by Jennifer Thomson, Gavekal Capital

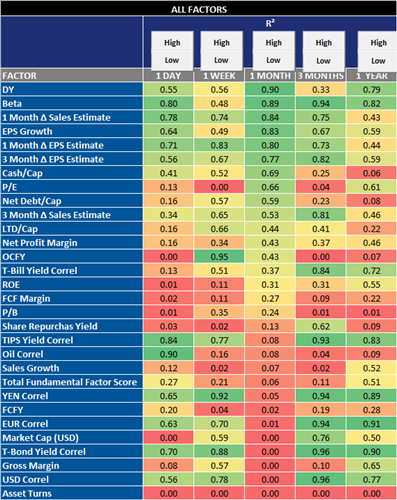

In the month of January, the most important factor correlation to performance of developed market stocks has been dividend yield (DY).

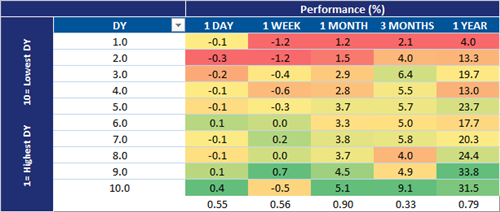

Interestingly, though, the best performance has been generated in those stocks that belong to the lowest decile (those that pay a smaller dividend relative to their share price) while those with the highest DY have underperformed.

The trend remains the same over the last year– during which time the dividend yield had a near 80% correlation with performance (i.e. it was in the top 20% of influential factors). Which brings us to the question: are companies being rewarded for offering lower and/or cutting back on their dividends?

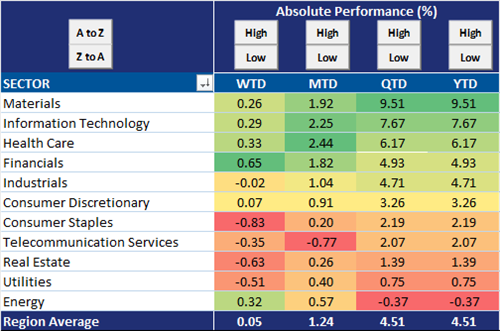

The best performing developed market sectors so far this year are materials, information technology, and health care.

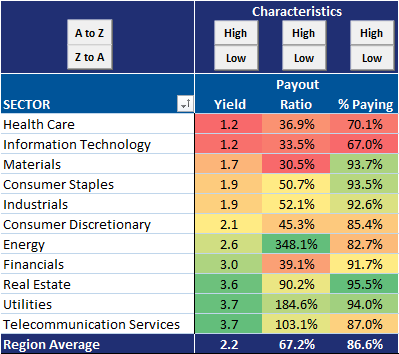

Those three groups also rank at the bottom of all sectors with respect to dividend yield, payout ratio, and the percent of companies that pay a dividend.

We have highlighted various shifts in investor preference over the last few months–from defensive-driven leadership to cyclical-driven leadership, from higher quality to lower quality companies, the battle between growth and value (and how that relates to bond yields), and even early signs of growing appetite for European equities at the expensive of fixed income. We’ll add this to the growing list!

Copyright © Gavekal Capital