by Ryan Detrick, LPL Research

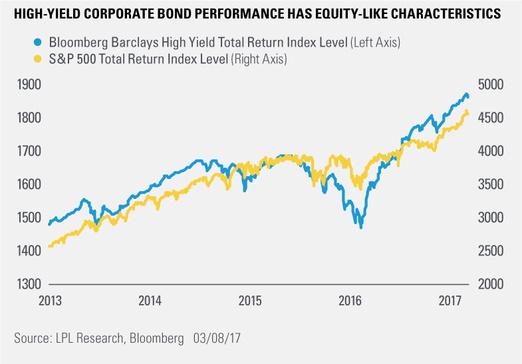

After returning 17.1% in 2016, high-yield corporate bonds have caught many investors’ attention. Year to date, the sector as measured by the Bloomberg Barclays High Yield Index has already returned 2.6% (as of March 7, 2017). High yield is a fixed income sector, and it does offer attractive yields relative to higher-quality options. However, investors should be aware that high yield’s performance has equity-like characteristics, and it tends to track equity markets more than high-quality fixed income sectors such as Treasuries or municipal bonds.

As seen in the chart above, when the S&P 500 Total Return Index falls, the high-yield corporate index tends to follow. Year-to-date performance for the S&P index has also been stellar, returning 5.7% (as of March 7, 2017), but is the recent weakness in equity markets and in high-yield corporate bonds an early indicator of trouble ahead? Only time will tell if recent turbulence in high yield has been driven by investors’ profit taking after a strong start to 2017, or by an aversion to high relative valuations. Regardless, it is important to remember that although high yield is fixed income, it may behave more like equities at an inopportune time: when equity markets stumble and when higher-quality fixed income (like Treasuries) shines.

*****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

The Bloomberg Barclays Capital High Yield Index covers the universe of publicly issued debt obligations rated below investment grade. Bonds must be rated below investment grade or high yield (Ba1/BB+ or lower), by at least two of the following ratings agencies: Moody’s, S&P, and Fitch. Bonds must also have at least one year to maturity, have at least $150 million in par value outstanding, and must be U.S. dollar denominated and nonconvertible. Bonds issued by countries designated as emerging markets are excluded.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

High-yield bond portfolios concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These portfolios generally offer higher yields than other types of portfolios, but they are also more vulnerable to economic and credit risk. These portfolios primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB (considered speculative for taxable bonds) and below.

Treasuries: A marketable, fixed-interest U.S. government debt security. Treasury bonds make interest payments semi-annually and the income that holders receive is only taxed at the federal level.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-589101 (Exp. 03/18)

Copyright © LPL Research