by Scott Brown, Ph.D., Raymond James

Consumer spending accounts for 69% of Gross Domestic Product. Last week, the data on the household sector were mixed. The Conference Board’s Consumer Confidence Index surged to a 16-year high. Meanwhile, inflation-adjusted consumer spending has been tracking at below a 1% annual rate in 1Q17. Does this spell trouble for the consumer? Or is this merely the pause that refreshes?

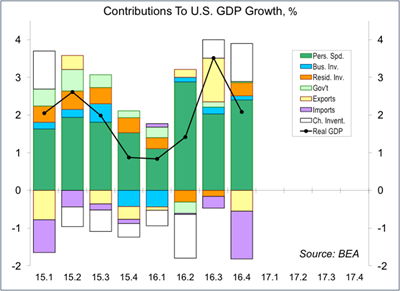

The 3rd estimate of 4Q16 GDP growth showed a stronger gain in consumer spending (a 3.5% annual rate). A year ago, spending was soft, but rebounded into 2Q16. Monthly figures through February suggest that inflation-adjusted spending is tracking at below a 1% annual rate. That’s a sharp slowing, but doesn’t look too terrible following a strong fourth quarter.

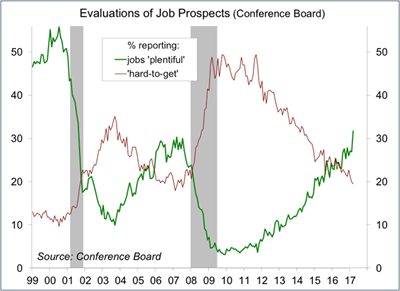

The Conference Board’s Consumer Confidence Index surprised to the upside last week, rising to its highest level since December 2000. Other attitude measures have been mixed. Interestingly, the report on UM Consumer Sentiment continues to show a sharp division on political persuasion. Democrats are depressed. Republicans are downright giddy (which remains a positive factor for the stock market). Getting a representative sample is a key issue for consumer surveys. A shift one way or the other in the composition can skew results.

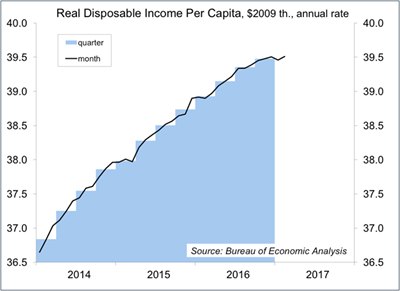

Consumers don’t spend confidence. Income is the key driver (wealth and the ability to borrow are also factors). While nominal (current dollar) average hourly earnings growth has been trending higher, real (inflation-adjusted) earnings are little changed relative to a year ago. Inflation-adjusted disposable income per capita has been trending about flat in recent months. That suggests limited firepower for consumer spending growth in the near term. This slowdown is likely to be temporary. Gasoline prices, up over the last year, have begun to stabilize in recent weeks (so y/y inflation is unlikely to be as high as it has been recently).

Other factors may have limited consumer spending growth recently. Delayed tax returns (relative to last year) have been widely reported. In addition, many households have health insurance plans with deductibles that reset once a year (often in January). This means more spending on prescriptions and doctor visits, and less money to spend on other things.

There were several tax aspects to the Affordable Care Act. Failure to repeal makes comprehensive tax reform unlikely, but we may see a reduction in tax rates in the months ahead. Still, tax cuts would be weighted toward the upper end of the income scale, and will provide little support for the typical worker.

As usual, the spring economic data will tell the tale. Keep a close eye on job and wage growth over the next couple of months. For the Fed, the focus is on the job market and the inflation outlook, but the outlook should remain consistent with a further normalization of monetary policy. Officials are likely to remain optimistic about growth despite the soft first quarter.

Copyright © Raymond James