by Jeffrey Saut, Chief Investment Strategist, Raymond James

By now, you have likely heard something, either directly or indirectly, about “The Great Rotation” from bonds into stocks. Just “googling” the term will pull up a whole host of articles written by practically every major financial news organization in existence, and it seems that every “bond king” and market strategist has weighed in with his or her own respective opinions on the matter. In short, the line of thinking behind the rotation is that, after 30+ years of interest rates in the United States generally falling and bond prices, resultantly, rising, an inflection point has been reached or is approaching where now interest rates will rise over time and bond prices will suffer. Most people, at least, seem to agree on that point to some extent, though what exactly that will mean for bonds and stocks as investments remains widely contested. Some have argued that this dynamic will prompt massive money flows to move from bonds into the stock market (producing the titular “great rotation”), while others contend it will not have as big of an effect on aggregate portfolio allocations as expected.

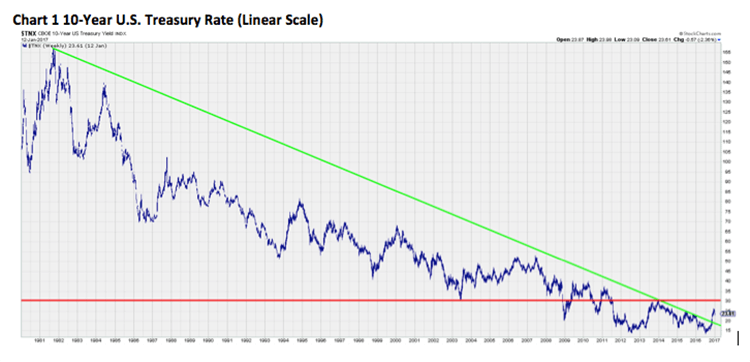

The financial media has tried quite hard to pitch this as a battle between Bill Gross, the well-known portfolio manager at Janus, and Jeff Gundlach, founder of DoubleLine Capital, who have shared a contentious past and don’t mind taking jabs at each other. However, to me, they seem to be saying the same thing except for a slight difference of opinion on the “key level” in the bond market. Gross has come out and said that 2.6% on the 10-Year U.S. Treasury is the line in the sand for the end of the bond bull market, while Gundlach argues that “second-tier managers” can focus on 2.6%, but 3% is the level to watch to “define the end of the bone bull market from a classic chart perspective.” In other words, both of these very smart bond guys, despite their minor differences, believe we are getting close to hitting that inflection point, with Gundlach going on to say that it is “almost for sure” that the 10-Year is going to take out 3% this year.

Meanwhile, we have already said that it is very likely that last July marked THE bottom for rates, when the 10-Year U.S. Treasury made an undercut low below the 2012 nadir before quickly recovering to shoot up about 125 basis points (almost a 100% move in percentage terms) by the end of 2016. The future trajectory for rates, therefore, does appear to be upward, but the exact path remains an unknown. Just as yields didn’t go straight down over the last three decades, they will not go straight up in the years ahead, as the last few weeks have reminded us with the 10-Year falling about 10%. Also, while the long-term chart of the 10-Year going back to the early 1980s looks to have already broken its downtrend line when using a linear scale (Chart 1), the logarithmic chart (Chart 2) still has some work to do and would need to better 3.5% before the downtrend is broken. 2.6%, 3%, and 3.5% may all act as fairly strong resistance, too, so it would not surprise me to see interest rates remain range-bound for much of 2017 until expectations about economic growth and inflation pick up enough to power rates above this resistance block. 3%, especially, may be tough to overcome in the next few months until we see just what the new administration’s policies are going to be.

So, what does this all mean for the stock market? Well, market strategists are sort of torn on that point, as well. Jeffrey Kleintop, chief global strategist at Charles Schwab, believes the fund flow shift from bonds to stocks that has taken place over the last two months, which has added $3 trillion to global equity values while bond values have dropped by $2 trillion per Bloomberg, “marks an important juncture” and has “years left to run.” Conversely, David Kostin of Goldman Sachs argued last week in a note that, many institutional investors, the ones who really move markets, are restricted from moving money out of bonds and/or owning stocks, so the impact of the “great rotation” may already be approaching its upper limit since allocations to debt securities are already near the lowest levels of the last 30 years.

The truth may lie somewhere in the middle, then. Overall, rates are still likely to be low and accommodative for the next couple of years when compared to their long-term averages, which should help keep interest in stocks high. At the same time, if we are correct and earnings growth picks up in the quarters ahead, that should bode well for stock prices, so we may still see a large amount of money flowing back from bonds into stocks, particularly among retail investors chasing returns, if stock prices go up while bonds are losing value and still yielding relatively low rates. However, David Kostin does make a fair point that we are certainly not going to see most fixed income investors suddenly switch to stocks – institutional investors are generally limited in what they can invest in by the terms of their portfolio agreements, and bonds will still play a large role for retail investors who need the diversification and income benefits that they can provide. So, on a net basis, I’d say that “the great rotation” may help provide a tailwind for stocks, but it might not be as “great” as many believe. At the end of the day, earnings and economic growth are still the primary drivers behind the stock market and, without this growth, interest rates and stocks may both have trouble rising significantly from current levels.

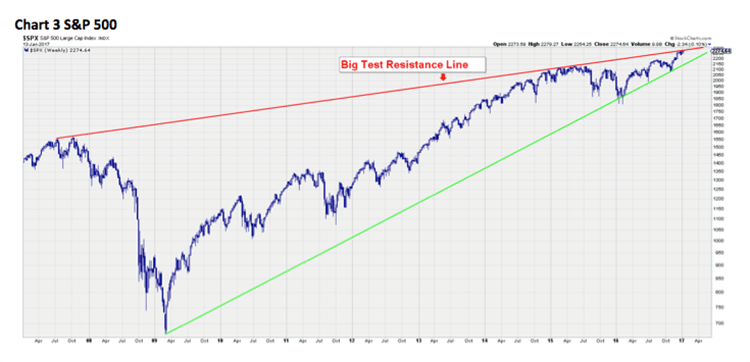

And on a more short-term basis, the S&P 500 seems to be having trouble rising at this very moment, with yet another week behind us where the index basically went nowhere. That’s not an exaggeration, either, as it opened the week trading at 2273 and finished just one point higher at 2274, putting in a total range of only 25 points in the process. Stocks continue to face tough resistance just above current prices, possibly because of that big test line (Chart 3) I have regularly referenced, but there just hasn’t been enough bad news out there to knock prices down. None of the major indices is really breaking down yet, and the NASDAQ has even managed to make new highs in the past few days, but there will likely come a point where the floor gives way if stocks can’t make any more progress on the upside.

As mentioned, our models indicate that late January could be when the market finally runs into trouble, and that could begin as early as this week unless we can break above the overhead selling pressure. It is options expiration week, too, which has historically been difficult in January over the last 18 years, according to Jeff Hirsch, the mind behind the Stock Trader’s Almanac. The S&P 500 has declined in 13 of those 18 years, with an average loss of 1.06%, and this expiration date also happens to come on inauguration day this year, which could up the volatility even more. And that leaves…

The call for this week: Earnings season should be the primary focus with this the first really big week for the 4Q16, though Donald Trump’s cabinet nominees and impending inauguration will continue to get a lot of attention. We will conclude the week with a new president here in the United States, and, as we have mentioned, this could be “buy the rumor, sell the news” type event where traders use the swearing-in as an excuse to take profits. Watch for a possible trading top coinciding with the inauguration, even if that doesn’t exactly make rational sense (when does the market ever make rational sense?). Also, expect even more attention to be paid to corporate earnings releases and conference calls this quarter to see how management teams are planning around the new administration. Investor sentiment seems to have greatly picked up since the election, but it will be interesting to see how companies feel given the uncertainty that exists with all the policy speculation. If managers are mostly in “wait and see” mode when it comes to future investments and strategic action, it could delay the impact Trump’s and Congress’s policies have on corporate earnings. However, we still believe the final earnings numbers will continue to show an improving growth environment, which will hopefully prevent any serious downside for the broad market. So, stay alert, as this has the makings of a pivotal week for the stock market over the short to intermediate term.

Copyright © Raymond James