate customers tell us that they are optimistic about the future, but are awaiting more clarity regarding potential changes in tax and regulatory reform, infrastructure spend and trade policies.” (US Bancorp)

“Loan growth, despite the optimism for change in a more business-friendly administration, has yet to materialize in a meaningful way…The net result is that our outlook for loan growth for the full year of 2017 is a little lower than it was in January.” (M&T Bank)

“If they make no progress in Washington at all then eventually that optimism will turn to pessimism and…capable of a return into recession… I don’t think it will wane immediately, but by the end of the year let’s say if there’s been no positive movement on taxes regulation, healthcare and all that combined then I will be very worried to be honest.” (BB&T)

Even the Fed’s Fischer had some comments about Washington and the recent data…

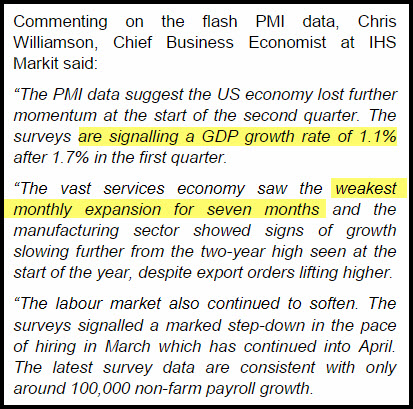

One close look at the recent PMI data shows the slowing…

(@MarkitEconomics, WSJ: The Daily Shot)

Also look at the post-earnings stock reactions of the companies selling nuts, bolts and fasteners to industrial America. Not pretty…

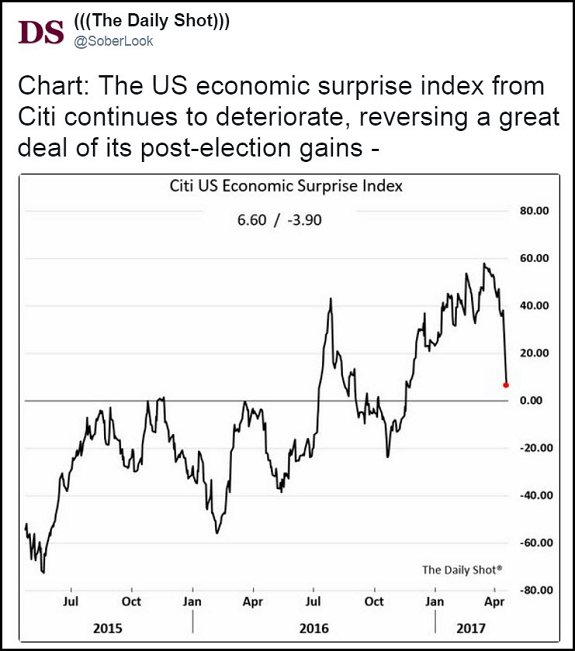

More broadly, the U.S. economic surprise index is about to go negative after the recent run of slowing data…

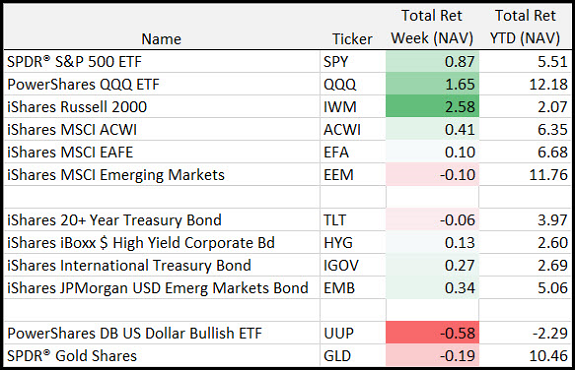

But even with mixed earnings and slowing economic data, last week was all about the promises made in Washington…

Risk on week with Small Caps and Nasdaq leading.

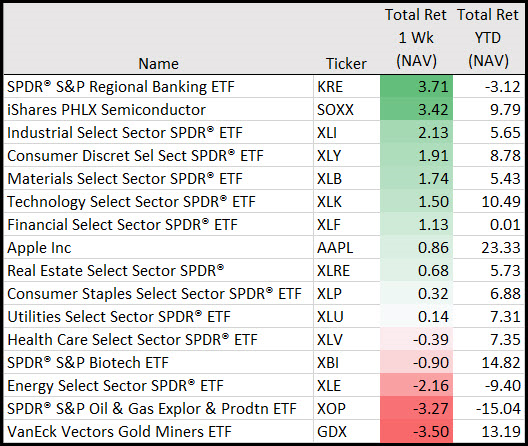

Among the sectors, Banks, Semis and Industrials soared, while Energy and Resource companies got buried…

This is the busiest week of earnings for the quarter as the visual calendar shows…

(@eWhispers)

So now we have an ETF of ETF providers. Hasn’t the 2nd derivative of ETF flows now turned negative?

The ETF Industry Exposure & Financial Services ETF (NYSE Arca: TETF), will begin trading today, April 20, 2017, providing investors with a single point of access to the companies driving and participating in the growth of the Exchange Traded Funds industry.

TETF will seek to track, before fees and expenses, the price and yield performance of the Toroso ETF Industry Index (the Index), which is designed to provide exposure to the publicly traded companies that derive revenue from the ETF industry. This includes ETF sponsors, index and data companies, trading and custody providers, liquidity providers, and exchanges.

ETFs and the industry have experienced significant growth over the past five years, as their assets have grown in the U.S. from $1.2 trillion to $2.7 trillion; the number of U.S. ETF sponsors has increased from 45 to 78; and the average ownership of U.S. equities by ETFs has more than tripled.

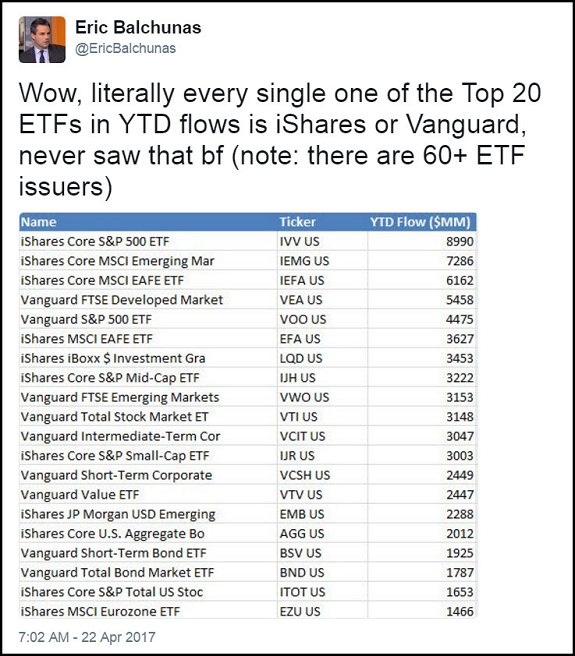

Interesting to see this chart of the leading ETF inflows YTD…

Even more interesting is that some of the oldest and largest ETFs: SPY, IWM & QQQ have negative flows YTD.

Oil prices remain terrible as they dip below $50 again…

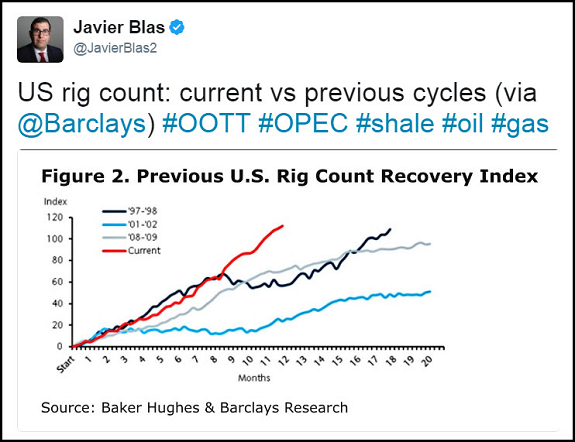

Not helping prices is the ramping production of the U.S. players…

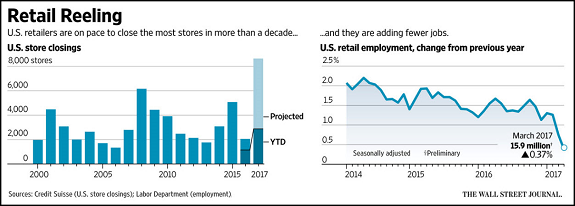

“Momma, don’t let your babies grow up to be cashiers”…

When business was bad during the 2015 holiday season, many chains blamed unusually warm weather. But when the most recent holiday season once again failed to produce robust sales growth, “retailers realized this was a structural change,” Credit Suisse analyst Christian Buss said.

Mall traffic is down, not just because people don’t want to buy winter coats when it is 60 degrees outside, but because consumers no longer view most malls as entertainment destinations.

Susan Smith, 63, used to visit the Neiman Marcus store at her local Tampa, Fla., mall once a month. In the past year, she went twice. “I don’t like going to malls anymore,” she said. “They’re energy suckers.”

(WSJ)

It is a great time to sell your home…

But good luck finding a new home to buy…

We hear identical stories in the Denver real estate market…

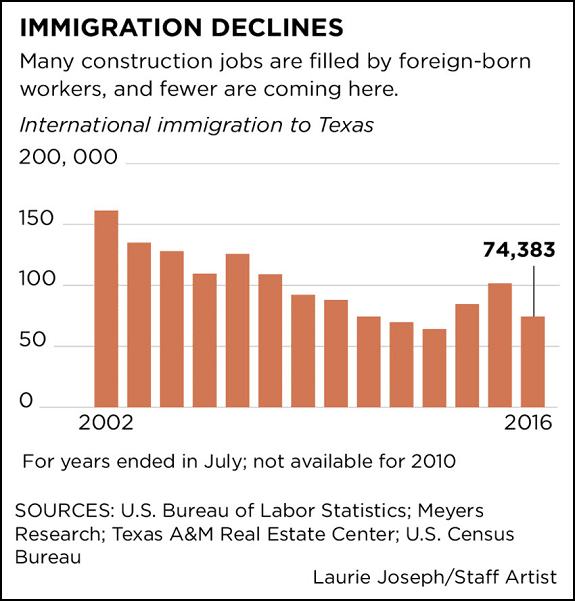

Dallas home prices are climbing rapidly, and homebuilders are complaining about labor shortages and soaring wages for construction workers. But something else makes this housing boom different from others: Immigrants aren’t riding to the rescue.

For decades, Mexicans and other foreign-born workers have been coming to Texas to build homes, apartments and office towers. By one estimate, they fill almost half the construction jobs in the state, which is about twice as many as in the rest of the nation…

In the Dallas-Plano-Irving area, just over 81,000 worked in the construction trades in February, according to government data. To fill current demand in the business, the industry needs up to 99,000 workers — not years in the future, right now.

That estimate from Meyers Research is based on a model that considers the growth in building permits and other trends. The research firm also reported that millennials are underrepresented in construction, even while they flock to physical work for solar panel companies.

In a recent survey in Builder magazine, just 3 percent of young adults said they were interested in a career in construction. In Texas, nearly 7 percent of private jobs are in the field. In addition to today’s demand for workers, many skilled tradesmen are in their 40s and 50s, so retirement is not far off.

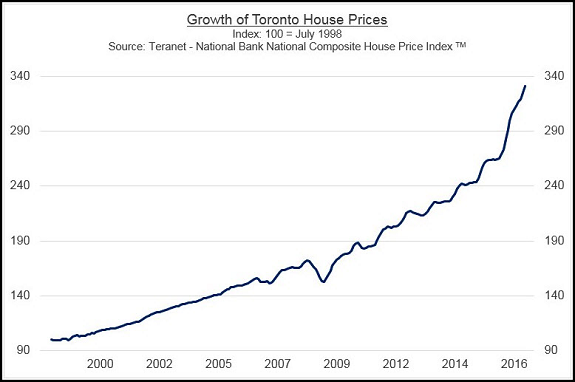

It is even more difficult to buy a home in Toronto…

(@hmacbe)

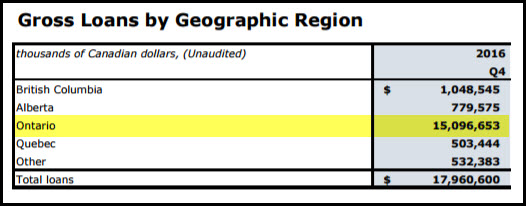

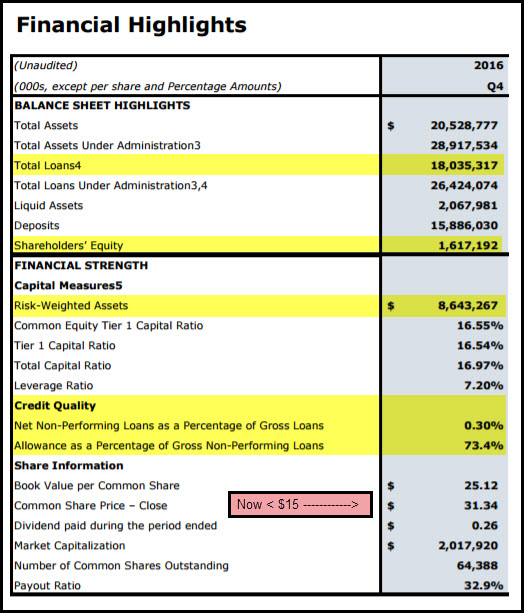

But if you want a Canadian Real Estate proxy to keep an eye on, put Home Capital Group on your radar…

The CEO was just asked to leave because they may have put some bad mortgages on the books. Also, the Ontario government is about to issue new taxes and regulations to crack down on foreign buyers. While the financials look decent today, the stock price tells me that ‘something wicked this way comes’. (Hat tip to Jared Dillian for the heads up on this one.)

The Uber Board of Directors Ulcer Index hit new highs this weekend…

SAN FRANCISCO — Travis Kalanick, the chief executive of Uber, visited Apple’s headquarters in early 2015 to meet with Timothy D. Cook, who runs the iPhone maker. It was a session that Mr. Kalanick was dreading.

For months, Mr. Kalanick had pulled a fast one on Apple by directing his employees to help camouflage the ride-hailing app from Apple’s engineers. The reason? So Apple would not find out that Uber had been secretly identifying and tagging iPhones even after its app had been deleted and the devices erased — a fraud detection maneuver that violated Apple’s privacy guidelines.

But Apple was onto the deception, and when Mr. Kalanick arrived at the midafternoon meeting sporting his favorite pair of bright red sneakers and hot-pink socks, Mr. Cook was prepared. “So, I’ve heard you’ve been breaking some of our rules,” Mr. Cook said in his calm, Southern tone. Stop the trickery, Mr. Cook then demanded, or Uber’s app would be kicked out of Apple’s App Store.

For Mr. Kalanick, the moment was fraught with tension. If Uber’s app was yanked from the App Store, it would lose access to millions of iPhone customers — essentially destroying the ride-hailing company’s business. So Mr. Kalanick acceded.

British Pound. Interesting chart. First time above the 200dMA in two years. Is a new trend under PM May underway?

Some tough words from a top Navy scientist, Rear Admiral David Titley, PhD…

If I could do one financial transaction, I would short South Florida real estate. Ultimately, it’s worth zero and there will be hundreds of billions of dollars lost. Miami’s strategy is to encourage as much development as possible and then use money in the tax base and try to figure this out. It’s the ultimate Ponzi scheme.

…I tell my climate friends, you’ve got to keep trying stuff. I hate to break it to National Geographic, but nobody cares about polar bears. That’s what most Americans think of when they think about climate change. It hasn’t energized the population at large. I think sea-level rise will ultimately get people’s attention. But by then, you’re really running out of runway.

Bloomberg also had a big story on South Florida and the rising tides…

Will the catalyst be a bank refusing to issue a mortgage? Will it be an insurer refusing to issue a policy? Or, he asked, “Will the trigger be one or two homeowners who decide to sell defensively?”

“Nobody thinks it’s coming as fast as it is,” said Dan Kipnis, the chairman of Miami Beach’s Marine and Waterfront Protection Authority, who has been trying to find a buyer for his home in Miami Beach for almost a year, and has already lowered his asking price twice.

Some South Florida homeowners, stuck in a twist on the prisoner’s dilemma, are deciding to sell now—not necessarily because they want to move, but because they’re worried their neighbors will sell first.

Food recall of the week…

MATTHEWS, N.C. (AP) — A food company is recalling frozen hash browns from stores in nine states because the potatoes may have pieces of golf balls in them.

McCain Foods USA’s recall notice said the golf balls apparently were “inadvertently harvested” along with the potatoes and chopped up. They say the pieces could be a choking hazard, but no injuries have been reported.

(AP News)

Two books for your 2017 reading list…

‘A Gentleman in Moscow’ is definitely my favorite book of the year. Extremely well written historical fiction. Can’t wait to read it again. Great for all ages starting with middle schoolers.

‘Shattered’ is the book that will challenge the new highs on your personal jaw-dropping index. It just hit the stores and is worth all the buzz. A must read for anyone involved in managerial decisions in an organization. Given the most foul mouths in the Beltway, avoid listening to this one on the school drop off or pickup. Voting age required on this one.

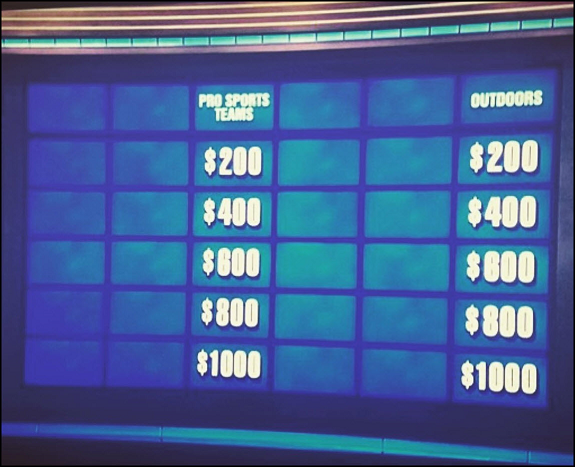

It would be even funnier if ESPN and Cabela’s were sponsors of Teen Jeopardy…

@heytherejeffro: Is there a funnier moment in television history than this snapshot of Teen Jeopardy?

Finally, one to entertain your little geeks at home with…

(XKCD)

Copyright © 361 Capital