by Blaine Rollins, CFA, 361 Capital

Knock, Knock…

You knew the protectionist measures would come. You just didn’t know how soon they would be implemented and how disruptive they could be. A border trade war with Mexico could mean some very expensive items in the produce aisles offset by a glut of beef, pigs and cheese in the U.S. So probably time to buy yourself a treadmill and get long diabetes insulin makers. The immigration bans created a big scare over the weekend when many professional employees and athletes with dual citizenship got caught overseas. Hopefully these individual issues get worked through quickly, but no doubt this move by the White House will cause some retaliation by other nations, as well as ongoing workforce disruptions and angst. We can only hope that the upcoming changes in business and individual taxation and reduced regulation order roll-outs can go much more smoothly.

Away from the show in Washington D.C., the market backdrop remains very healthy. Most every major index hit new highs last week, junk bond yields are nearing 10-year lows, Q1 earnings are coming in well ahead of expectations, and corporate confidence is rising as evidenced by Cisco’s move last week to pay $3.7b for AppDynamics the day before it was supposed to go public and paid an 80%+ premium to the filing price. So let’s hope that the Executive Office can learn from its week one mistakes, or else the market is going to take up the VIX for the next 207 weeks.

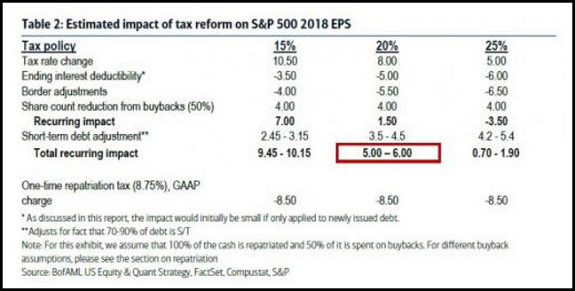

BofA Merrill Lynch put some pencil to paper on Paul Ryan’s corporate tax blueprint…

A new 20% corporate income tax rate will increase corporate profits by 4%. Using a 20 multiple and you get a 100 point increase in the S&P 500 which is about how much the market has increased since the election.

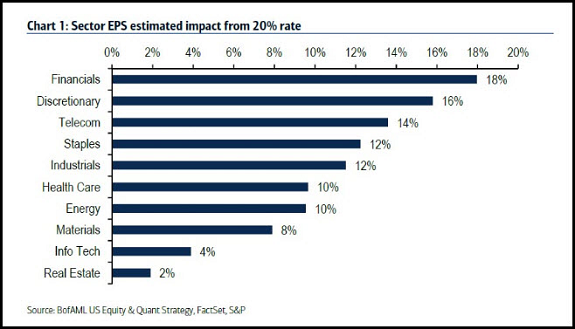

Looking at the sector winners and losers, Financials sector wins as they have the highest current rate and are more concentrated toward U.S. revenues…

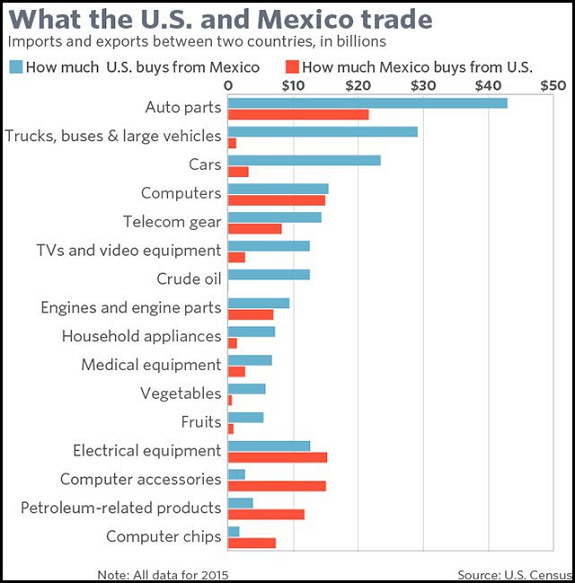

There is much uncertainty right now on how the border tax will work. And it is scaring many small business owners…

A proposed overhaul of the U.S. tax code favored by Republicans in the House of Representatives is drawing fire from small-business owners who sell everything from toys to materials used in kitchen cabinets.

Some business owners say they worry that a part of the proposal, known as border adjustment, could force them to raise prices and lay off workers. Others fear it could even put them out of business. The proposal could, however, benefit firms that are exporters or don’t import raw materials or finished products.

Under the plan, imports couldn’t be deducted as a cost of doing business, while exports would be exempted. That could lead to higher tax bills for firms that rely heavily on imports. The proposal is part of a broader tax overhaul that would cut corporate and individual tax rates.

(WSJ)

So what gets traded across the Mexican border will likely be subject to new taxes, duties or restrictions?

(@PlanMaestro)

All-time highs nearly across the board last week except for in Small Caps…

Small Caps have underperformed along with the U.S. Dollar which has pulled back from its December peaks.

(Briefing.com)

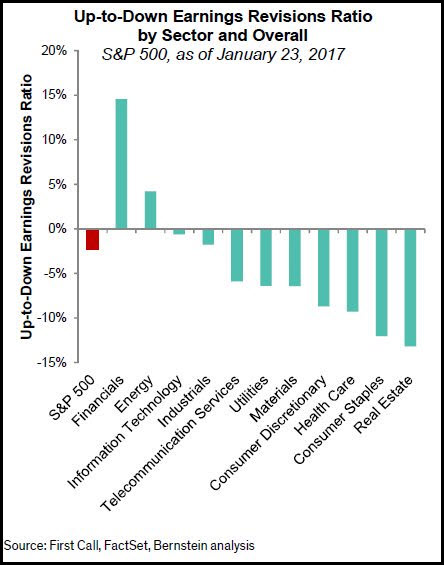

Looking at Q1 earnings revisions, Financials and Energy are leading…

But while Financials have moved back toward highs, Energy stocks have burned up YTD.

(@DriehausCapital)

As mentioned, high yield spreads continue to march toward 10-year lows…

If you really wanted to scare me out of risk assets, show me a sharp move higher in this chart.

(@PlanMaestro)

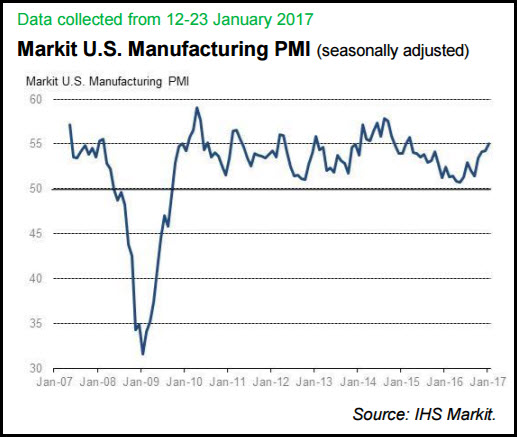

Detailed economic data continues to move higher as confidence builds. Here is the summary of last week’s Markit U.S. Mfg PMI…

The U.S. Manufacturing sector had a solid start to 2017, with overall operating conditions improving at the quickest pace for nearly two years. This was shown by the seasonally Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ posting 55.1 in January, up from 54.3 in December, to signal a marked upturn in the health of the sector that was the strongest since March 2015. The solid improvement in business conditions was largely driven by sharper increases in output and new orders, which rose at the fastest rates in 22- and 28-months, respectively. At the same time, companies raised their purchasing activity at the steepest rate since early 2015 and increased their payrolls further in order to meet greater production requirements. Positive expectations around the demand outlook were highlighted by further increases in stocks of purchased items and finished goods, with the latter increasing at the quickest pace since the series began in early 2007. Optimism around the 12-month outlook for production also improved at the start of the year, and reached its highest level since March 2016.

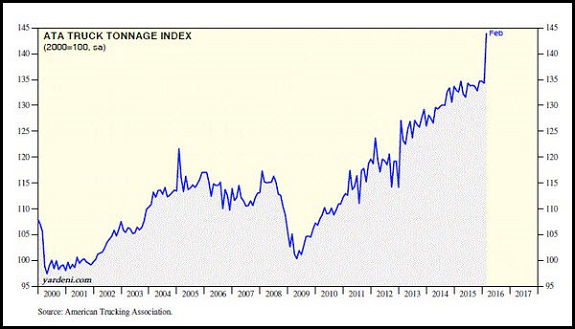

Even truckers are seeing a surge in volumes…

@ukarlewitz: New high. A good indicator of the broader economy since trucks account for 69% of tonnage carried by all carriers

Individual earnings tidbits continued to show a positive trend…

We’re going to continue to plan for a slow-growth global economy, but it still feels more positive than it has in a while coming off the worst recession since the Great Depression,” said David Cote, chief executive of Honeywell International Inc.

(WSJ)

KLA-Tencor during its conference call, says it is seeing “unprecedented levels of demand in its end markets.”

“it was broad-based growth in Industrial, both in terms of the businesses and in terms of the geographical area…And if you look upon PMI, the United States had a PMI of 54.7% in the quarter, China 51.4%, and Germany 55.6%. If you think about that in terms of big economies that will help us as we move forward, and as I said, it was broad-based.” (3M CEO Inge Thulin)

“the economy remains pretty darn strong. There really aren’t any factors at this point pointing to a softening or a downturn in the local economy. So I think that’s, if you will, the tailwind that we are looking at from a loan perspective and a deposits perspective” (Bank of Hawaii CEO Peter Ho)

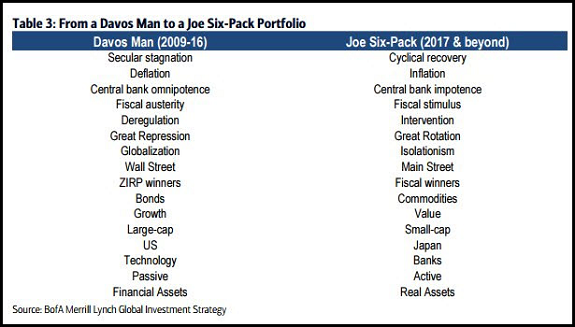

I forgot to look at what kind of beer the ‘Davos Man’ drank but I guess that does not matter now…

“We continue to recommend deeper rotation within investor portfolios away from secular stagnation plays to cyclical inflation plays” (BofA Merrill Lynch)

(@NickatFP)

A good follow on chart for Merrill’s attraction to Value stocks…

(@Callum_Thomas)

Finally, a great chart to end with for those wondering how their city crane count stacks up…

Seattle has again been named the crane capital of America, as the local construction boom shows little sign of slowing in 2017.

Seattle had 62 cranes dotting the skyline at the end of 2016, the most in the country, according to Rider Levett Bucknall, a firm that tracks cranes across the world. That’s up from 58 in the middle of last year.

The company releases tower crane counts twice a year. In the last update, Seattle had an 18-crane lead over second-place Los Angeles.

But this time, a surge in construction in Chicago has catapulted the Midwest city into second, with 56 cranes, just six shy of Seattle. Los Angeles has dropped to third on the list with 29.

Copyright © 361 Capital