by Blaine Rollins, CFA, 361 Capital

There will be surprises on both sides of the return spectrum—as equity and alternative assets will post solid gains, while bonds will get punched. And, any lean toward active management should put a smile on your face, as those managers who moved quickly into riskier, U.S.-focused assets had an even better month. While stocks will have put a big ‘hurt’ on bonds for November, don’t expect a big tactical balance to hurt stocks into December. As Jeff DeGraff will remind you, December returns are typically very good after a strong November. Junk bond spreads continue to be very favorable for risk sentiment, as does consumer credit quality. And with a fiscal government tailwind ramping up to hurricane-like speeds, it is tough to place bets against this market. No doubt that we could have violent, short-term pullbacks over the war of words in Washington, but I would expect the big pools of active capital to be buyers on the dips of U.S. risk assets, while they lighten their weighting of risk-free bonds.

J.P. Morgan has the major market calendar outlined for you through year end…

Big macro events to watch for over the balance of 2016 (aside from unscheduled Trump-related announcements):

- 1) OPEC meeting Wed 11/30

2) US Nov jobs report Fri 12/2

3) Italy referendum and Austrian election both scheduled for Dec 4

4) UK Supreme Court to hear Brexit appeal Dec 5-8 (although ruling not expected until ’17)

5) ECB meeting Thurs 12/8 (this is the last major scheduled macro event of the year as the ECB has important decisions to make w/regards to the APP)

6) 2017 outlooks from industrial firms (GE Wed 12/14, DHR Thurs 12/15, and HON Fri 12/16)

7) FOMC decision Wed 12/14

8) China Central Economic Work Conference (expected in Dec)

9) Deutsche Bank US RMBS settlement (investors assume the final settlement amount will be in the ~$4-5B range)

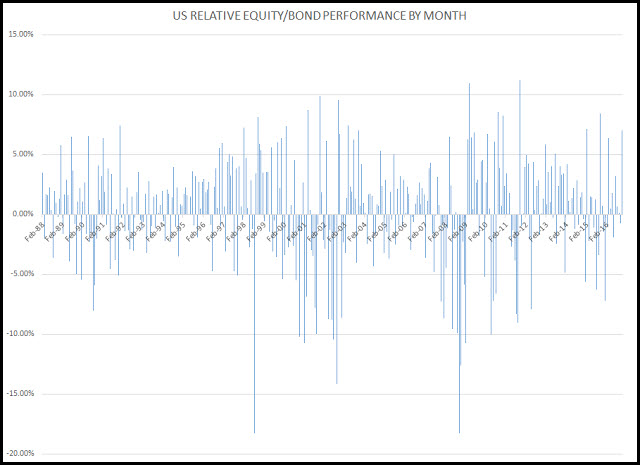

The long-term chart of stocks vs. bonds show you how outstanding November 2016 was for equities…

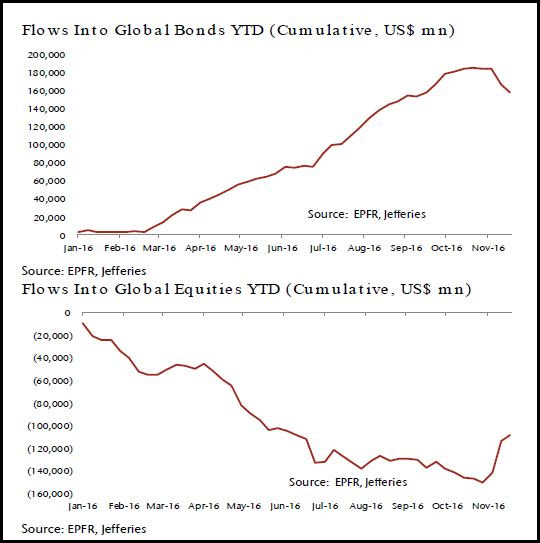

One month does not make a trend, but the real question will be if the most recent performance will have a long-term impact on flows…

And portfolio managers in the active equity space will also wonder if their tide will turn…

@todd_harrison: This mean will revert, if not completely reverse, by the end of the next cycle.

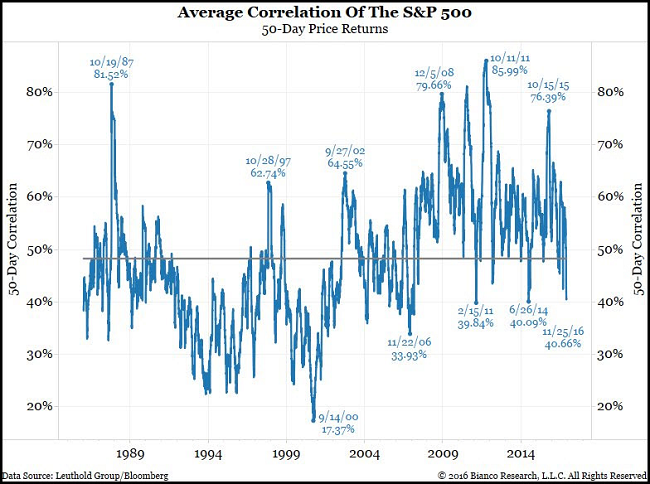

Helping active equity managers will be the S&P 500 component correlation looking to break to seven-year lows…

This recent decline in correlation has helped to widen the return dispersion of active managers…

The days of low return dispersion — in other words, of slender differences between the returns of different funds — may be coming to an end. According to a new note from Barclays Plc., there’s been a sharp polarity between winners and losers after the President-elect’s surprise win.

“Based on our database of over 800 active equity mutual funds, we find that 54 percent of mutual funds underperformed their benchmark since the election,” the team, led by Keith Parker U.S. head of asset allocation, said in the note. “However, the performance dispersion since the election has varied greatly, with roughly 4 percentage points between the top and bottom 10 percent of equity mutual funds,” they write.

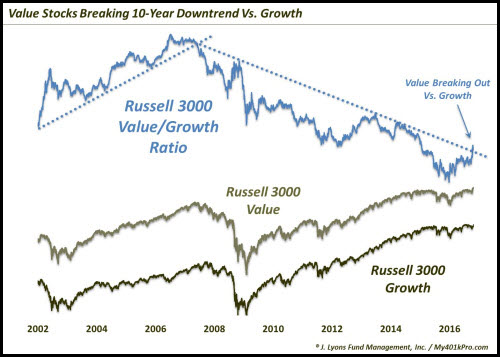

Another big shift in the market is the pickup in Value versus Growth which is now solidly breaking out of its eight-year downtrend…

(JLFMI)

Helping Value to outperform Growth into the future will be the rapidly increasing cash hoards at the buyout funds…

Private equity shops are sitting on about $862 billion in dry powder, the cash they’ve raised but haven’t deployed, according to data from researcher Preqin. That’s up 14 percent from 2015 and is the highest level since at least 2008, according to the data.

Meanwhile total spending on mergers and acquisitions has fallen 13 percent from last year, according to data compiled by Bloomberg.

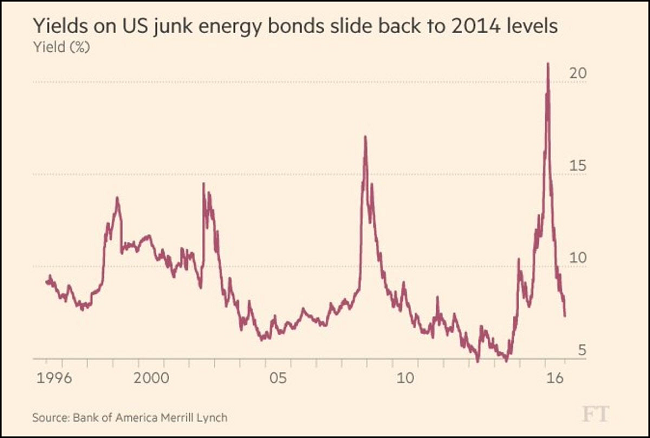

Remember when the Energy sector broke the credit and stock market?

Remember when the Energy sector broke the credit and stock market?

If you have hedge fund managers with big alpha generation in the last 12 months, they probably grabbed two handfuls of returns in oil and gas junk bonds.

When the four major indexes set new highs, the market tends to keep up its longer-term momentum…

(S&P 500 returns after the S&P, DJIA, Nasdaq Comp & Russell 2000 set all-time highs together.)

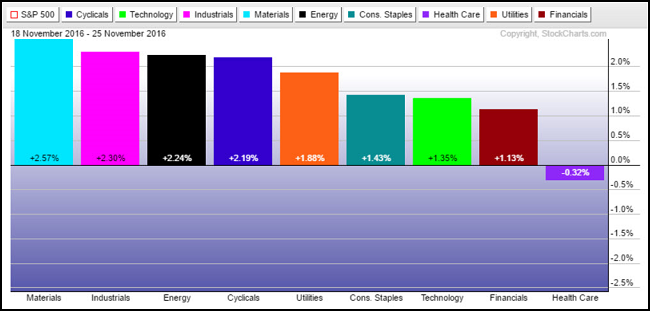

A quick glance at the short, Thanksgiving week performance shows you where the market continues to want to trend…

An all-time high breakout alert is near for the Materials sector (XLB) so let’s glance at the components…

Meanwhile, be extra giving to your friends who run healthcare funds this year…

If this new personal tax plan passes, the demand for buying homes, donating to charities and owning municipal bonds will fall…

Jared Dillian outlined the new personal tax return goals of the new administration over Thanksgiving. As you look through the simplified tax plan, how do you not see falling demand for housing, giving to charities and owning municipal bonds? Lifting the standard deduction to $30,000 is going to tear individuals away from using the itemized deduction worksheet. So significantly reduced demand for boosting itemized deductions for all Americans unless you are earning at the top income slice. This tax plan will cause big shifts. Plan ahead.

Here is the tax plan, in a nutshell (I hate that phrase):

3 brackets:

Less than $75K: 12%

$75K – $225K: 25%

More than $225K: 33%

3.8% surtax on investment income: gone

Capital gains stay at 20%

But here is the kicker: The standard deduction (for married filing jointly) goes from $12,600 to $30,000.

Talk about a monkey wrench—with the standard deduction at $30K, how many people do you think are going to itemize deductions?

Quote of the week…

“Coastal mortgages are growing into as big a bubble as the housing market of 2007,” said Philip Stoddard, the mayor of South Miami. But this time, he said, there will not be a rebound because the waters will not recede and properties will eventually lose all of their value.

(NY Times)

Finally, great news for half the feet in the developed world…

If we’re to take Victoria Beckham’s word as gospel (as we should), women will pitch their sky-high stilettos once and for all. The style legend famously ditched her Christian Louboutins this year for comfy sneakers, and women will follow in her newly cushioned footsteps. Increasingly health-conscious consumers now see high heels—once the epitome of elegance—as an unnecessary bodily risk.

(Fortune)

Copyright © 361 Capital