by Richard Turnill, Blackrock

Richard shares three key takeaways from a topsy-turvy 2016 characterized by big market reversals in the second half.

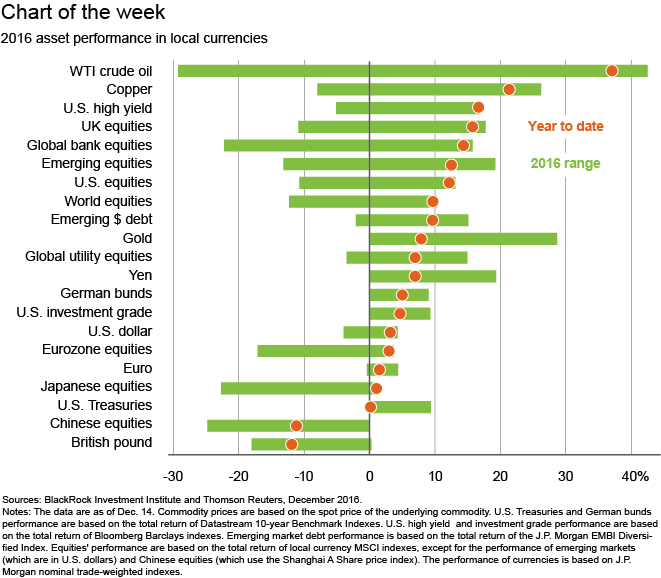

This year started on a fraught note with worries about China, plunging oil prices and sliding shares. Then reflationary expectations in the U.S. helped drive a second-half global growth pickup and big market reversals. The chart below helps explain three takeaways we see from this topsy-turvy year.

The chart shows year-to-date performance across assets. What stands out: strong returns to many risk assets in a year of significant political upheavals and major market reversals. U.S. equities sit just below record levels, the 35-year bull market in government bonds likely ended and oil prices have doubled from 13-year lows. Big winners in 2016 include natural resources, global banks and emerging market (EM) equities.

Here are the three takeaways from 2016’s big moves.

Economics can trump politics.

The world waking up to reflation has been the dominant driver of 2016 asset returns, outweighing political surprises and uncertainty. This trend accelerated after the U.S. election on expectations for an extra fiscal boost.

Uncertainty does not imply widespread volatility.

Equity volatility spikes after big surprises such as the UK’s Brexit vote and the U.S. presidential election were short-lived. Instead, political surprises and initial selloffs were seized on as buying opportunities. We believe this argues for taking the long view rather than reacting to short-term market noise.

Opportunities abound despite today’s low-return environment.

Asset returns varied widely in 2016. Perceived safe assets such as government bonds and low volatility shares underperformed. Higher-risk areas of the market delivered high returns. And the reversal of longstanding trends created opportunities, such as in the recoveries of value stocks and commodities. We expect some of these trends to extend into 2017 and see the potential for more flows into risk assets next year. Read more market insights in our 2017 Outlook and Weekly Commentary. Happy Holidays.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

International investing involves special risks including, but not limited to currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of December 2016 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

©2016 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Copyright © Blackrock