by Ryan Detrick, LPL Research

Following several challenging years, some market participants are expecting that 2017 may be a better year for active management, given the potential for a continued rise in interest rates and more volatility in equity and bond markets. Active managers generally have more opportunity to outperform when volatility is high (potentially creating opportunities to buy low and sell high), and when asset classes and individual securities see more dispersion in returns (versus the “rising tide lifts all boats” market experienced in recent years).

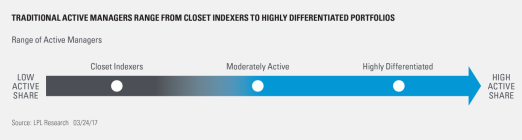

The financial industry often lumps all active funds into one bucket, but in reality there are a continuum of products, as shown in the figure below. On the left are managers who have portfolios that are not very differentiated from the benchmark they follow. These types of managers, which we refer to as closet indexers, may have a hard time generating enough return in excess of their benchmarks (alpha) to cover their fees. On the right are managers whose portfolios are more differentiated from their benchmarks, which may offer a higher potential to outperform even after the impact of management fees.

So how do investors tell the difference? A metric called active share can help. The concept of active share was developed in 2009, as a systematic way of determining how much a fund deviates from its benchmark. A study conducted by Cremers and Petajisto found that historically, “funds with the highest active share significantly outperformed their benchmarks, both before and after expenses, and they exhibited strong performance persistence.”[1]

Like any piece of data, active share just tells one piece of the story and shouldn’t be relied upon as the only factor when purchasing an active fund. This measure can be misleading if a manager typically holds stocks from outside of the benchmark (i.e., international stocks in a domestic portfolio) or in more diversified asset classes such as small cap stocks, given a larger number of small positions in the benchmark. However, your financial advisor can help you incorporate active share as part of a broader due diligence process to help avoid paying fees for closet indexers, and ensure that the active manager you are using is truly active.

[1] Cremers, M., and A. Petajisto. “How Active is Your Fund Manager? A New Measure That Predicts Performance.” International Center for Finance at the Yale School of Management, March 2009.

*****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not ensure against market risk.

Investing in mutual funds involves risk, including possible loss of principal. Mutual funds have specific risks such as manager, concentration, and liquidity risk.

Indices are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

Active management involves risk as it attempts to outperform a benchmark index by predicting market activity, and assumes considerable risk should managers incorrectly anticipate changing conditions.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking #1-593611 (Exp. 3/18)

Copyright © LPL Research