by Ryan Detrick, LPL Research

One of our favorite indicators to gauge the strength of the economy is the Conference Board’s Leading Economic Index (LEI). This has historically provided early warnings of recession and the start of equity bear markets. As we discussed in our Weekly Market Commentary: How Much Is Left In The Tank?, the LEI remains comfortably above 0% year over year, and when has turned negative, a recession has typically followed within the next 14 months. Fortunately, that isn’t close to happening.

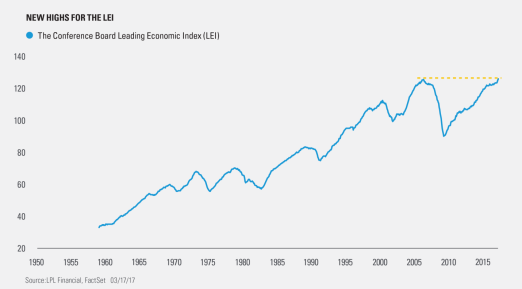

On Friday, March 17, the February results from this economic indicator, which looks at 10 diverse economic indicators, were released. The year-over-year change was 3.1%, the highest since November 2015. Additionally, the month-over-month gain has been 0.6% for three consecutive months, and it hasn’t made it to four straight months since mid-2009. Oh, and the actual index made a fresh new all-time high in the process, topping the previous peak from March 2006.

Per Ryan Detrick, Senior Market Strategist, “If you are looking for signs the economy is improving, look no further than the LEI. A new all-time high is a new all-time high. Should this keep expanding, we see little risk of a recession over the next 12 months.”

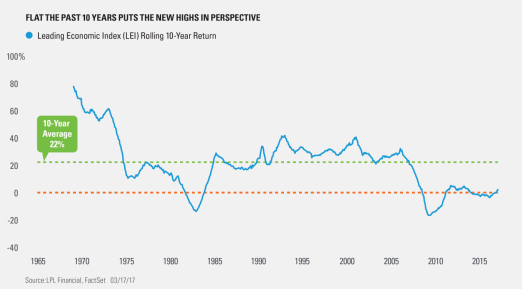

Last, sometimes we hear “new all-time high” and immediately get a fear of heights. It is important to remember that the LEI should continually improve over time and make new highs as the economy also expands. To put this in perspective, over the past 10 years, the LEI has gone nowhere. In fact, the average rolling 10-year return going back nearly 40 years is 22. Against this backdrop, there could be substantial room for the LEI to continue to run higher even though the index is making new highs.

*****

IMPORTANT DISCLOSURES

The Leading Economic Indicators (LEI) Index is an economic variable, such as private-sector wages, that tends to show the direction of future economic activity.

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Stock investing involves risk including loss of principal.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-591909 (Exp. 3/18)

Copyright © LPL Research