National Defense: Is Another Spending Boom on the Horizon? - Context

by Fixed Income AllianceBernstein

February 09, 2017

If President Trump’s promise to increase defense spending comes to fruition, it would sharply reverse the trend of the past five years—and have important implications for the outlook on US growth and inflation.

Trump’s National Defense Plan

President Trump has promised an ambitious program to rebuild the US military. His plan includes modernizing US nuclear weapons systems, investing more in cybersecurity, enlarging the US Navy’s fleet and increasing the number of US Air Force fighter aircraft. Military personnel levels would also grow: Trump envisions adding more than 100,000, according to some estimates.

The details of Trump’s first Pentagon budget is part of the overall budget he’ll submit to Congress in late February or early March. The actual funding request for the current fiscal year (which ends September 30) must be completed by April 30—that’s when the current legislation funding the military budget is set to expire. More important, Trump’s blueprint for the Pentagon budget could set the baseline for defense spending for at least the next four years.

The President’s military expenditures could be at the low end of what some in Congress are proposing. For example, Senator John McCain, who chairs the Senate Armed Services Committee, recently released a white paper on defense spending, Restoring American Power. McCain argues the US has underinvested in the military for years, and that it’s now vital to substantially increase funding for the Pentagon. His plan calls for a US$640 billion defense budget for fiscal year 2018, which is US$58 billion above the current budget baseline. Moreover, McCain’s defense plan urges an additional US$430 billion in military spending over the next five fiscal years.

Defense Spending Patterns: Unlike the Rest

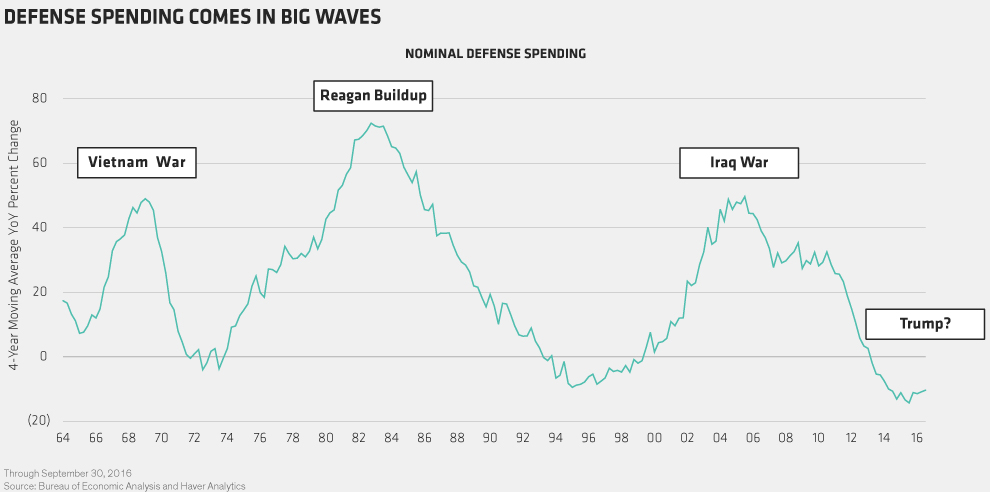

Defense spending patterns are unlike other federal programs in that they’re neither cyclical nor countercyclical. They’re usually based on military and political strategies, as well as the country’s ongoing readiness to respond to or engage in global encounters. In the past 50 years, we’ve seen three large defense spending programs in the US (Display), according to historical gross domestic product data.

Vietnam. The first buildup, tied to the country’s military engagement in Vietnam and Southeast Asia, occurred in the mid-1960s, during President Lyndon Johnson’s term. It ran for five years.

Reagan Era. The second large defense spending boom occurred during the first four years of Ronald Reagan’s presidency. This buildup was part of Reagan’s political and military strategy to rebuild the military apparatus after what he characterized as years of neglect.

Iraq War. The third major increase started during the first term of President George W. Bush and was linked to 9/11 and the events that followed in the Middle East.

From a political and military standpoint, the Trump defense plan parallels the goals and objectives of Reagan’s military push. And with McCain’s more aggressive plan aligned on the same premise of modernizing and improving the readiness of the US military, Trump will likely have the influential senator’s backing to beef up the budget.

Today’s Backdrop: Reminiscent of the 1960s

It’s important to look at the multiyear defense spending plans in terms of the economic and financial backdrop of the time. From a historical context, today’s conditions have more similarities with the economic setting of the mid-1960s than with the defense buildups of the early 1980s or early 2000s, which were in recession or in the very early stages of recovery.

In contrast, in the mid-1960s, the US economy was already in its fifth year of expansion, the jobless rate of 4.5% was relatively low and inflation was tame (roughly 1.5%). The extra defense spending boosted domestic-demand growth and added significant pressure to labor costs, materials, supplies and product prices—so much so that the acceleration in consumer price inflation (from 1% in 1961 to near 6% in 1970) from the start to the end of that business cycle was one of the largest of any economic growth cycle during the postwar period.

Today’s economic backdrop looks similar in many ways. The economy has been in recovery for seven years, the jobless rate is in the mid-4% range and inflation is stable (at around 2%). While many domestic and global factors are different now, we would still expect a large multiyear defense spending program to boost growth and put upward pressure on labor costs and inflation in the coming years. It’s important to note that we’re coming off the weakest five-year defense spending trend in the past 50 years, so Trump’s defense spending need not match any of the prior three to have a major impact.

When Trump unveils his budget, the defense spending request will be a key focus. A large multiyear program would definitely lift inflationary pressures. While we wouldn’t expect an acceleration like that of the 1960s, a sustained rise of one to two percent in general inflation would still seem reasonable—and much more than the US Federal Reserve and financial markets are currently expecting.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein