by Jean Boivin, PhD, Head of Economic and Markets Research, BlackRock Investment Institute

We believe markets appear too pessimistic on Europe’s outlook—a big reason why we are positive on European stocks. Jean explains.

Europe’s sluggish recovery after the double whammy from the global financial and sovereign debt crises has made it easy for investors to dismiss the region’s prospects. The potential for more populist surprises in the region’s elections this year doesn’t help, nor does the anti-European Union sentiment behind some parties. Yet absent a political or external shock, we believe the eurozone’s improving economic dynamics have longer to play out in a reflationary world. This underpins our positive view on European equities, as my colleagues and I write in our new Global Macro Outlook on Europe’s stealth comeback.

Since mid-2016, eurozone growth has steadily strengthened and is now receiving a boost from an unexpected global trade rebound. France has picked up momentum to join Germany and Spain as a growth engine. Italy’s economic data are starting to turn up after a long funk that has stoked an anti-establishment mood. Bank lending is slowly recuperating. Efforts to clean up bad loans at Italian banks, along with capital raisings, may help unclog the credit channel and unleash better growth.

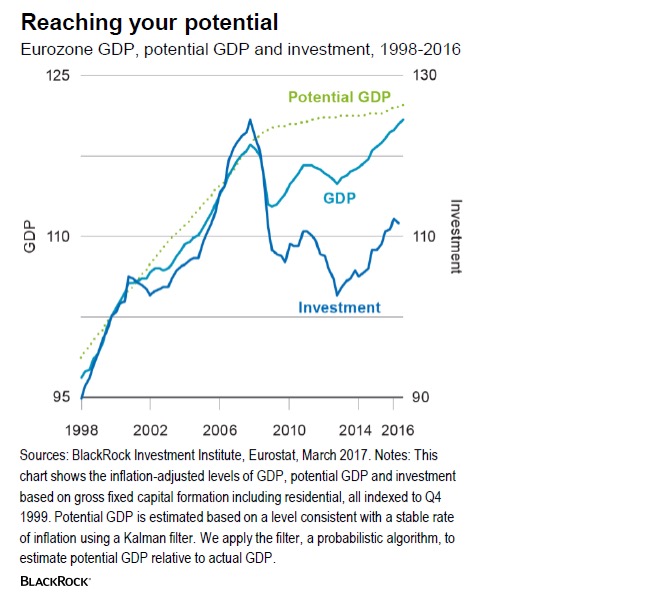

The expansion is gaining traction, yet the eurozone has only just clawed its way back to near potential output. Potential output is also much lower than it might have been due to the post-crisis deleveraging, along with graying populations. That means growth has room to run before gross domestic product (GDP) outpaces its potential in a way that generates stronger wages and quicker inflation. Household spending has largely powered the economic healing. Business investment has lagged GDP growth, notably in Italy and Spain. Our analysis points to pent-up demand for greater investments, perhaps as revived animal spirits give companies confidence to take on new projects. See the chart below.

Perking up

After a four-year slide, inflation expectations have finally perked up in Europe. Market pricing of future inflation on a five- to 10-year horizon—which the European Central Bank (ECB) has typically focused on—has rebounded back near 2%. That marks an important shift for a central bank whose credibility had been threatened and was seen at risk of mimicking the Bank of Japan’s long, losing battle with deflation. Those fears have now dissipated. Yet price pressures remain very subdued.

The ECB may revise up its inflation forecasts but looks unlikely to deviate from its policy stance, especially after hard-fought internal battles to adopt an asset-purchase program that is just starting to prove effective. Indeed, policymakers would welcome any upside inflation surprise and still not make major changes to the policy trajectory given their cognizance of premature tightening in the past. We expect a gradual wind-down of asset purchases even if the process starts in 2018. The ECB will likely keep reassuring investors that it wants to see core inflation—not just headline—getting close to the target.

We find that the market appears very downbeat on Europe’s growth prospects. A big reason we are positive on risk assets in Europe is because the market is not reflecting the region’s better economic performance and outlook. Backing out growth expectations from moves in bond yields and equity indices, we see the market pricing GDP growth of just 1% in the eurozone’s big four economies in the year ahead. That compares with our BlackRock GPS forward view of 1.4%. The breakdown in 2015-16 between market-implied GDP for the big four and our GPS can be tied to political risks: Spain’s two elections within six months, the uncertainties stirred by Brexit and Italy’s banking and political woes returning to the spotlight.

The political risks in Europe today are very real and could carry historic consequences, with the fate of the single currency zone and even the European Union still in doubt. The scars of the Brexit surprise are still fresh. We can’t exaggerate what a global shock a eurozone breakup would be. Yet we also believe the market is overstating those risks while remaining too negative on Europe’s economic outlook. Read more in our full Global Macro Outlook.

Jean Boivin, PhD, is head of economic and markets research at the BlackRock Investment Institute. He is a regular contributor to The Blog.

Copyright © Blackrock