by Frank Holmes, CIO, CEO, U.S. Global Investors

Risk is one of my all-time favorite board games. It’s among the very few that’s equal parts strategy and luck, and the stakes can’t get much higher than total world domination. It wasn’t uncommon for games between my friends and me to last for hours, sometimes deep into the night.

Today a real-life game of Risk is unfolding on the world stage, with major players moving their pieces into place.

As you probably recall, President-elect Donald Trump recently took a call from Taiwanese President Tsai Ing-wen, a decision that flies in the face of 40 years’ worth of U.S.-China diplomacy. Since 1978, the U.S. has had no diplomatic relations with Taiwan after acknowledging the “One China” policy—a policy Trump says the U.S. is not necessarily bound to.

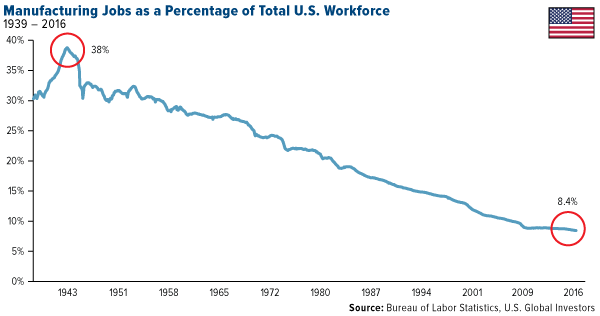

His phone call and comment follow tough talk on the campaign trail about China manipulating its currency and stealing American manufacturing jobs—though bringing them back might be hard, as we’ve steadily been losing such jobs since the Second World War.

Trump has also threatened to impose an unrealistically high 45 percent tariff on Chinese imports, prompting U.S. companies operating in the Asian country to fear “retribution.”

For their part, the Chinese say they have “serious concerns” about Trump’s position on Taiwan and international trade, with one state-run newspaper describing the president-elect as “ignorant as a child” in the field of diplomacy.

China’s “retribution” could be coming sooner than we expect. Last week, a top Chinese official visited Mexico to strengthen ties with the Latin American country, which has also frequently found itself caught in Trump’s crosshairs. Both countries—our number two and number three trading partners, after Canada—have expressed interest in lessening their dependency on the U.S., especially given the strong possibility that Trump could raise certain trade restrictions.

In the fight for American jobs, we could be “risking” a trade war with China right on our southern doorstep. Though the stakes might not be as high as total global domination, they come pretty close. With rates moving up and the world resetting to less quantitative easing, inflation might accelerate. To avoid a global recession, Trump will need to make streamlining regulations a top priority.

Gold Sidelined as Trump Rally Continues and Yields Surge

For only the second time since 2008, the Federal Reserve raised interest rates last week, surprising no one. Although the 25 basis point lift was in line with expectations, markets took some time to digest the news that three rate hikes—not two, as was earlier expected—were likely to happen in 2017. Major averages hit the pause button for the first time since last month’s presidential election, but the Trump rally quickly resumed Thursday morning.

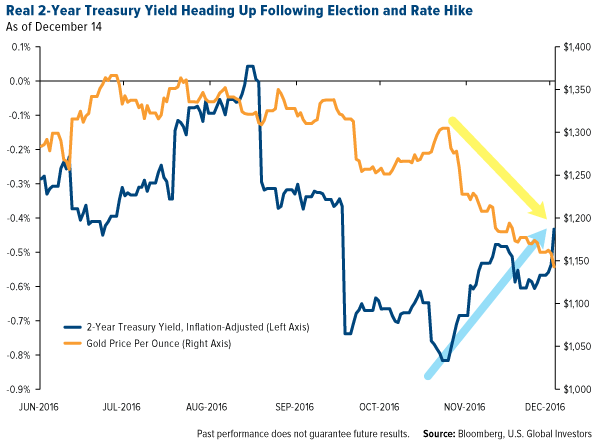

The two-year Treasury yield immediately jumped to a nominal 1.27 percent after averaging 0.80 percent for most of 2016, an increase of 58 percent. In real, or inflation-adjusted, terms, the yield is still in negative territory, but it’s clearly heading up following the U.S. election and rate hike. Thirty-year mortgage rates, meanwhile, hit a two-year high.

Gold retreated to a 10-month low. As I’ve explained many times before, gold has historically had an inverse relationship with bond yields, performing best when they’re moving south.

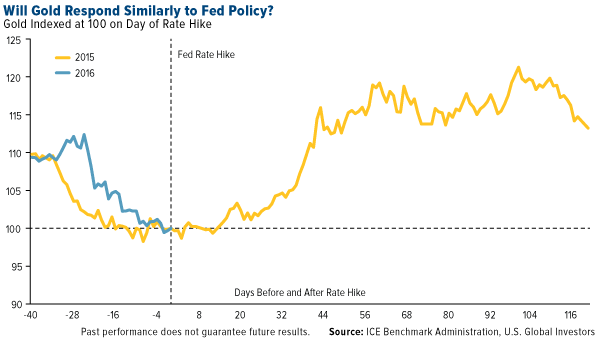

It’s worth pointing out that the most recent gold bull market, which carried the yellow metal up 28 percent in the first six months of 2016, was triggered last December when the Fed hiked rates.

Again, as many as three rate hikes are expected in 2017—unlike the one this year—with Fed Chair Janet Yellen commenting that economic conditions have improved well enough to warrant a more aggressive policy. If true, this should accelerate upward momentum of Treasury yields and the U.S. dollar—currently at a 14-year high—which could dampen gold’s chances of repeating the rally we saw in the first half of this year.

|

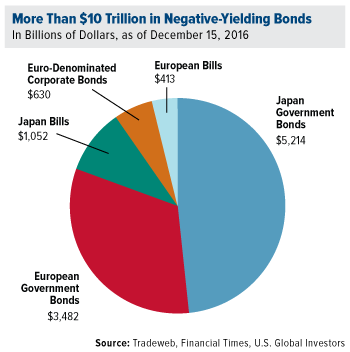

Other gold drivers still remain in place, though, including negative-yielding government bonds elsewhere around the world. The value of such debt has dropped considerably since the election of Donald Trump, but it still stands at more than $10 trillion, supporting the investment case for the yellow metal. And as I mentioned previously, many of Trump’s protectionist policies—opposition to free trade agreements, imposition of tariffs on Chinese-made goods—are expected to heat up inflationary pressures in the U.S., which could serve as a gold catalyst.

What’s more, gold is looking oversold, down two standard deviations for the 60-day period, which has historically signaled a good buying opportunity. With prices off close to 12 percent since Election Day, I believe this is an attractive time to rebalance your gold position. I’ve always recommended a 10 percent weighting, with 5 percent in gold stocks and the other 5 percent in bullion, coins and jewelry.

Will Trump Tear Up Dodd-Frank? The Market Is Betting on It

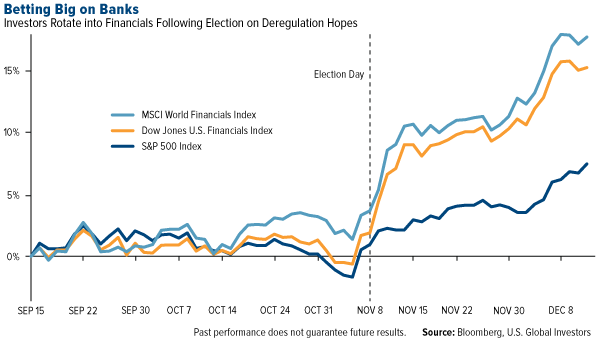

The top beneficiary of the Trump rally so far has been the banking industry, with bets driven by the potential for higher lending rates and stronger economic growth in the coming months, not to mention the president-elect’s pledge to reject any new financial regulations.

I wouldn’t call this rally “irrational exuberance” just yet, but according to Bank of America Merrill Lynch’s monthly survey, fund managers have built up the largest overweight position ever in bank stocks—31 percent above their benchmarks on average.

This phenomenal run-up implies investors have confidence Trump can make good on his promise to unleash the U.S. economy and dismantle Wall Street regulations.

As I’ve made clear in previous commentaries, regulations are usually created with the best of intentions, and they’re sometimes necessary to establish a level playing field. But all too often, they end up impeding financial growth, hurting not just businesses but also consumers.

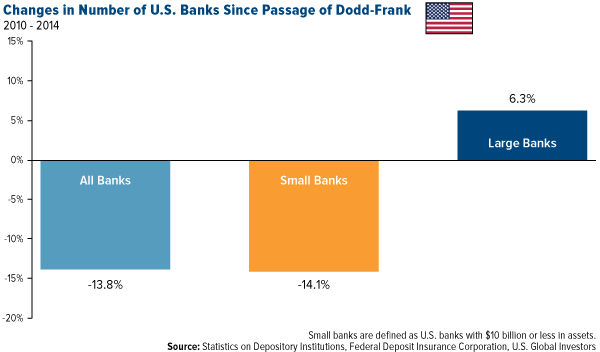

Take Dodd-Frank. What was intended as a set of policies to prevent another financial meltdown has dramatically limited consumer choice, shrunk the number of retirement options and squeezed out smaller banks and credit unions. The 2,300-page act, signed in 2010, places a monumental burden on financial institutions, from banks to brokers to investment firms, which we have felt indirectly. Even former Fed Chair Ben Bernanke had a hard time refinancing his house in 2014, one of Dodd-Frank’s unintended consequences.

Before 2010, about 75 percent of banks offered free checking accounts. Only two years later, that figure had fallen to less than 40 percent. Since the law went into effect, the U.S. has lost one community financial institution a day on average. This hurts credit-seeking small businesses and startups, not to mention consumers in the market to buy a new home or vehicle.

In House Speaker Paul Ryan’s “A Better Way” initiative, several solutions to runaway regulations are proposed. One that stands out is a “regulatory budget,” which would limit the number and dollar amount of rules federal agencies can impose every year. My hope is that Ryan and Trump can set aside their differences to streamline the ever-growing mountain of rules that weighs on American businesses and restricts the flow of capital.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

The MSCI World Financials Index captures large and mid-cap representation across 23 Developed Markets countries. All securities in the index are classified in the financials sector as per the Global Industry Classification Standard (GICS). The Dow Jones U.S. Financials Index, a member of the Dow Jones Global Indices family, is designed to measure the stock performance of U.S. companies in the financials industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors