by Carl Tannenbaum, Asha Bangalore, Northern Trust

The economic setting within the United States as the new year commences is largely constructive. Data received in the latter weeks of 2016 were encouraging, and there seems to be an improving economic sentiment.

This improved sentiment anticipates reductions in personal and corporate tax rates, as well as a substantial program of infrastructure spending. But it is unlikely, in our view, that the scale of these efforts will match what was promised on the campaign trail. Further, the effective dates of these actions are unknown and will most likely occur in late 2017 or early 2018. And monetary policy may be forced to respond to the risk of higher inflation, which could result from the economy running hotter while near full employment.

For now, we have made little allowance in our forecast for the impact of fiscal expansion. We’ll be monitoring the details of the new administration’s economic policies and their progress through Congress. When the contours become clearer, we’ll update our expectations accordingly.

For now, third quarter real gross domestic product (GDP) was revised up, and recent U.S. economic reports point to continued forward momentum.

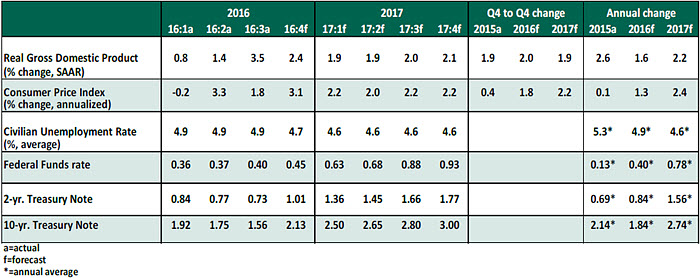

Key Economic Indicators

Key Elements of the Forecast

- Consumer spending is predicted to remain strong in the final three months of 2016, supported by a robust pace of car sales (18.1 million units vs 17.5 million in 2016:Q3). Personal income and employment conditions are also favorable and underpin growth in consumer spending during the quarters ahead.

- Residential investment expenditures fell in the second and third quarters of last year. The data we have for 2016 show that home sales have increased, but at a slightly slower pace than the level of activity recorded for 2015. Construction of new homes advanced in 2016, but posted roughly half the gain seen in 2015. Undoubtedly, the 80 basis points increase in mortgage rates since September will be a negative for home sales. But positives such as employment and income are significant factors that support housing demand. On net, a modest increase in housing sector activity cannot be ruled out.

- Barring a large jump in fourth-quarter outlays, business spending (equipment and structures) could decline in 2016, the first annual drop in the current expansion. The weakness in capital expenditures is partly related to the oil industry suffering from severe margin pressure due to low prices. The pickup in oil prices and OPEC’s plans to reduce production are important changes that should bear positively on overall business spending.

- The indexes tracking production and new orders in the latest Institute of Supply Management’s factory survey rose to levels seen in late 2014. This implies not only an increase in industrial production but also an overall improvement in business conditions. The price index of this survey posted the highest reading since 2010. Although it is partly a reflection of higher oil prices, these higher costs will be passed on downstream to consumers.

- The economy is predicted to grow slightly above trend in 2017, which could result in a small measure of labor market tightening. The 4.7% unemployment rate and other labor market indicators suggest that economy is currently at full employment. The recent acceleration of wages, the job openings rate and anecdotal reports of skill shortages corroborate this impression. This will certainly attract the Fed’s attention.

- Inflation and inflation expectations are both trending up. Actual inflation stands 1.4% higher than a year ago, a 50 basis points increase in five months. Core inflation, which excludes food and energy prices, has risen 1.7% from a year ago. Inflation expectations have increased nearly 25 basis points since early November. Given that the oil price trajectory has changed and inflation readings are moving up, the Fed and markets will be extra attentive about inflation numbers. Inflation is most likely to match the Fed’s 2.0% target in 2017.

- The 10-year Treasury note yield is around 2.40%, up 60 basis points since November 2016. This development reflects expectations of further improvements in growth and higher inflation in the U.S. economy. The global economy is in a different place today than it was at this time last year, when economic data from China were foreboding and the eurozone was on less firm ground. Equity and oil prices have moved up. It will take a major shock to reverse long rates in the near term.

Copyright © Northern Trust