by Mawer Investment Management, via The Art of Boring Blog

I had the opportunity to ask David Ragan, co-manager of the Mawer International Equity Fund, about investment style. While this is a widely discussed topic in our industry (a google search of “investment style” uncovers 12 million hits), growth and value are the two most commonly referenced.

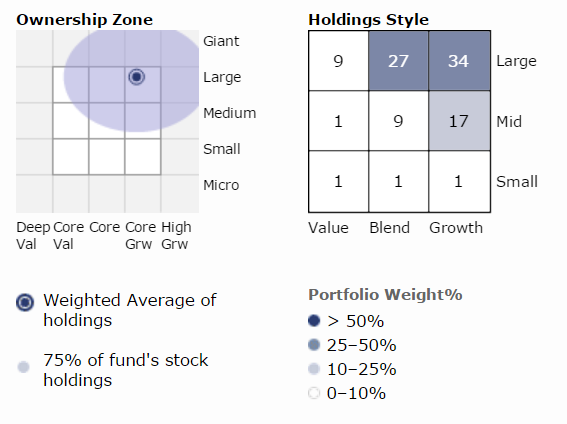

The Morningstar style box (shown below), is a widely known framework within the industry that measures value/growth characteristics on one axis and market cap characteristics on the other. The Mawer International Equity Fund currently plots on this style box as follows:

Source: Morningstar.ca as at March 22, 2017

What I discussed with David is how the Mawer approach doesn’t really fit any of these styles. Neither growth nor value is truly accurate, and the catchy acronym GARP (Growth-at-a-Reasonable-Price) doesn’t quite fit the bill. David prefers something more reflective of our pursuit of finding high quality companies, run by excellent management teams purchased at a discounted valuation. But how do you shorten that one – HQCRBEMTPDV? Very un-catchy indeed.

CW: David, if someone were to say to you “Mawer is a value investor,” how would you address that statement?

DR: The typical value investor places price ahead of all else; we see some problems with this, and that is why we also look for quality. Looking just at value can get an investor caught in a value-trap—something cheap that just gets cheaper. One common example, and particularly heartbreaking to a capitalist, is when a management team is actively investing its company’s capital poorly and reducing the value of the company on a daily basis.

A good example is Hyundai Group of South Korea. Hyundai consistently has shown up as a value asset. While there are some ok to good businesses within the Hyundai group, management has made some decisions to allocate cash to wealth-destroying activities. The most black-and-white example is when they spent the equivalent of 10 billion USD on a piece of land for its new head office, when the land was appraised for 3 billion USD. Overnight, shareholders were 7 billion USD poorer.

CW: You are clear there—in a value investment style, the key to success appears to be timing the catalyst; however, time is generally against you. Let’s turn to growth. Someone says to you “Mawer is a growth investor.” How would you address that statement?

DR: In my experience, with this style of investing you run the risk of overpaying for the growth you may be expecting. People get excited about growth, but paying any price for a stock is a bad idea. Take Tesla, for example. It may have very high potential for growth in the future, however, we don’t know how much growth, or how it will play out over the next five, ten, or twenty years. We do know that their competitors are rolling out electric vehicles and that success in the industry is primarily a volume game. Estimating volumes is one element we don’t really have an edge on. Tesla is trading at a high multiple despite it currently burning through a lot of cash. In other words, Tesla is not creating a lot of wealth right now even though the stock price has done well. While I may think Tesla is a good company, I’m just not sure what it’s worth. Some Internet companies are like this where investors value the stock price highly but it’s very difficult to determine the actual value of the company.

I would round this out by saying that the rational individual understands a higher return comes with higher risk. If you continue up that risk spectrum high enough, people start to reach for “lottery tickets.” There will probably always be people who are attracted to big payoffs for a small investment. Look at your typical 50/50 ticket. People are willing to do it on the basis of a small bet for a potentially high payout even though the odds are against you. We don’t like those odds; make this bet many times and you’re guaranteed to lose in the long run.

CW: So Mawer is neither a value investor nor a growth investor. How would you describe Mawer’s approach?

DR: We’re looking for good assets, ones that create wealth so that time is on our side. You don’t need an immediate catalyst to bring the share price to the company’s intrinsic value, because a company that earns a high return on capital sees its intrinsic value increase every day. In fact, you are happy to hold this stock and build a position over the long term at reasonable prices. Quality comes through in many ways but ideally it is the stability of the business and the enduring competitive advantages that enable the company to earn a high return on a dollar invested in the business. If you find that, then there’s a good chance that the company you buy today will be as good or better in the future.

Finding high quality dovetails into our formal valuation process. Quality gives you more confidence to forecast margins and cash flow if the business is stable, well-run, and solid. Set that against typical value or growth styles and our approach of buying companies earning high returns on capital, run by smart management teams and not paying too much for them, is a very rational process.

We really think our focus on quality at a fair price puts the odds in our clients favour over the long term because we are both aware of the potential traps of value investing and the lure of a good growth story. We just wish the acronym wasn’t HQCRBEMTPDV.

This post was originally published at Mawer Investment Management