by Blaine Rollins, CFA, 361 Capital

In a surprise to every investor, we have been presented with an entire new set of tea leaves to look at. A more predictable, low economic growth set of data has been replaced with a less certain, aggressive set of numbers. Whether you believe that the new scenario will work out doesn’t matter to the markets. A Hillary/Gridlock government was so heavily bet that the markets will now have to adjust to the RRR that just won Washington D.C for the next 4 or 8 years. If the Congressional fiscal hawks allow it to happen, it will be easy to cut taxes and ramp spending for the next few years. Of course at some point, you need to pay your credit cards back and the markets will need a good sign of that before the 2020 Presidential election.

For investors who had their bets on bonds, equity income proxies, technology and international stocks, the ground just shook. If GDP growth does accelerate anywhere close to the 4% that is being promised, then the well-positioned portfolio of yesterday could be toast. Even passive investors could get left behind by their major indexes which are now historically overweighted toward Tech and Healthcare and underweighted in Financials, Industrials and Materials. The global bond markets are very big in size and they are scared. The move last week is trying to suggest that this has been a very good 34-year run. If 4% GDP growth in the U.S. occurs, and maybe pulls some of the rest of the world with it, then you will have seen the end of negative interest rates.

If you are a portfolio manager or investment advisor, now is the time to put the personal politics aside and remain very flexible in your thinking toward capturing some of the potential new investment opportunities that are being placed in front of you. Many of the industries and stocks that could benefit from a U.S. growth ramp are ones that have underperformed for several years. Think financials and other cyclical industries and sub-sectors. And many names that you look to buy will look expensive, but remember that is only because the analysts have yet to factor in the new economic growth and incremental margins into their earnings. At the same time, many great names and industries will be used as a source of cash. You will scratch your heads as to why that great tech or staples stock, with consistently rising earnings, goes lower in price each week. Multiple compression can be painful as investors run to better opportunities.

Of course this shift towards a potentially higher GDP growth rate will not be a smooth path. There will pitfalls and poisoned darts at every turn which will cause an increase in volatility. Congressional approval of the spending and tax cuts, trade tariffs and their effect on U.S. jobs and supply chains, changes in Obamacare, Dodd-Frank and Immigration policies can move the market with every headline. So, you should have plenty of opportunities to buy your new positions on dips and sell your old holdings on rips. If you like dynamic markets and change, then you picked a great year to manage money. Now if we only knew for certain what the capital gains tax rate was going to be in 2016 and 2017?

If you want to dig into the specific policy goals of the Trump Transition Team, here is the website…

The easiest way to navigate the website is to scroll down to the bottom and then click on the specific policy area.

The President Elect/Making America Great Again

A short cut to the immediate spending and jobs impact is outlined here by J.P. Morgan…

The Financial Times outlined the same plan numerically…

According to Michael Feroli at J.P. Morgan, the full adoption of the Trump campaign package would involve tax cuts (mainly on households at the upper end of the income scale, and on corporations) worth $500bn per annum along with extra infrastructure and defense spending equal to about $150bn a year.

The Keynesian multiplier applied to the tax cuts may not be much more than 0.7 for households and 0.2 for corporations, but infrastructure spending may have a multiplier of 1.0 or more, so the entire programme could add about 2 per cent to the level of US GDP by 2018. This implies about 1 per cent per annum on the growth rate.

Food for thought from Eric Peters…

Nightmares: “I went to sleep with a Clinton/Yellen portfolio and woke up in Trump world,” said the CIO, commiserating, in good company. No one in finance envisioned a Trump victory. Which meant we remained positioned for the status quo; modest global growth, low inflation, ultra-loose monetary policy, and bond yields artificially suppressed by central bank buying. “When you considered his populist promises, combined with a Republican House and Senate for the first time since 1928, there was just one thing to do – get the hell out.”

100 Days: “Seventy percent of all new legislation for any administration throughout American history comes in the first 100 days in office,” he said. “So it’s all happening now,” he continued. “Run the numbers on this thing; $9trln of stimulus over 10yrs.” US GDP is $18trln. So $900bln per year is 5% of GDP. “Even if he does half of what he’s promised, it’s embarrassingly large.” Reagan’s stimulus wasn’t half this big. And he had to raise taxes 2yrs after cutting them because the deficits were too large. “No one has ever seen anything like this.”

(Eric Peters/Wknd Notes)

The election was a complete portfolio changer for Stan Druckenmiller…

Stan Druckenmiller appeared on CNBC today to give his thoughts on the markets and election.

He noted that after the election a lot of regulation will be taken out of the system which should help get things going. Other changes like tax reform, especially reducing the corporate tax rate encouraged him as he was “quite optimistic” on the economy.

Druckenmiller said that, “I have a large bet on economic growth … I’m short bonds globally … I’m short bunds, I’m short Italian bonds, I’m short US bonds. I like sectors of the equity market that respond to growth, value, and materials, not things like staples and traditional growth stocks.”

He also added he likes the US dollar, with an emphasis against the euro. And he has dumped his gold long (he sold during the night of the election). He noted the reasons he previously owned it for ‘might be ending.’

Druckenmiller also added, “If it wasn’t for the messy conflict of rates rising with the stronger economic growth through fiscal policy, I would think there’s so much low hanging fruit in terms of deregulation and tax reform, we could get a jolt of 4 percent growth for about 18 months.”…

“Dr. Copper: have you seem him lately? It’s been rising. Interest rates have been at stupid levels, they’ve been held down… they’re like beach balls under water.”

The hot hand at J.P. Morgan also believes the election was a game changer and could add meaningfully to S&P 500 price targets…

“Expectations of decreased regulation, favorable tax reform, increased fiscal spending and less congressional gridlock should drive stronger revenue growth and higher net income margins. Further, the removal of election uncertainty and some form of cash repatriation should result in increased investment activity.”

Lakos-Bujas cited how a reduction in the corporate tax rate to 15 percent or 20 percent versus the current effective rate of about 25 percent could add $10 to $15 in earnings per share to the S&P 500. As a result, he predicts the benchmark will rally to 2,300 “by early next year,” representing 6 percent upside from Wednesday’s close.

“Trump administration reinforces the reflation trade that started post-Brexit. We expect reflation to support rotation from Low Vol stocks, the largest beneficiaries of falling yields in this cycle, into value and growth stocks,” he wrote.

(CNBC)

Gundlach first called the election correctly. Now he sees interest rates headed much higher…

Trump’s pro-business agenda is inherently “unfriendly” to bonds, Gundlach says, as it could to lead to stronger economic growth and renewed inflation. Gundlach expects President-elect Trump to “amp up the deficit” to pay for infrastructure projects and other programs. That could produce an inflation rate of 3% and nominal growth of 4% to 6% in gross domestic product. “If nominal GDP pushes toward 4%, 5%, or even 6%, there is no way you are going to get bond yields to stay below 2%,” he says.

The yield on the benchmark 10-year Treasury bond rose 0.27 percentage point in the two trading days following the election, to end the week at 2.15%.

(Barron’s)

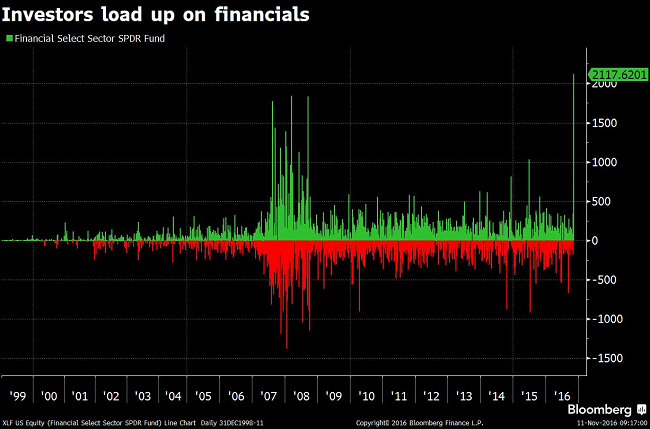

So the immediate winner last week were banking and financial stocks…

With rising rates, a steeper yield curve, potentially increasing loan growth and falling regulatory costs, this was the easiest move to make. And investors did not waste time according to XLF inflows.

But don’t think that the one-week move has captured all the upside…

Financial stocks have basically underperformed for 10 years and have fallen from 20% of the S&P 500 to 13-14%. This could be only the first inning if U.S. GDP growth starts heading upward.

A look toward other sectors or factors that made new all-time or 52-week highs last week…

Again, given the multi-year underperformance of many of these areas of the market, I am willing to bet that the new environment should allow these groups to continue in their gains.

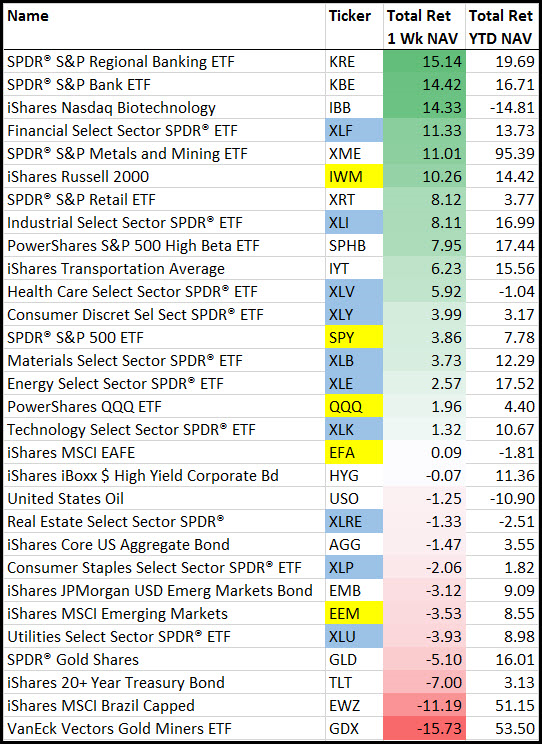

A glance at the week will show you the winners and losers for the Trump victory week…

(Priced 11/11/16)

Why are small cap stocks outperforming?

Small caps are less affected by higher interest rates and a stronger U.S. dollar. They also win more than large caps from lower corporate tax rates because they don’t employ the 100-person tax departments used to hide and shield taxes. As this chart shows, small caps tend to leg higher when both rates and the dollar move higher.

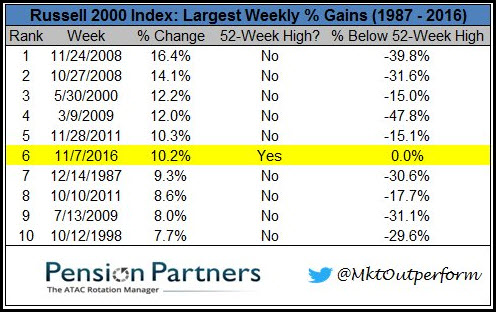

More on small caps. Very surprising to see such a large gain in an index occur at the highs. Another reason to think that this move could be sustainable…

@MktOutperform: Russell 2000: largest weekly % gain in history that coincided with a weekly close at a 52-week high. $RUT

@MktOutperform: Highly unusual. Largest % gains tend to occur during/after bear markets in higher vol regimes: 1987, 1998, 2000, 2008/09, 2011.

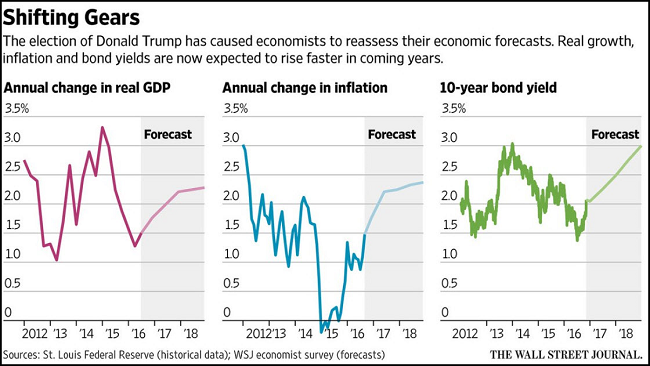

The Wall Street Journal was able to poll economists after the election. No surprise that Trump is viewed as reflationary given his policy goals.

(WSJ)

So how high will bond yields go? This simple regression confirms that yields have an easy double in them from today’s level and this is before ramping U.S. GDP…

@jsblokland: #Yields elevated? If things would return to ‘normal’ the US 10-year Treasury would double!

But don’t ever forget the 34-year run in the Bond Market. Negative interest rates across Europe was just icing on the cake…

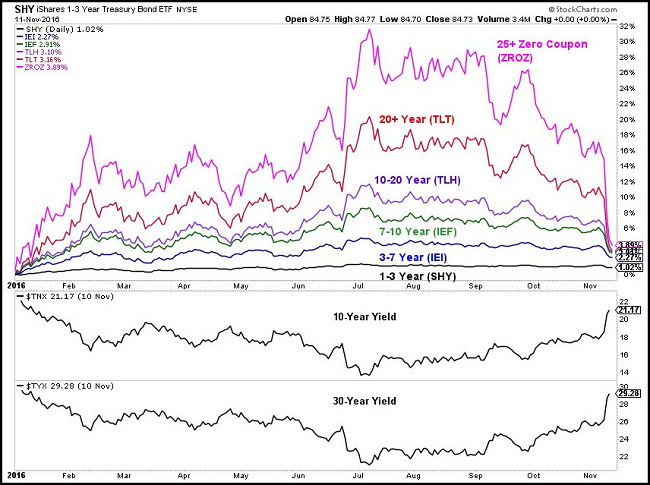

And 2016 bond returns have now fallen to their coupon level…

@MktOutperform:

Treasury ETFs, Total Return YTD…

1-3 Yr: +1%

3-7 Yr: +2.2%

7-10 Yr: +2.9%

10-20 Yr: +3.1%

20+ Yr: +3.1%

25+ Zero: +3.9%

But what about the outlook for credit? J.P. Morgan has that thought covered for you…

The election outcome is positive for USD credit, negative for EM debt, in our view. US HG spreads should tighten further on higher all-in yields attracting demand from overseas investors and pension/insurance companies, and lower bond supply driven by anticipated tax repatriation of foreign cash and potentially greater scrutiny on large M&A deals. Uncertainty on US-EM trade relations poses most risk to EM economies in the near term, with many highly exposed to US exports.

(JP Morgan)

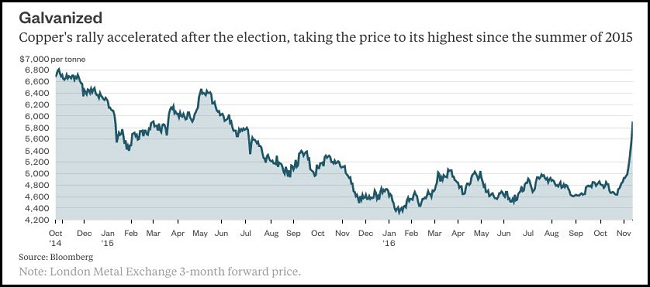

As interest rates soar, it is only natural for the prices of base metals to run with them. Here is copper…

But as the article notes, a lift in U.S. GDP growth cannot solely sustain copper and other metal prices. Copper demand from China is 6 times great than that of the U.S. So you need to hope that the U.S. can pull along the rest of the world to keep the rally running.

It was industrial and materials-centric states that won the election for Trump. They will want a payback in the form of trade protectionism and tariffs…

In this election, the decisive factor—the one that actually was the difference between a Trump victory and a narrow Hillary Clinton one—was the surprising outcome in the old industrial states of the upper Midwest: Pennsylvania, Ohio, Michigan and Wisconsin. Wisconsin hasn’t gone Republican since 1984; Pennsylvania and Michigan since 1988; Ohio since 2004.

Mr. Trump won them all, now that his razor-thin margin in Michigan appears to have been confirmed. It’s in this spot on the map that the much-discussed Democratic “blue wall” of states that have long provided protection for Democrats was breached.

And that it was breached in states where damage and job loss suffered in the manufacturing sector—by foreign competition and trade pressures, as well as other factors—is a more obvious voter concern than is immigration.

(WSJ)

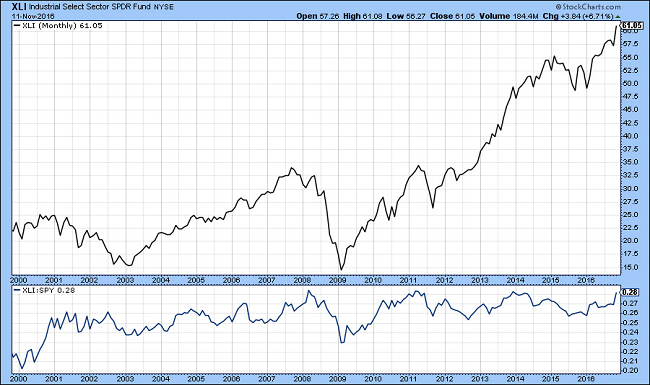

Industrial stocks have not outperformed for 15 years. Could this change with a GDP growth ramp?

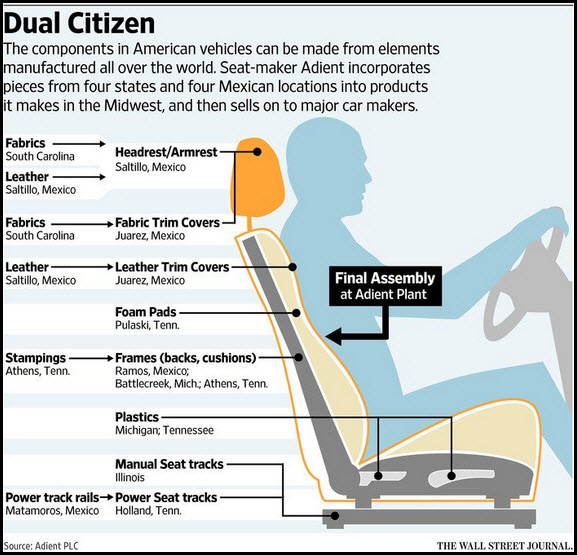

An industrial resurgence will not be a straight line. Major industrial supply chains are now global. An end to trade deals and increased tariffs and quotas will likely lead to disruptions in all major product lines. Questions for your analysts surround finding the winners and losers. U.S.-centric small caps are in a much better position than Ford, Boeing and Apple.

Ending the 1994 trade pact is relatively easy. The U.S. legally can pull out of Nafta six months after Mr. Trump as president notifies Mexico and Canada of his intention to do so, according to a September study by the Peterson Institute for International Economics in Washington. Imposing tariffs on imports lies within the authority of U.S. presidents.

For the auto industry, as Mr. Fledderman’s business shows, such a change would be substantially more complicated, because of the multilayered connections between U.S. and foreign suppliers and assembly points. The tens of thousands of parts that make up any vehicle often come from multiple producers in different countries and travel back and forth across borders several times.

This is a tenet of modern manufacturing: Where a product is ultimately assembled increasingly has little bearing on where its component parts are made.

(WSJ)

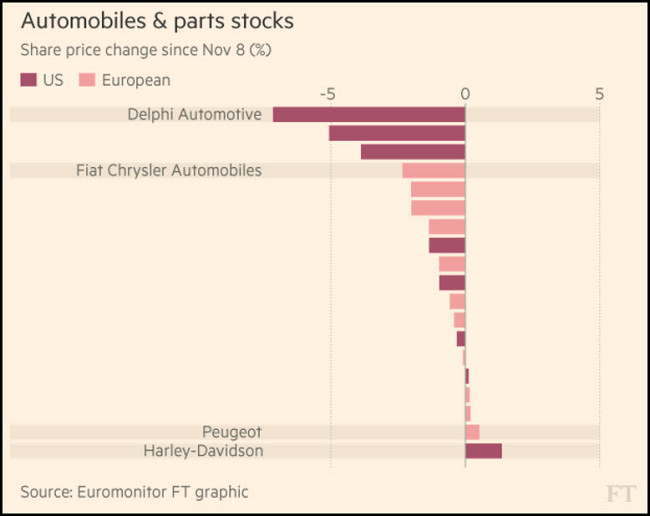

Speaking of Ford, the global automotive manufacturers and suppliers were not happy with the election results last week…

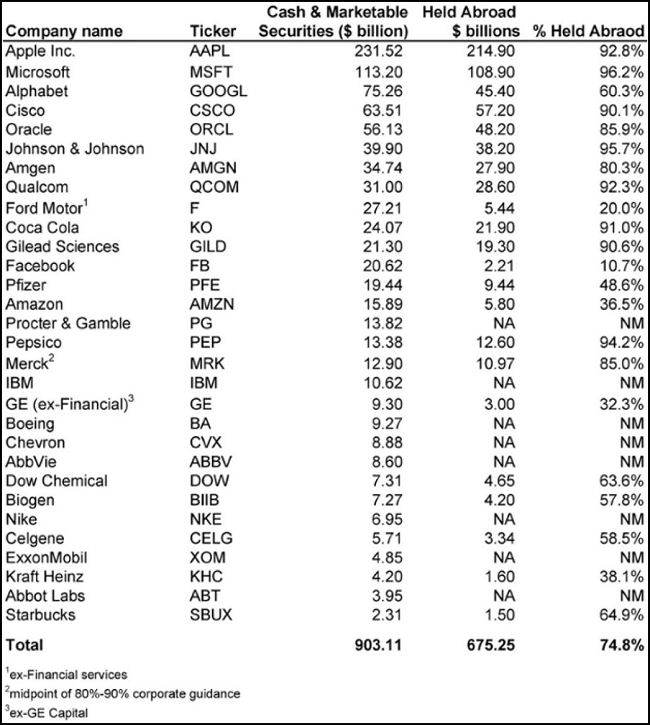

A layup move for Congress and the White House will be to bring the $1 trillion in cash home to the U.S. by creating a tax holiday or change to the taxes on repatriation…

THE BIGGER PAYOFF for the techs would be a repatriation of their enormous cash piles. Goldman estimated that if something like Trump’s proposed 10% tax rate on cash brought back from overseas were passed, it could result in $500 billion of cash brought to the U.S. Following a tax holiday in 2004, companies plowed this money into buybacks, and Goldman expects that would be the case again.

Morgan Stanley ’s Katy Huberty, who follows hardware makers such as Apple, expects repatriation to be the bigger boost. Last week she wrote Apple will be the biggest beneficiary, with 37% of its market value, $216 billion, in cash overseas. If it moves all that to the U.S., she estimates it would save $54 billon in taxes. That money could be used to boost shareholder payouts or for a “sizable acquisition,” and Huberty opined it would “remove an overhang to the stock that has been in place for many years.”

(Barron’s)

(@PlanMaestro)

Individual investors have had their heads in the sand for two years. Not any more…

(@bespokeinvest)

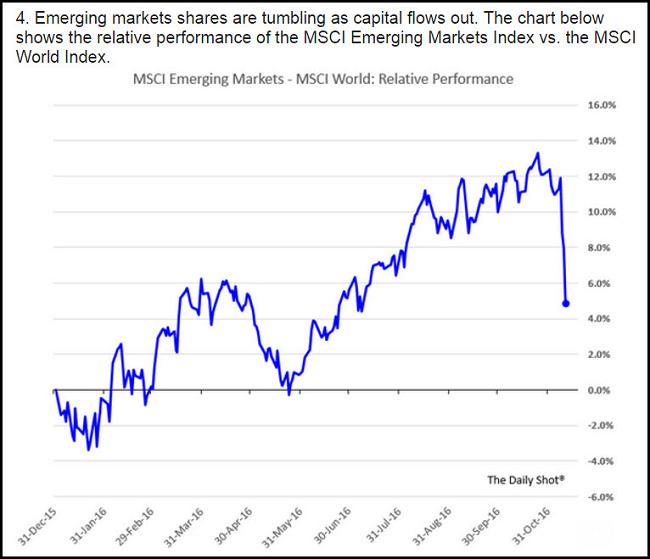

Lastly on the markets, I do not have an answer for emerging market equities…

I thought that they were lined up to benefit from low valuations and recovering earnings. But until we know the impact of Trump’s new trade and immigration policies, all bets are off which is what the market told you last week.

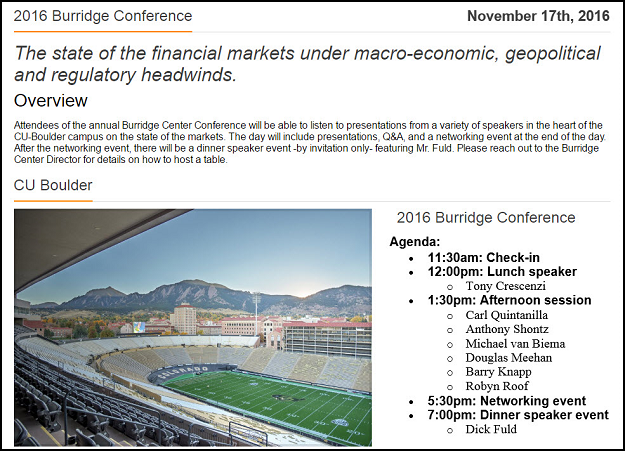

Finally, one last time. The Burridge Conference has a great lineup of speakers this week…

Come out to Boulder for the 2016 conference, where you can listen to experts in the financial markets, earn continuing education credits and enjoy lunch and a networking event in a fantastic venue.

Copyright © 361 Capital