by Blaine Rollins, CFA, 361 Capital

While the majority of the financial world has its focus on every move in Washington D.C., there is another very important development happening in the German bond market. What was once the best short bet for some very high profile investors; it’s now become the next widow-maker trade as German yields plunge to levels not seen before. While U.S. yields have begun to reflate on higher growth and inflation potential, the German interest rate market has refused to join, as political worries across Europe have made German fixed income the place to hide. In addition, the ECB continues to buy bonds monthly as part of their continuing QE. All the buying and lack of selling has driven the two-year German bond yield to less than -0.9%. Not sure how anyone without a forex bet makes money in two-year paper from here, but it does tell me that there are many worried European investors. This can be great news if you are a distressed or value buyer of European risk assets. But with yields falling so precipitously, one has to think that prices could get even cheaper. The rising uncertainty has been great for day-to-day volatility and noise which my international counter-trend algorithms enjoy. But for most global investors, the action in German bonds only raises the hair on the back of our necks. So keep an eye on those bonds trading in the clouds. Their direction might be your sign to buy Euro risk assets or to bolt the main gate.

The yield on Germany’s two-year bond has fallen to another record negative low this morning as bondholders snap up German assets amid escalating fears about the EU’s political stability. Dubbed one of the “most sought after assets in financial markets“, the price on Germany’s two-year “schatz” bond has been pushed to an all-time high this week, driving yields head-long towards the minus 1 per cent mark. Yields are currently trading at minus 0.96 according to Bloomberg and have declined 15 basis points this week – their best performance since the depths of the eurozone crisis in July 2012. The rally has been turbo-charged by fears that Marine Le Pen is closing the gap on her rivals in France’s presidential election and could come good on her promise to take the eurozone’s second largest economy out of the single currency area.

Back in the U.S., political uncertainty also hit our financial markets last week as the ‘Trump Trade’ took a pause…

President Trump’s drive to greatness hit a few bumps last week as conflicting reports of the White House’s goals hit the tape. As bold ideas get closer to specific details, the markets can tell that the policy makers are working 24/7 (and not always on the same page) as they float those details to Congress, the press and to the people. While Secretary Mnuchin appeared to back away from 2017 infrastructure spending plans and corporate income tax cuts on CNBC, Gary Cohn was backing away from the Border Tax to a group of CEOs. Then within the same 24-hour period, denials of both came from others within the White House. The good news is that everyone is working on their plans. Now hopefully Congress and the White House can all get on the same page before summer with the fine details. If not, expect more disappointment and chop from the markets.

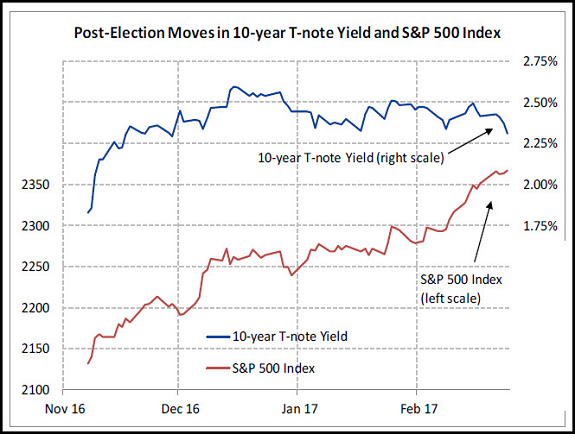

Here is what U.S. political disappointment looks like in the U.S. markets…

While bond yields move to 2017 lows, the S&P 500 continues to float higher.

But last week, Goldman Sachs began to prepare investors for future disappointment in the markets…

It has been a year since the last 10% US equity market drawdown but long periods of stability are not good indicators of drawdown risk. In recent years, investors have bled premium by hedging positions while stocks continued to climb. Looking ahead, the distribution of market outcomes appears asymmetrical. Near-term downside catalysts include (1) investor recognition that lower corporate tax rates may not take effect until 2018; (2) multiple Fed hikes; (3) European elections.

(Goldman Sachs)

Looking at the Border Tax mechanics, would the White House really want the U.S. dollar to rise by 25%?

Marty Feldstein pencils out why a Border Tax would work…

The House plan calls for cutting the corporate tax rate to 20% from 35%. It would also impose a 20% tax on all imports while giving a 20% subsidy to all exports. What would this mean in practice? Imports constitute about 15% of American gross domestic product, so the 20% tax would raise revenue equal to 3% of GDP. On the other side of the ledger, exports are about 12% of American GDP, meaning the subsidy would cost the Treasury only 2.4% of GDP. The net effect of the two would therefore be tax revenue equal to 0.6% of GDP—about $120 billion a year and more than $1 trillion over the next decade.

Retailers and importers understandably fear that the tax would raise the cost of their products and inputs, ultimately increasing prices for consumers. But the border-adjustment would also cause the international value of the dollar to rise, reducing the cost of imports by enough to offset the tax.

Here’s why the dollar would rise: Without a change in the currency’s value, the border adjustment would cause imports to fall and exports to rise, reducing the overall U.S. trade deficit. But it is a fundamental fact of economics that the size of a country’s trade deficit equals the difference between national investment and national saving. Since the border-adjustment tax would not alter either investment or saving, there must be no change in the trade deficit. What would happen instead is a 25% increase in the dollar relative to other currencies, enough to offset the tax on imports and the subsidy on exports.

(WSJ)

Besides the Border Tax, the other major radical idea being discussed is eliminating the interest expense deduction…

The measure would force companies to include the interest they pay on loans in their taxable income. That could pit financial services firms such as banks and insurers that have been promised relief from the proposal against private equity firms, which rely on leverage and wouldn’t get special treatment.

As Ryan struggles to get support within his own party for border adjustments, the interest provision is more likely to be included in a House tax bill, according to Robert Willens, an independent tax and accounting expert. That’s because eliminating interest deductions may be politically easier for Congress to support since consumers wouldn’t be directly affected, as critics of border adjustability argue, Willens said.

More House Republicans are also supportive of making the tax treatment of debt equal to that of equity, which the GOP interest provision would effectively do, since companies can’t currently deduct dividend payments, according to Willens.

Corporate earnings commentary continues to suggest higher growth and higher prices…

“I think everybody is optimistic…it’s really not specific to one particular industry, okay. It’s really across the board and it’s across the country, whether it be if you’re on the East Coast, West Coast, the mid chapters, what have you, all of our companies are all simultaneously doing better than, frankly, we would have thought.” (Reliance Steel CEO, Gregg Mollins)

“We would expect that you’re going to see a change. We already started to see it in the fourth quarter in some of the businesses. The price lag usually is several quarters for us…we’re going to have some margin pressure from inflation in the first couple of quarters…there are certain markets where we’ve clearly seen wage inflation driven by the low unemployment” (Ecolab CEO, Doug Baker)

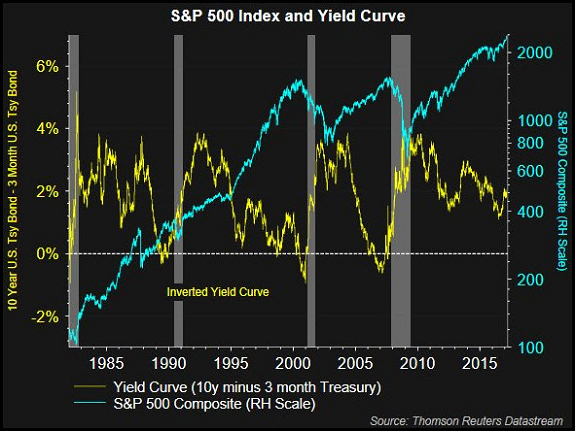

And the U.S. remains very far from an inverted yield curve (thus reducing recessionary fears)…

(@HoranCapitalAdv)

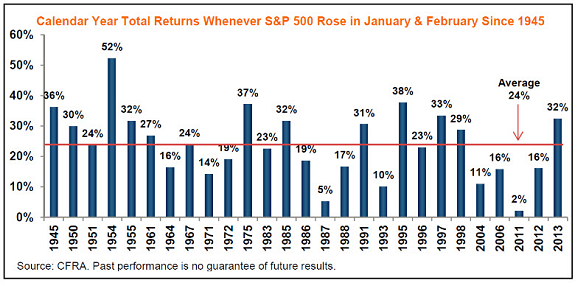

And if you have been a student of the market for long, you will know that early year strength in equities tends to persist…

“If you need additional encouragement that a bear market is not just around the corner, history again may offer some more virtual Valium,” says Stovall, who delivers our call of the day.

Since 1945, there have been 27 years when the S&P has achieved gains in January and February. The stock index then finished up for the year (on a total-return basis) in every one those years, according to Stovall. That’s going 27 for 27, or batting a thousand.

The average rise in those years was 24%, as shown in his chart below, and the gauge was up further in the remaining 10 months 25 of 27 times.

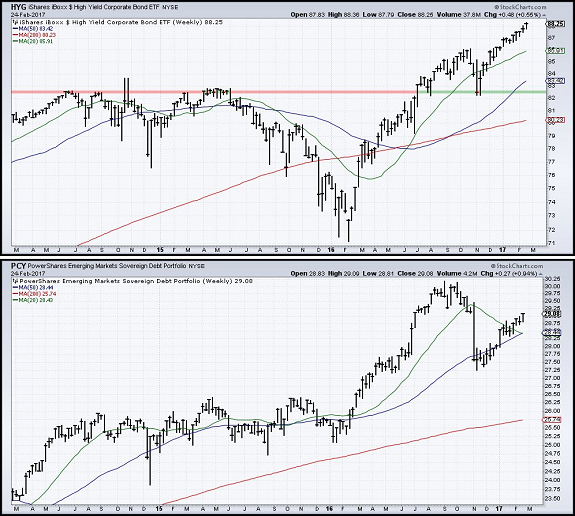

Junk credit prices remain stellar. But also note the continued post-election recovery in emerging market bonds…

(@beckyhiu)

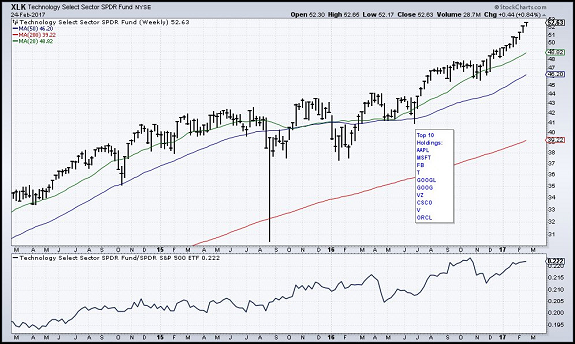

Looking across the major U.S. equity sectors, the Technology chart has taken on a life of its own…

(@beckyhiu)

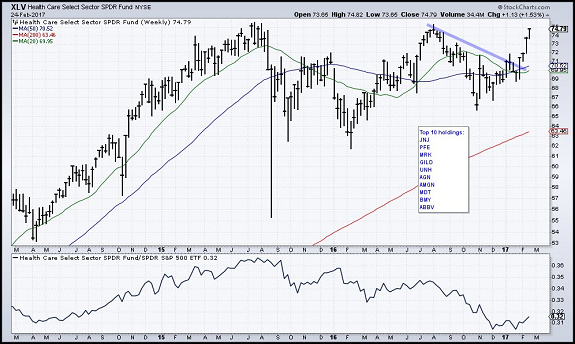

And Healthcare is rising like a phoenix…

(@beckyhiu)

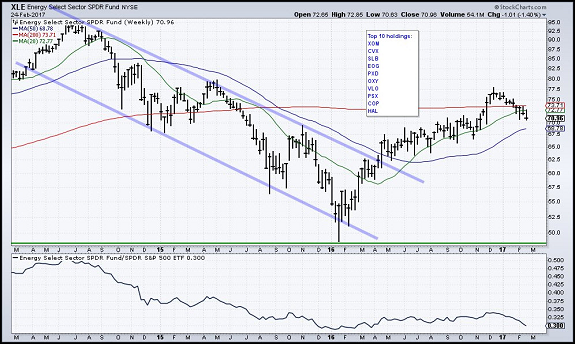

Energy on the other hand could not be more disappointing…

The good news is that much of the pain in the chart is caused by an increase in U.S. production (good for jobs) and the 10 degree above normal temps that we are all experiencing (good for household expenses).

(@beckyhiu)

His stock is up six fold over 20 years and Warren still refuses to use stock for acquisitions…

“I would rather prep for a colonoscopy than issue Berkshire shares” (Warren Buffett, Berkshire Hathaway 2016 Annual Report)

My other favorite tidbit from the Berkshire Hathaway 2016 Annual Report…

“BNSF, like other Class I railroads, uses only a single gallon of diesel fuel to move a ton of freight almost 500 miles. Those economics make railroads four times as fuel-efficient as trucks! Furthermore, railroads alleviate highway congestion – and the taxpayer-funded maintenance expenditures that come with heavier traffic – in a major way.”

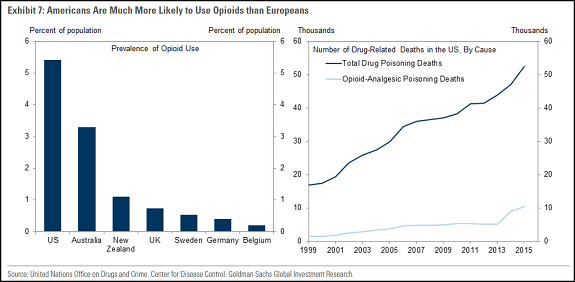

Opioid addiction should be a top priority in Washington D.C…

A Fed Governor mentioned the negative effect of opioids on the U.S. workforce last week. Now here is Goldman Sachs discussing it in more detail.

In addition to the mortality data, there are further signs of health-related distress in the US prime-age population. Alan Kruger has documented that nearly half of prime-age men who are not in the labor force take pain medication on a daily basis and almost 20% report that their health is poor. The left-hand chart of Exhibit 7 shows that Americans are far more likely to use opioids than Europeans, while the right-hand chart shows that drug-related problems have worsened considerably in the US, with the number of drug-related deaths tripling since 2000. As with many potential contributors to reduced labor force participation, health and drug issues should probably be viewed as both cause and effect to some degree. Nevertheless, the data suggest that these factors are likely part of the explanation for why the US prime-age participation rate stands out.

(Goldman Sachs)

Expect to see more stories like this one as the ban on foreign travel increases…

”I’m a lot safer in Jordan,” he says. “You hear about people being robbed and killed [in the U.S.] all the time. My relatives say sometimes even in gas stations, there are bullet-proof windows between people working there and the customer. You never have to worry about that here.”

Most Jordanians say their biggest problems are economic. At a demonstration Friday in downtown Amman to protest price increases in fuel and public services, another recent graduate, Zina Khabbas, said she was thinking of moving to the Gulf.

Khabbas, wearing designer sunglasses and an elegant head scarf woven with gold threads, is an engineer. She says it’s tough to make ends meet in Jordan, but neither she nor her friends are considering the U.S.

“America was an opportunity for people here before,” says the 22-year-old. “But now, no one is actually thinking about the United States for a future place to live.”

(NPR)

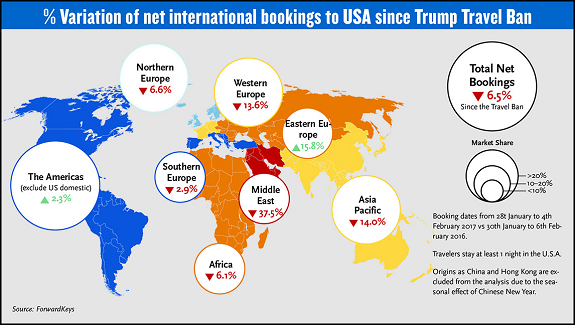

The ban is starting to work its way into all of the U.S./Int’l travel data…

Following the Jan. 27 ban on travel to the U.S. by nationals from Iran, Iraq, Libya, Yemen, Somalia, Sudan and Syria, net bookings from those seven countries were down 80% between Jan. 28 and Feb. 4, compared with the same period last year, according to flight reservation transactions analyzed by the travel data company ForwardKeys.

ForwardKeys also reported a 6.5% drop in overall international travel to the U.S. for the same period when compared with the equivalent eight-day period the year before.

Meanwhile, Hopper, a flight app that tracks GDS searches in order to analyze fare prices and demand, also found that the number of flight searches for travel from international points of origin to the U.S. — a key indicator of future travel intent — was down 17% the week of Jan. 27. Last year, there was only a 1.8% decline during the same time period.

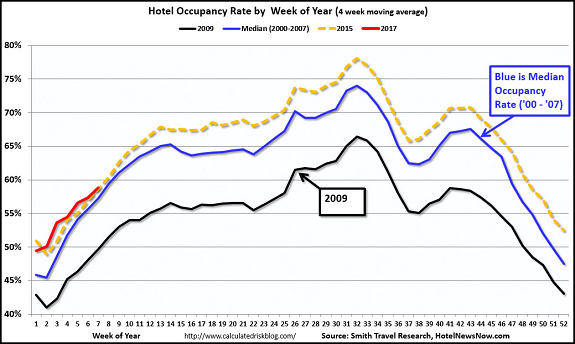

You wonder if the travel ban is now becoming a drag on U.S. hotel occupancy…

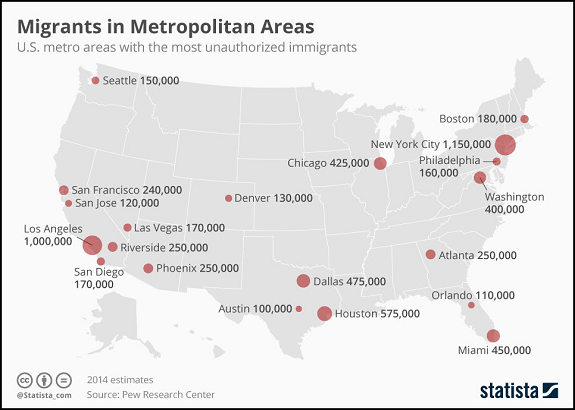

What could the impact be of a reduction in unauthorized immigrants?

There are 11 million undocumented workers in the U.S. they make up about 4.5% of Denver, 7.7% of Los Angeles and 8.8% of Houston. If all of them picked up and left one day, how would that impact real estate prices and the local economies?

(@DA_Stockman)

The pricing for Uber’s next fund raise will be interesting to watch…

If there is one quote that sums up the ethos of Uber, it might be this cut from the company’s firebrand CEO Travis Kalanick: “Stand by your principles and be comfortable with confrontation. So few people are, so when the people with the red tape come, it becomes a negotiation.” But after a month marked by one disaster after another, it’s hard to see how Uber’s defiant, confrontational attitude hasn’t blown up in its face. And those disasters mask one key, critical issue: Uber is doomed because it can’t actually make money.

After a discombobulated 2016, in which Uber burned through more than $2 billion, amid findings that rider fares only cover roughly 40 percent of a ride, with the remainder subsidized by venture capitalists, it’s hard to imagine Kalanick could take the company public at its stunning current valuation of nearly $70 billion.

And now, in the past few weeks alone, Uber has been accused of having a workplace that fosters a culture of misogyny, accused of stealing from Google the blueprint of a successful self-driving system, and has lost 200,000 customers over ties to President Donald Trump and how it responded to a taxi driver boycott.

(Jalopnik)

If you are about to head out to a beach with the kids and need a good book, get Dave’s list…

Dave Lutz, the head of exchange-traded funds at JonesTrading, recently released his annual “Spring Break reading” list.

Over 600 Wall Streeters around the world contributed to this list of great books for outdoor reading.

From science-fiction thrillers to business profiles, the full list is stellar, but we’re highlighting only the 25 most frequently mentioned books.

The list includes short reviews of the books — occasionally by the person that recommended them to Lutz.

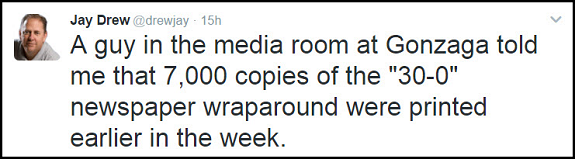

Jinx of the week…

Finally, the most surprising photo of the week…

Copyright © 361 Capital