by David Wolf, Portfolio Manager, Fidelity Investments Canada

Key Takeaways

-

Trump win should usher in late cycle environment

-

We have added to equities while underweighting duration, overweighting USD

Trump won. It is clear that we will be entering a new era for policy in the United States. It is far less clear what exactly that will look like.

But even if we can’t know the details at this point, we can make some reasonable projections regarding the broad contours of the economic policies that will be enacted, their effects on financial markets, and thus their consequences for our active asset allocation strategy in the Canadian multi-asset class funds.

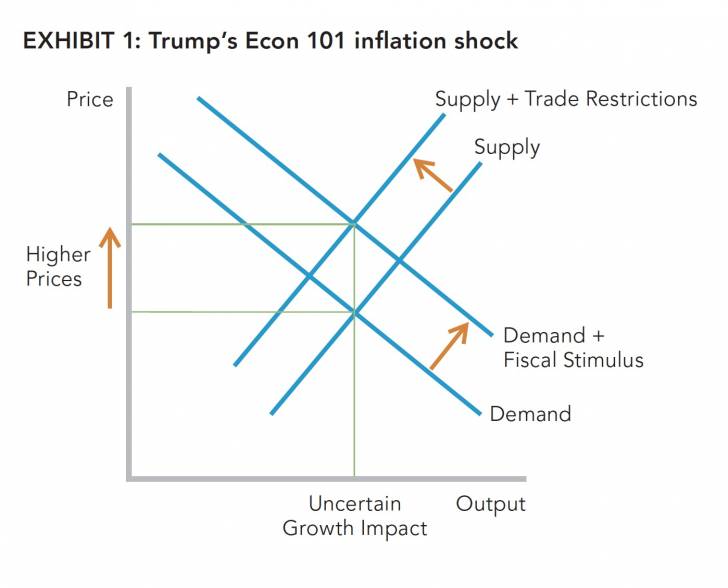

First, we’re likely to see some fiscal stimulus in the U.S. Tax cuts should be easy for President Trump and the Republican Congress to agree upon. Paying for them may be a more contentious issue, particularly if a big increase in infrastructure spending is added to the bill. But it seems very likely, from my perspective, that we will see some combination of lower taxes, higher spending and wider deficits. Taken together, this will represent a cyclical impulse to the economy. In Economics 101 terms, this is a ‘positive demand shock’.

Second, we’re likely to see some restriction of international trade. This could potentially range anywhere from a few ‘Buy American’ requirements in an infrastructure bill all the way to tearing up NAFTA, slapping big tariffs on Chinese goods and generally starting a global trade war. We cannot know where we will end up on this spectrum, or how long it will take. But we do know that such restrictions will add to Brexit in intensifying the general movement away from globalization in the world economy that had already been building in the years since the Global Financial Crisis. By unwinding some of the efficiencies gained during the prior multi-decade push towards greater global economic integration, this will represent a ‘negative supply shock’ in Economics 101 terms.

As the (highly stylized) Exhibit 1 shows, a positive demand shock plus a negative supply shock is ambiguous with respect to economic growth, but additive with respect to inflation. More demand for goods and services from fiscal loosening will tend to push inflation higher, as will less ability to supply goods and services in a cost-effective way. Through this simple lens, Trump looks like an inflation shock.

Of course, inflation control in the U.S. is ultimately the responsibility of the Federal Reserve, and thus the Fed’s inclination to ‘take the other side’ of these inflationary shocks will be critical. A decade ago, I wouldn’t have had much question about the outcome here – with the U.S. economy already close to full employment, the Fed would be tightening to fully offset the demand side of the shock while recognizing the pinch on the supply side, producing a slightly slower growth trajectory and relatively stable inflation.

But I can think of at least a couple of reasons why the Fed may end up ‘lagging the cycle’, thus allowing some near-term swell in both growth and inflation. One, the Fed and other central banks have spent years throwing the kitchen sink at the economy trying to combat a stubbornly disinflationary environment; they’re hardly likely to want to flip around and tighten pre-emptively now, particularly given the massive uncertainty regarding just what kind of fiscal impulse we’ll get. And two, central bank independence cannot fully be taken for granted in this political environment, and it is not implausible that the Fed sees letting a Trump recovery run as the path of least resistance.

So what we’re looking at in the U.S. is probably a boomlet of questionable sustainability. It is notable that something of a similar dynamic seems to be at work in the world’s second-largest economy, China, where the fiscal and monetary spigots have opened as policy-makers appear to be prioritizing near-term growth over further reform, despite already-sizable domestic imbalances.

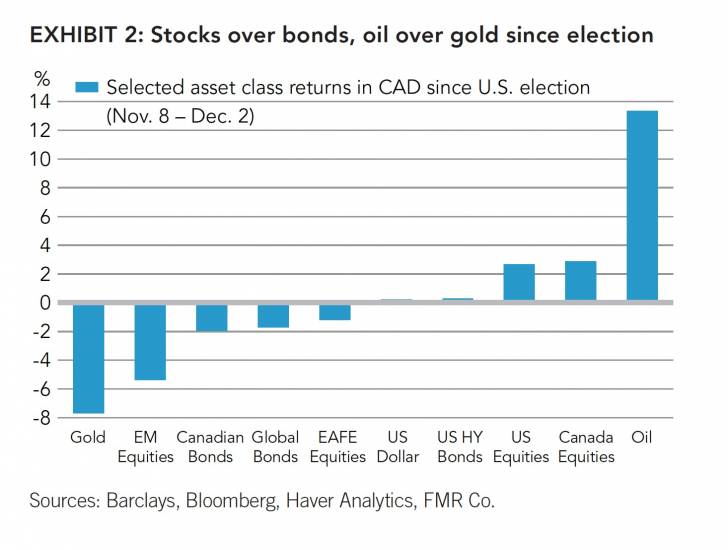

Through the lens of the business cycle framework that informs our asset allocation process, the consequences here are pretty straight-forward – we should be moving more definitively into a late cycle environment, a view consistent with movements across many (though not all) markets in the weeks since the election (see Exhibit 2). While we have been preparing for late-cycle for some time, some further adjustments in our active asset allocation positioning have been warranted. I discuss three particular dimensions below.

First, as our head of asset allocation research, Lisa Emsbo-Mattingly, is fond of saying, “late cycle is not recession.” We’re not battening down the hatches, and in fact have added some equity risk to our portfolios recently, after spending much of the year with more conservative positioning. But we are not inclined to chase a rally of questionable magnitude and duration – this may be a new era, but it’s an old cycle. Within our equity allocations, we are generally overweight in US and emerging market stocks and underweight in EAFE and Canada, while tilting away from the ‘bond proxy’ sectors in favour of more commodity-oriented exposures.

Second, we are underweight fixed income across our multi-asset class funds. Through most of this cycle, we have ‘kept our bonds’, fading widespread expectations of a normalization of interest rates. But as I discussed in Opportunistic Defense and Knowing What You Can’t Know, we reduced our holdings of nominal bonds earlier this year in favour of inflation-linked bonds, high yield and cash, as the risk/reward trade-off in investment grade fixed income deteriorated upon the further decline in yields. With a late cycle environment now emerging, we maintain our bond underweight, while reducing allocations to sectors like high yield that tend to underperform late in the cycle as interest rates rise and corporate balance sheets deteriorate.

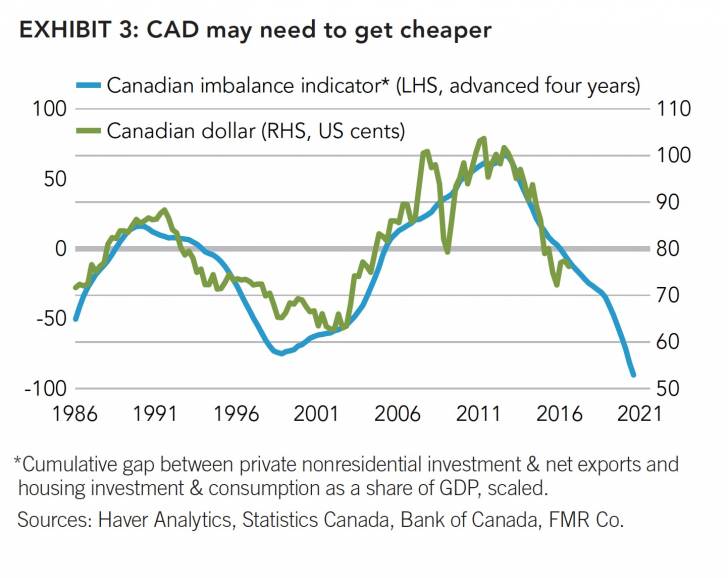

Third, we have increased our U.S. dollar overweight, notably against the Canadian dollar. The rationale here is two-fold. One, while recent developments favour tighter U.S. monetary policy, the reverse is probably true for Canada – stronger U.S. demand won’t help Canadian exporters much if U.S. market access is reduced, and higher longer-term interest rates are a greater threat to Canada’s more leveraged household sector. This reinforces the view that the balance of risks looks to be tilted towards a weaker Canadian dollar ahead (see Exhibit 3), even from already-cheap levels. Two, we are less convinced that fixed income performance will be as negatively correlated to equity performance going forward as it has been in the past, and thus we are choosing to rely somewhat less on bonds for downside risk protection in our portfolios and somewhat more on defensive currency exposures like the U.S. dollar.

In sum, though the U.S. election surprise has brought uncertainty on number of fronts, it may actually have brought greater clarity to the cyclical outlook. We are allocated accordingly. Nonetheless, as always, we will be monitoring the market environment and evolving our positioning as necessary to maximize return and manage risk across our Canadian multi-asset class funds.

David Wolf, December 6, 2016

INM 21993e DWolf Q4 2016 NewEra Retail Secured by dpbasic on Scribd

*David is portfolio co-manager of Fidelity Managed Portfolios, Fidelity Canadian Asset Allocation Fund, Fidelity Canadian Balanced Fund, Fidelity Monthly Income Fund, Fidelity U.S. Monthly Income Fund, Fidelity U.S. Monthly Income Currency Neutral Fund, Fidelity Global Monthly Income Fund, Fidelity Dividend Fund, Fidelity Global Dividend Fund, Fidelity Income Allocation Fund, Fidelity Balanced Managed Risk Portfolio and Fidelity Conservative Managed Risk Portfolio. He is also portfolio co-manager of Fidelity Conservative Income Private Pool, Fidelity Asset Allocation Private Pool, Fidelity Asset Allocation Currency Neutral Private Pool, Fidelity Balanced Private Pool, Fidelity Balanced Currency Neutral Private Pool, Fidelity Balanced Income Private Pool, Fidelity Balanced Income Currency Neutral Private Pool and Fidelity U.S. Growth and Income Private Pool.

*****

For Canadian investors

For Canadian prospects and/or Canadian institutional investors only. Offered in each province of Canada by Fidelity Investments Canada ULC in accordance with applicable securities laws.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

The information presented above reflects the opinions of David Wolf as at December 6, 2016. These opinions do not necessarily represent the views of Fidelity or any other person in the Fidelity organization and are subject to change at any time based on market or other conditions. As with all your investments through Fidelity, you must make your own determination as to whether an investment in any particular security or securities is consistent

with your investment objectives, risk tolerance, financial situation and your evaluation of the security. Consult your tax or financial advisor for information concerning your specific situation.

Investing involves risk, including the risk of loss.

Copyright © Fidelity Investments Canada