Finding Planning Opportunities in Clients' Tax Returns: A Checklist

by Commonwealth Financial Network

At this time of the year, finding planning opportunities in clients' tax returns is a goal for many financial advisors. But it's also a chance to assess your clients' overall financial situation, plus add value to the client-advisor relationship.

At this time of the year, finding planning opportunities in clients' tax returns is a goal for many financial advisors. But it's also a chance to assess your clients' overall financial situation, plus add value to the client-advisor relationship.

This simple checklist below is designed to help you use the tax return as a road map for exploring future planning strategies. The goal? Learn about your clients' current situation—and how'd they'd like to see it evolve in the future.

For retirement, social security, and Medicare, 62, 65, and 70½ are important ages—so consider timing and different strategies for these distributions. You might also describe how careful planning and repositioning of assets can help minimize taxes on retirement income.

Does your client own real estate? Be sure to discuss whether it is adequately insured. If he or she owns multiple properties in different states, explore his or her need for estate planning.

Learn as much as you can about your client's family and filing status. A recent divorce—as well as changes in alimony payment or receipt—can have significant implications for tax and cash flow, insurance, and estate planning needs. For example, the receipt of alimony is taxable and should be part of the overall tax planning. If the client is paying alimony, he or she may need guidance to create a new budget.

If the client has children or dependents, ensure that all life insurance and estate planning documents are up to date. Also, consider if the family will be affected by kiddie tax rules or will have future education costs. If so, plan for a discussion of saving strategies that might help your client meet these needs.

Given recent changes to the tax code, managing income has become more important than ever. Review the various employer-funded retirement options and stock option strategies. If the client is self-employed, you might cover the benefits of incorporation, business insurance options, and a retirement plan.

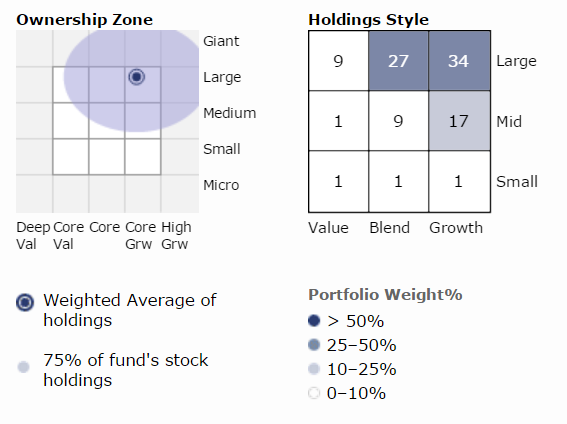

Besides assessing if the portfolio is being managed in a tax-efficient manner, you'll want to ask the following questions:

- Is your client happy with his or her current investment choices?

- If an investment strategy is in place, is it successful?

- If there is no strategy, what's the timeline for putting one in place?

Something else to watch out for is an overreliance on tax-free bonds or CDs. Large losses could prompt a discussion of moving assets to your investment management platform.

Reviewing capital gains and losses may reveal important tax planning opportunities. Are there strategies you could implement to manage Medicare tax or opportunities to harvest losses to offset capital gains? Could your client benefit from diversification based on his or her stock positions?

When reviewing your clients' IRA or pension distributions, determine if the client is taking advantage of tax-deductible contributions to an IRA or taking normal RMD distributions. Here, a Roth conversion or unnecessary RMDs might be used to purchase insurance.

If you see high interest deductions on your client's return, this may indicate an opportunity to refinance. Points paid, on the other hand, could indicate a new real estate purchase—signaling the possible need for additional life insurance.

Review whether the client can deduct investment advisory fees as "ordinary and necessary expenses" paid for producing taxable investment income. You'll also want to look for investment advisory fees paid to other advisors—as consolidating accounts can minimize fees.

Take stock of how your client could make charitable contributions differently—including donor-advised funds, charitable trusts, or private foundations. If he or she has appreciated stock, suggest donating it to both avoid capital gains and support philanthropic goals.

Does your client need professional help when it comes to preparing the return? If needed, refer the client to a trustworthy CPA. Of course, be sure to emphasize that your role is to help coordinate tax planning, not to prepare the return.

Through your careful attention to your clients' tax returns, you'll demonstrate your commitment to offering meaningful guidance and support. Plus, this analysis may lead to other planning opportunities, such as increasing 401(k) contributions, tax-advantaged investing, tax-deferral options, charitable strategies, insurance sales, estate tax returns, and more. Best of all? Discussing tax returns allows you to create a more successful overall strategy to help meet your clients' specific planning needs and goals.

How do you analyze clients' tax returns? Comment below—we're excited to hear from you.

Editor's Note: This post was originally published in March 2014, but we've updated it to bring you more relevant and timely information.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network