by Frank Holmes, CEO, CIO, U.S. Global Investors

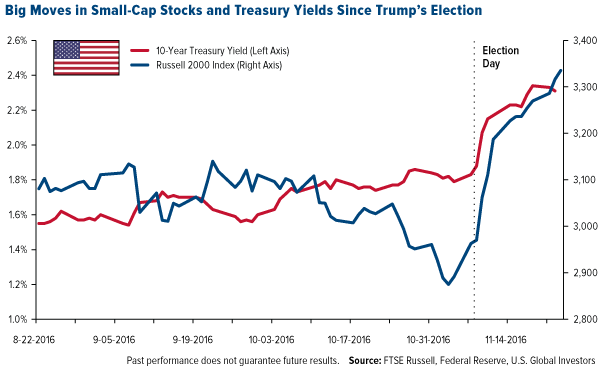

In a Frank Talk this week, I discussed the surge in small-cap stocks since Donald Trump’s election. A bet on smaller domestic stocks, I wrote, is a bet that Trump will deliver on his promise to “make America great again.” He plans to lower taxes, streamline regulations and spend big on infrastructure—all of which has led to a rally in the small-cap Russell 2000 Index and the 10-Year Treasury yield.

The ramifications of government policy change under Trump, especially fiscal policy, have the potential to be huge. Since Election Day, we’ve seen the strong U.S. dollar hurt gold, while the Canadian dollar and Chinese renminbi have dropped.

The question now is whether Federal Reserve Chair Janet Yellen will put the brakes on the so-called Trump rally. She asserts that Fed policy is not politically motivated, but I wonder how many people actually believe that. She’s already criticized Trump’s plans to tear up or at least significantly weaken Dodd-Frank Wall Street Reform.

Both former Fed Chair Alan Greenspan and billionaire investor Warren Buffett have recently suggested Dodd-Frank needs to go, with Greenspan telling CNBC that he’d love to see the 2010 law “disappear.” Buffett, meanwhile, commented in an interview this month that the U.S. is “less well equipped to handle a financial crisis today than we were in 2008. Dodd-Frank has taken away the Federal Reserve’s ability to act in a crisis.”

|

Since the election, banks have seen strong inflows, as investors are betting that the financial industry could be one of the largest beneficiaries of Trump’s administration.

According to Evercore ISI analyst Glenn Schorr, “Animal spirits and higher confidence have returned, and investors are now expecting a better revenue, expense, tax, capital and regulatory profile for financials.” In addition, “we might have just flipped from feeling pretty late cycle right back to early cycle depending on how much we want to buy into Trump’s pro-growth agenda.”

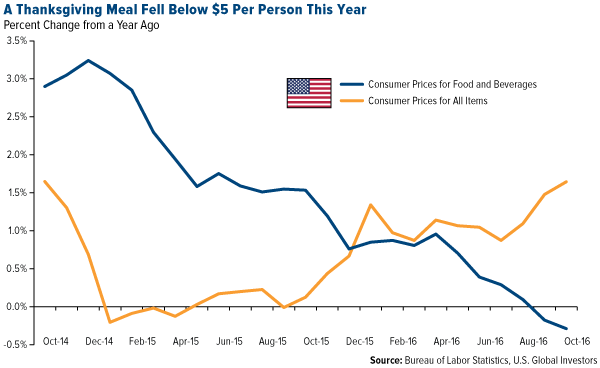

Americans Take Advantage of Low Inflation

Last year, lower gas prices helped American households save $700 on average. Although savings aren’t likely to be as much this year, Americans managed to save in other ways—namely, food and beverages.

According to the American Farm Bureau Federation (AFBF), the cost of a typical Thanksgiving meal for 10—consisting of a turkey, stuffing, sweet potatoes, cranberries, a pumpkin pie and other traditional sides—fell 24 cents from last year’s average to $49.87. That translates to a per-person cost of just under $5, confirming that “U.S. consumers benefit from an abundant high-quality and affordable food supply,” says AFBF Director of Market Intelligence Dr. John Newton.

As I’ve said multiple times before, the U.S. shale oil boom helped deliver an “oil peace dividend” to the world, which drove transportation costs and, therefore, food and beverage costs down over the past two years.

Low fuel costs have also encouraged a huge number of families to hit the highway this Thanksgiving weekend. According to AAA, roughly 50 million people—about 1 million more than last year—will journey 50 or more miles from their homes, the most since 2007.

With gas prices at the second lowest in a decade, driving remains the most popular mode of transportation. But as I shared with you last week, flying has also become more and more affordable for many Americans. This week, an estimated 27 million passengers flew on U.S. airlines, an increase of 2.5 percent over last year.

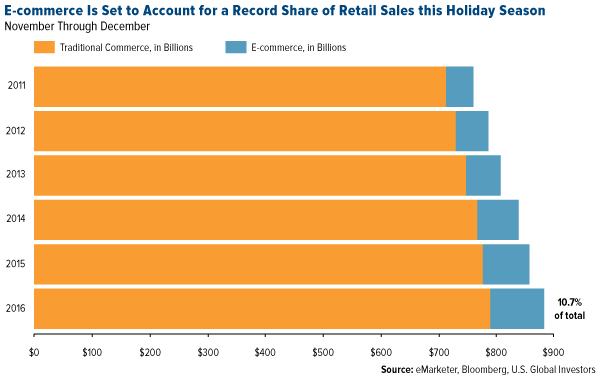

Black Friday Is the New Cyber Monday

It isn’t just travel that’s back to pre-recession levels. This year, it appears more Americans than ever before—enjoying low inflation and rising wages—will be spending their savings on gifts for friends and family, if estimates from the National Retail Federation (NRF) are accurate.

According to the retail trade association, as many as 137.4 million consumers plan to shop this Thanksgiving weekend, up a whopping 60 percent from last year’s 135.8 million people. This includes both in-store shopping as well as online shopping, which, as you might have noticed, is becoming a huge deal.

Black Friday remains the busiest shopping day, with 74 percent of consumers telling the NRF they plan to venture out into the crowds to take advantage of gotta-have-it bargains.

But e-commerce is quickly catching up, with the internet-only Cyber Monday second in sales to Black Friday. For the first time this holiday season, online purchases are expected to account for more than 10 percent of all retail sales, according to consumer research firm eMarketer. “Online sales,” reports Bloomberg, “are likely to climb to $94.7 billion, representing almost 11 percent of total sales in November and December, an all-time high.”

The growing popularity of online shopping has prompted more and more brick-and-mortar retailers to push their e-commerce sales earlier to Black Friday and even Thanksgiving Day. In years past, retailers waited until Cyber Monday to post digital discounts, but today they risk losing market share among shoppers who increasingly prefer making purchases off their laptop and smartphone.

One of these retailers is Walmart, which will start offering online sales two days in advance, in a bid to stay ahead of competitor Amazon. In a press release, the Arkansas-based behemoth announced it has tripled its assortment of online products, from 8 million last year to more than 23 million today.

Another Record Year for Packages Delivered

The rise in e-commerce has had the inevitable effect of giving more business to ground and air delivery companies such as FedEx and United Parcel Service (UPS). It’s expected that, with online sales jumping 17 percent this year, the number of packages handled and shipped will jump to a record high.

According to Business Insider, UPS—the world’s largest delivery company—projects it will ship a record-setting 700 million packages between Thanksgiving and Christmas, or 70 million more than the same time last year. FedEx hopes it can ship 10 percent more than the 325 million it delivered last year.

Meanwhile, Amazon’s plans to establish its own in-house transportation network have hit a setback. About 250 pilots contracted with Amazon partners Air Transport Service Group and Atlas Air Worldwide Holdings went on strike Tuesday over a “longstanding labor dispute.” The Jeff Bezos-run retailer has been determined to deliver its own products after bad weather in 2013 delayed millions of Christmas deliveries, but it appears these efforts are off to a rough start.

Wishing You Health, Wealth and Happiness!

I wish to conclude by giving thanks to our loyal Investor Alert readers as well as investors. Visit us on Facebook or Twitter and let us know what you’re thankful for this season!

Copyright © U.S. Global Investors