Should I Invest Outside the U.S.?

by Brad McMillan, CIO, Commonwealth Financial Network

With U.S. stocks surging to new highs and trouble brewing elsewhere in the world (the failed Italian referendum and resignation of Matteo Renzi, not to mention the continued decline in the Chinese currency), I’ve been getting questions about whether investors should just stay here in the USA.

With U.S. stocks surging to new highs and trouble brewing elsewhere in the world (the failed Italian referendum and resignation of Matteo Renzi, not to mention the continued decline in the Chinese currency), I’ve been getting questions about whether investors should just stay here in the USA.

In a scary international environment, does investing outside the U.S. make sense anymore?

Viewed in isolation, maybe not. You can make a good case not to invest in any one country, or even any one region—China, Italy, Japan, the list goes on and on. The U.S. has been, and continues to be, one of the healthiest economies and markets out there.

How soon we forget . . .

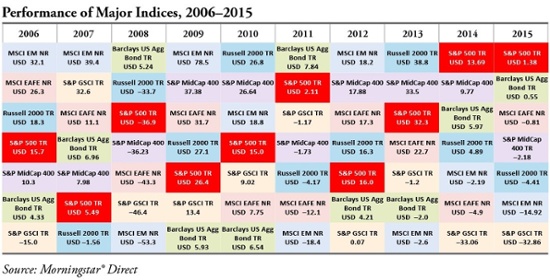

Over the past couple of years, U.S. stocks have been the place to be, but what about before then? Consider the following chart:

For five of the past ten years, emerging markets have beaten the S&P 500. For four of the past ten years, developed international markets, as tracked by the MSCI EAFE Index (the acronym stands for Europe, Australasia, and Far East) have beaten the S&P. On a year-to-year basis, you would be adding more volatility—and risk—to your portfolio by excluding international investments.

You’ve probably seen this chart before, but take a closer look. It really does show why diversification can work.

Looking ahead, why might U.S. stocks do worse?

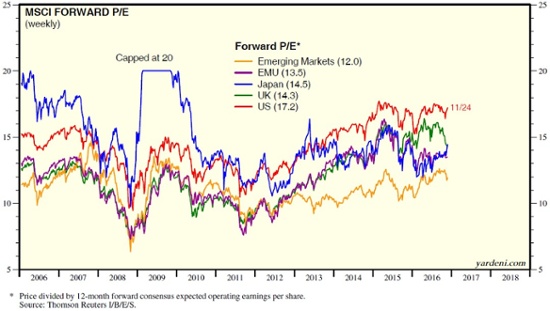

A big reason is valuations. The more you pay for something, the less room there is for it to appreciate. Buy low is, after all, the first part of conventional investing wisdom. When stock markets are expensive, future returns tend to be lower, and the U.S. is expensive at the moment. Looking at the forward price-to-earnings ratio, from yardeni.com, you can see that the U.S. is far and away the most expensive market out there.

Buying into the U.S., you are paying for all the good news and relative outperformance (and certainly not buying low). Other markets, even if their companies don’t perform as well, may be better investments simply because they can be bought more cheaply.

Once again, my friends, diversify

For most investors, the goal is not to maximize returns but to maximize risk-adjusted returns. Putting all of your assets into U.S. markets, at a historically high price level, is assuming a substantial amount of risk. Buying into foreign markets, at better valuations, can help diversify that risk—and, on a year-to-year basis, provide exposure to better returns.

The argument to stay in the U.S. usually gets most attractive when the U.S. has been outperforming, like right now, but this is also the time it is most dangerous. As with any other investment, when everyone wants to get in is usually not the best time to do so. My advice? Keep your eye on your goals, and keep your investments diversified.

The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The S&P MidCap 400® Index measures the performance of mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. The S&P GSCI® Index measures general price movements and inflation in the world economy. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Barclays Capital Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Barclays Capital government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network