by Ben Carlson, A Wealth of Common Sense

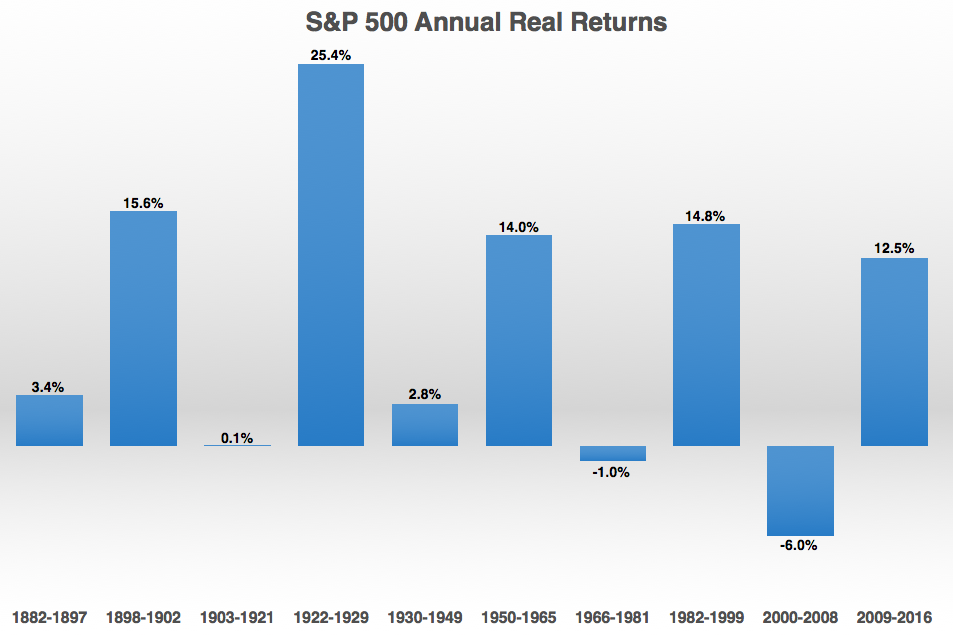

The past 20 years or so have seen some massive boom and bust periods in the stock market. Many investors see this period as an aberration. Unfortunately, it’s not. See the following chart on inflation-adjusted annual returns on the S&P 500 going back to the late-1800s:

Source: Bull: A History of Boom & Bust: 1982-2014/Returns 2.0

If you torture financial data enough and play around with start and end dates you can show almost anything you want historically but it’s obvious that the stock market is cyclical in nature. Periods of high returns are eventually followed by periods of low returns. Cycles are one of the few dependable aspects of investing in stocks.

A few thoughts on these numbers and how to think about market cycles:

- Stock market returns are lumpy and inconsistent. To state the obvious, this can make it difficult to invest in stocks as our brains have a hard time dealing with inconsistencies.

- Diversification can help with this inherent inconsistency. From 2000-2008 emerging markets outperformed the S&P 500 by almost 8% per year. REITs and bonds did even better than that. During the inflationary 1970s period, foreign stocks outperformed US stocks by almost 4% per year.

- Speaking of inflation, it can be a killer of long-term returns in high doses. Nominal S&P 500 annual returns from 1966-1981 were actually pretty decent, coming in at around 6% per year. This period was so brutal for investors because inflation was close to 7% per year, making real returns a loss of 1% per year. (See here for the other side of why this period wasn’t so bad for investors.)

- Momentum is consistently underrated by investors. As long as humans control the buy and sell decisions the pendulum will continue to swing too far in either direction and cause above and below average returns to follow one another on a consistent basis. The problem is that it’s nearly impossible to predict how long and how far things will go before investors see the other side of the cycle.

- This idea of market cycles plays into investor lifecycles as well. Some markets are better for the accumulation phase while others favor those who are looking for growth on the savings they’ve already built up. Basically, markets that go nowhere are perfect for younger people who are saving on a regular basis while the periods with strong returns are better for those who don’t have as much human capital remaining.

- There is a much larger element of luck involved in the financial markets than many people would have you believe. Where you stand in terms of your investing lifecycle and where the markets are in terms of peaks and valleys in performance numbers can have a huge impact on your investment experience.

- While cycles are one of the few dependable features of investing in the stock market, your life doesn’t always match up perfectly with where we happen to find ourselves in any particular cycle. Strong returns are promised to no one so those people who find themselves on the wrong side of a cycle will have to pick up the slack elsewhere in their financial plan by saving more, earning more, living on less or some combination of the three.

Further Reading:

To Win You Have to be Willing to Lose

Copyright © A Wealth of Common Sense