by Jean Boivin, Ph.D., Blackrock

Risk appetite is relatively subdued, but we see potential for a recovery. Jean explains.

Some stock indexes are reaching record levels. Yet, risk taking is not particularly buoyant, in our view. Investors still appear scarred by the 2007-2008 financial crisis and have been reluctant to embrace risk. However, we see potential for a recovery, as my colleagues and I write in our latest Global Macro Outlook, Climbing the wall of money.

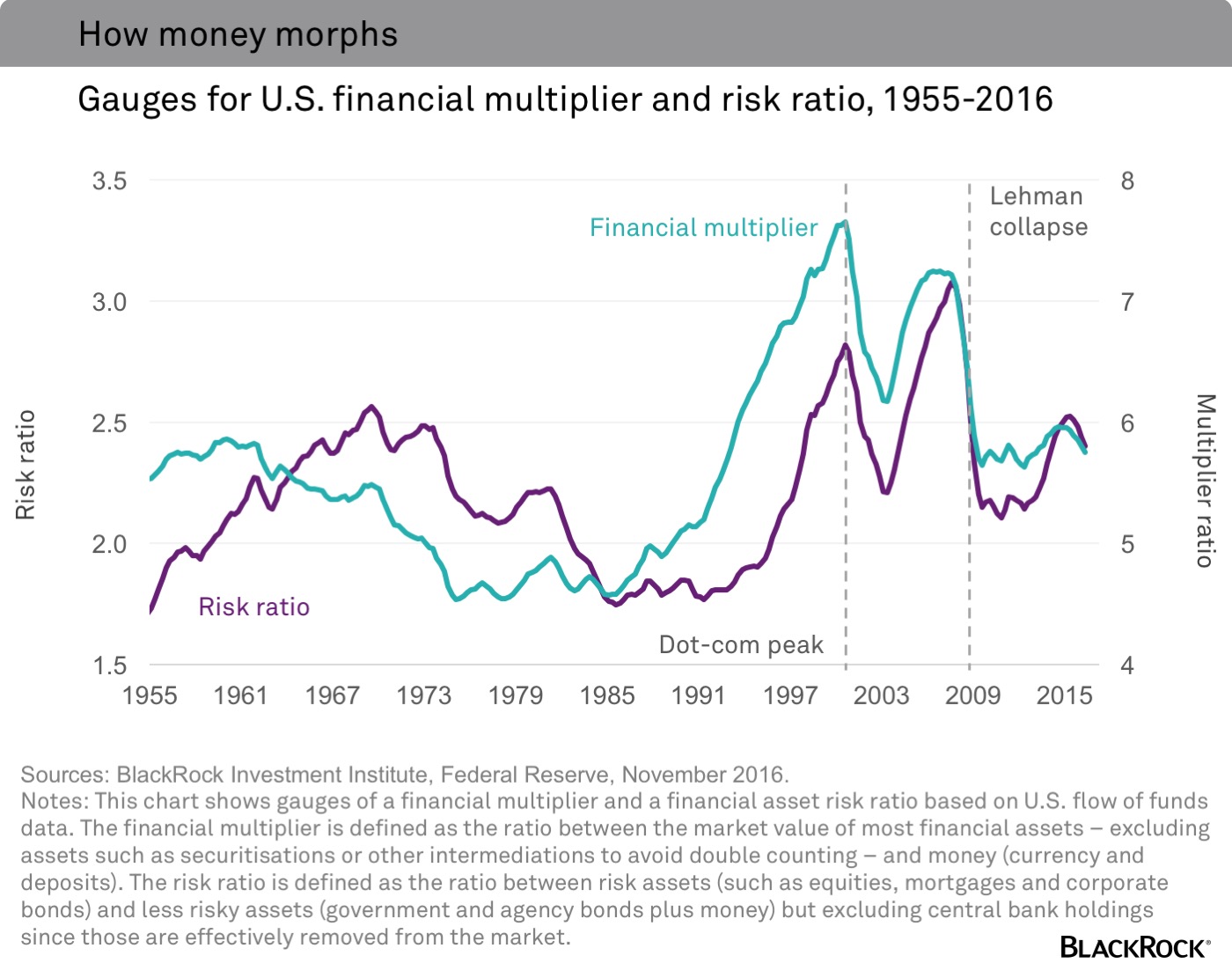

Optimistic investors tend to have a greater desire to put money to work to buy risk assets. Such buying should push up asset prices, keeping the amount of money in the financial system the same (being simply transferred from buyers to sellers). The rate at which money is used to bid up asset prices can be thought of as a “financial multiplier” and can be gauged by looking at the ratio of overall asset values to money. A rising ratio suggests that investors are putting money to work harder to buy financial assets.

Arguably, other assets can also be seen as money-like. Thus we also look at another ratio: the value of risk assets relative to that of perceived safe assets (mainly money and government bonds, less central banks holdings)—what we call the risk ratio. This shows more directly whether investors are venturing out the risk spectrum. The chart below shows how both the risk ratio and financial multiplier are well off peaks reached at the height of the dot-com bubble and early in the 2007-2008 financial crisis in the U.S. This is in contrast to valuations in equities and other assets that appear stretched. But history may not be a good guide when overall allocation to risk is still so low.

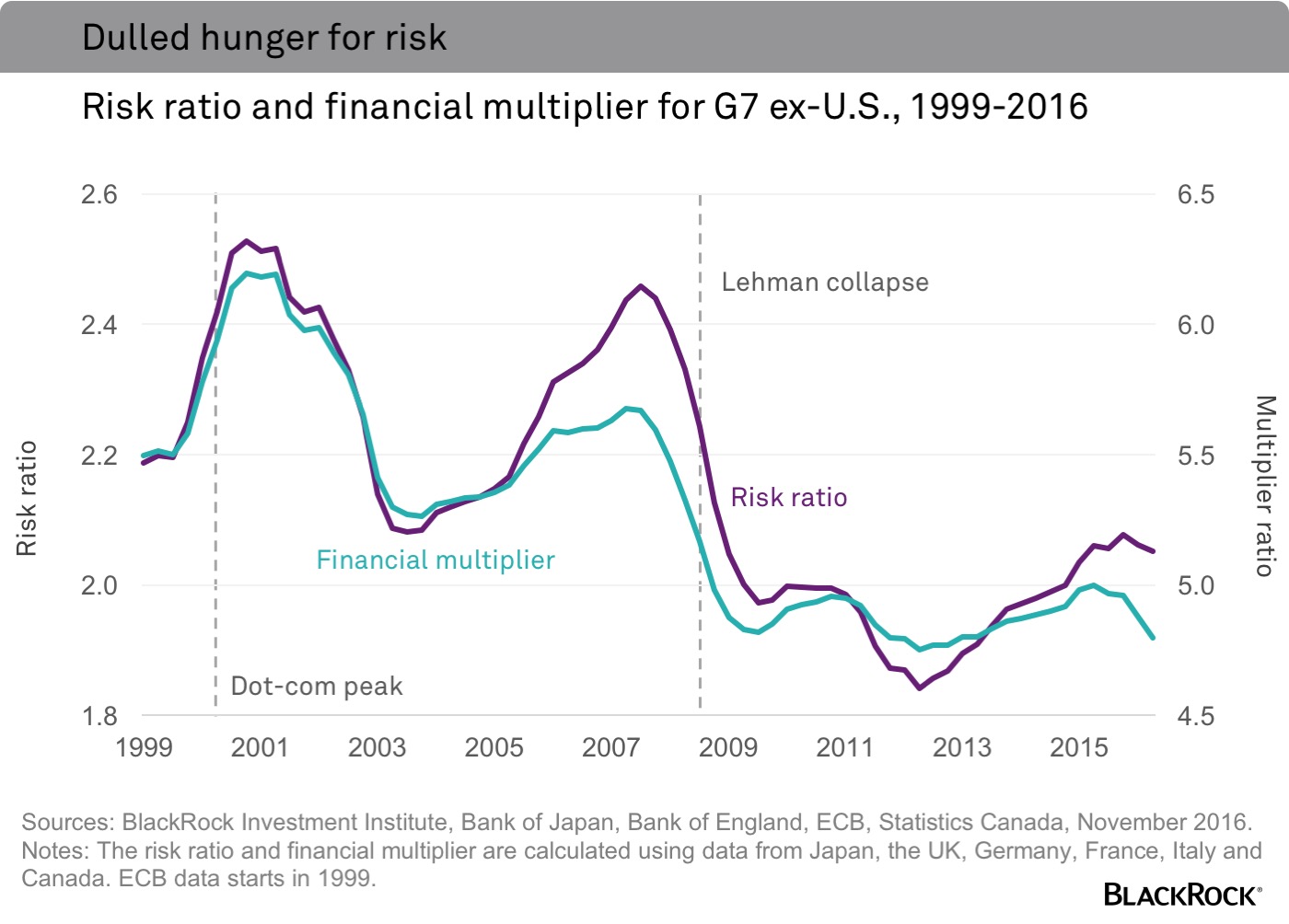

The subdued appetite for risk also appears to be more than just a U.S. phenomenon. The financial multiplier for the G7 excluding the U.S. has fallen steadily from its dot-com highs. It touched new lows during the height of the eurozone crisis and remains mired near there. The risk ratio has recovered more relative to 2012 lows but is also relatively subdued. See the chart below.

So, will risk appetite rise? Our BlackRock Macro GPS suggests that economists remain too pessimistic on the growth outlook for major economies in the months ahead. It highlights that economic conditions may not be as downbeat as the consensus suggests. At some point, stronger confidence in the economic outlook may prompt money to shift into risk assets, providing some upside potential. We believe upgrades to growth forecasts and greater clarity on the policy agenda of U.S. President-elect Donald Trump could help stir more investor hunger for risk. We don’t expect renewed bouts of euphoria, but we see scope for investor optimism to lift equities and other risk assets, and see a mild rise in bond yields. Read more in our full Global Macro Outlook.

Jean Boivin, PhD,is head of economic and markets research at the BlackRock Investment Institute. He is a regular contributor to The Blog.

Copyright © Blackrock