by Ryan Detrick, LPL Research

The better-than-expected February jobs report released earlier this morning (March 10, 2017) all but cemented the case for a rate hike by the Federal Reserve (Fed) at next week’s Federal Open Market Committee (FOMC) meeting. The report showed that the economy created a net new 235,000 jobs in February 2017, 35,000 more than the pre-release consensus of economists polled by Bloomberg News. The details of the report were as solid as the headline:

- The prior months’ readings were revised higher by 9,000.

- The unemployment rate, as expected, dipped to 4.7% in February 2017 from 4.8% in January 2017.

- The drop in the unemployment rate, calculated using a survey of households, was achieved the “right way,” as the labor force rose 340,000 between January and February 2017 while the number of unemployed dropped by 107,000.

- Average hourly earnings, a key measure of wage inflation, accelerated to a 2.8% year-over-year increase in February 2017, from 2.6% in January 2017, and is within 0.1% of an eight-year high.

On balance, there wasn’t a discouraging word in the February 2017 jobs report, which put the average monthly gain in new jobs over the past 12 months at 196,000. As a reminder, Fed officials have said publicly that job growth as low as 80,000 per month is enough to tighten the labor market and push up wages and ultimately inflation.

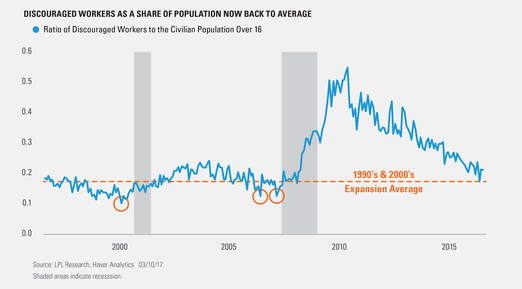

But where does that leave the discouraged worker*, workers who have given up looking for work and are no longer counted as unemployed or as part of the labor force, and therefore no longer have an impact on the unemployment rate calculation (unemployment rate = unemployed persons / labor force)?

There were 522,000 discouraged workers in February 2017, down from 532,000 in January 2017 and 599,000 a year ago. To put these numbers in context, at 522,000 in February 2017, the number of discouraged workers is nearly 800,000 less than at the peak in late 2010 as the labor market was bottoming out after the end of the Great Recession, when 1.3 million people were characterized as discouraged workers.

Looking at it another way, at just 0.2%, the ratio of discouraged workers to the over age 16 civilian population in February 2017 is only slightly above the average of 0.18% seen during the long 1990s economic expansion and the 2001-2007 expansion. While not yet back to pre-Great Recession lows (0.12%), the decline in the number of discouraged workers as a percent of the labor force is another signal for the Fed (and the market) that the labor market is tightening and that more rate hikes are on the way.

*Discouraged workers include those who looked for jobs in the past year but have not in the past four weeks because they believed they were not sufficiently qualified for available jobs or that no jobs were available.

*****

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve Board that determines the direction of monetary policy. The eleven-person FOMC is composed of the seven-member board of governors, and the five Federal Reserve Bank presidents. The president of the Federal Reserve Bank of New York serves continuously, while the presidents of the other regional Federal Reserve Banks rotate their service in one-year terms.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-589607 (Exp. 01/18)

Copyright © LPL Research