by Shreenivas Kunte, CFA, CFA Institute

Retail investors are important stakeholders in wealth management. Indeed, they form the basis of the wealth management industry.

For a sizable portion of wealth managers, including those in the United States, however, the end investor is not the principal source of management income. Instead, compensation is derived mainly through product commissions from asset management companies. As a result, unaddressed misaligned interests have created a trust deficit between retail investors and their wealth management practitioners.

From short-term greed to a lack of transparency, misaligned interests take on both blatant and subtle forms and lead to an ever-widening trust gap. Specifically, perceived and actual conflicts of interest and advisory fees have been a matter of debate and scrutiny for some time.

There is a growing view that a conflict of interest is not a completely insurmountable challenge. On the contrary, sacrificing an adviser’s short-term interests in favor of the client’s is an opportunity to build a stronger foundation for trust. After all, most of us have an innate desire for trusting relationships.

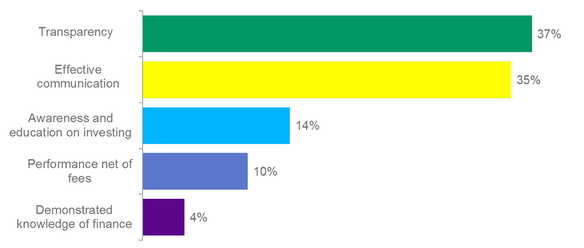

What are some other factors that can build trust? Can wealth management professionals improve on them? We asked CFA Institute Financial NewsBrief readers their opinion, and the poll results offer some interesting insights.

In addition to addressing misaligned interest, which of the following can contribute the most toward building trust in private wealth management?

Transparency

Of the 492 respondents to this survey, the largest group — representing 37% of the vote — chose transparency as the biggest contributing factor to building trust. This result is in line with a recent global trust survey commissioned by CFA Institute in partnership with Edelman. The survey confirmed the increasing demand among retail investors for a higher level of transparency.

In the context of a fundamental misalignment in interests, it is easy to see the role that transparency can play in reassuring end clients. Shared awareness on the complexity of the advisory business and a clear understanding of inherent conflicts can help convince clients that their interests matter. This awareness provides a much needed reassurance as to the integrity and soundness of the services wealth management practitioners offer.

Effective Communication

The second largest group of respondents in this survey, representing 34% of the vote, chose communication as the prime trust-building factor. Communication is essential for enhancing all relationships. The wealth management industry is no different.

Leading financial services practitioners place a special emphasis on listening to and communicating with clients in order to foster a trusting relationship. According to one practitioner, professionals should budget for three to four face-to-face client meetings to best understand client needs and to cultivate a basic client relationship. The investment policy statement (IPS) is an important tool that can help all stakeholders communicate effectively.

Awareness and Education on Investing

Awareness and education on investing garnered 14% of the vote. The need for financial education varies depending on specific needs and circumstances. A large proportion of the population in India, for example, lacks a basic awareness of finance. This in no way suggests that financial literacy is not an issue in developed countries. It may surprise some readers that advanced economies, France, Japan, and Italy among them, also have low levels of financial literacy.

Performance Net of Fees

Just 10% of the respondents agreed that fee-adjusted performance is the most persuasive factor in building trust. This result supports other data that suggest even more than performance, transparency is what matters most.

Demonstrated Knowledge of Finance

Demonstrated knowledge of finance received the weakest support, with 4%. Performance and competence are deemed more important than demonstrated knowledge. This suggests that performance in practice is viewed as a proxy for a demonstrated knowledge of finance.

It is important to remember that it can take time, even a lifetime, to build confidence and trust. Small actions driven by petty greed can quickly and irreversibly destroy it. Putting the interests of clients above everything else can create mutually profitable and trustworthy relationships.

Copyright © CFA Institute