by Adam Butler, GestaltU

Benjamin Graham famously said that “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” But this is not quite correct. Rather, in the short term, the market is a machine where investors “vote” about what the market will “weigh” in the future. Of course, when Benjamin Graham referred to “weighing,” he was actually referring to how investors “value” an asset.

The goal of this article is to summarize the complex dynamics that drive asset returns. You’ll discover that asset returns are impacted by four sources of risk. Two of these risks affect all assets in the same way, and therefore are undiversifiable. The other two risks impact different kinds of assets in different ways. Since some assets respond positively to changes in these risks while others react negatively, these latter two risks can be diversified away. In other words, investors who take an informed view of diversification can almost eliminate fully half of the sources of risk in their portfolio.

Prices always reflect investor expectations

Before investigating the four sources of risk, it’s important to understand that markets are constantly adjusting prices to reflect investor expectations about the future. As a result, meaningful changes in prices will only occur if investors receive new information that is inconsistent with current expectations. When this happens, investors experience a shock, which causes them to adjust the price of assets higher or lower to reflect this new reality.

To make this concept more concrete, imagine that investors are currently expecting a poor environment for a certain asset. To reflect these pessimistic expectations, investors will have acted accordingly to lower the price of the asset. If the future environment is unfavorable for the asset, the price of the asset should not change. That’s because investors have already priced the asset appropriately for an unfavorable future. The price of the asset will only be reset higher or lower if investors receive new information that causes a meaningful change in expectations.

To summarize this critical point, asset prices do not change in response to favorable or unfavorable environments. Rather, asset prices reflect investors’ current expectations about a favorable or unfavorable environment. Prices will only experience meaningful change if investors receive new information that represents a shock to their current expectations.

Asset classes

Asset classes refer to the broadest categories of financial assets. Few investors think about investing from this perspective, but in fact most of the important things that happen in markets are driven by what happens at the asset class level.

When we refer to asset classes, we are talking about global stocks, bonds, currencies, commodities, inflation protected securities, and traded real-estate. These asset class categories have very different underlying mechanics, which cause them to react in different directions to certain types of shocks. In other words, a given shock may cause stocks to be repriced in one direction while bonds are repriced in the opposite direction.

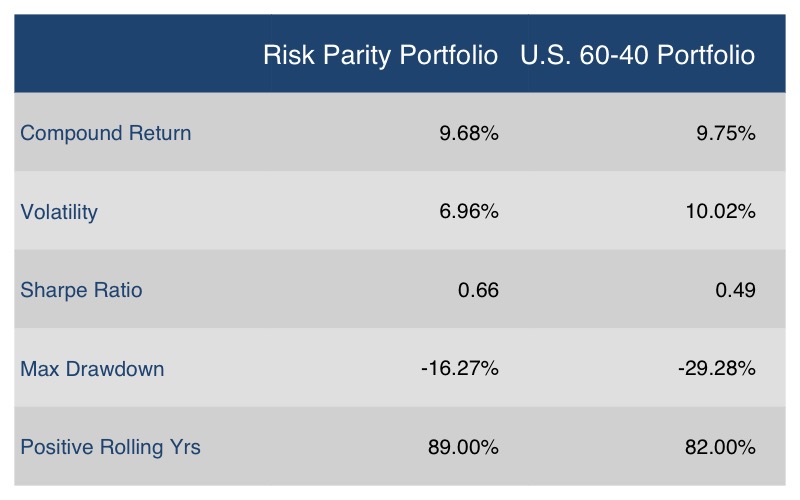

In some cases, stocks and bonds in different regions of the world will also react to shocks in different directions for intuitive fundamental reasons. For example, some regions are primarily exporters while others are primarily importers. Some regions produce a surplus of commodities, while other economies produce few commodities. As a result, it is sometimes useful to divide global stocks and bonds into regional baskets to capture this diversity. Figure 1. below describes the major asset classes that matter to this discussion.

Figure 1. Asset class behavior in different inflation and growth environments

Source: ReSolve Asset Management

There are other ways to segment stock and bond markets, such as by industry sector or credit rating. While these categories are useful for certain investment activities, they are not meaningful distinctions in the context we will discuss here. At root, stocks of all industries within a given regional economy will react in the same direction to the same fundamental shocks. For this reason, thinking about asset classes in terms of sectors adds little incremental value in terms of diversity.

A Fundamental Pricing Model

All things equal, investors prefer to hold cash because it is available for immediate consumption. Most investors don’t hold cash on hand directly, but rather hold their savings in bank accounts. Larger investors hold cash in Treasury bills. As a result, cash actually earns a small return. As Treasury bills mature, they are rolled over at different rates. Savers have a good sense of what cash will earn at each point in the future by observing the yield curve, which signals investors’ expectations about future cash rates.

Why would an investor abandon a safe cash investment, which can be used for guaranteed consumption at any time, for a risky investment which may produce an uncertain amount of consumption in the future? The answer is that in return for accepting the risk of uncertain future consumption, including the possibility of loss in the short term, investors expect to produce higher returns to fund a larger amount of consumption in the long-term. But how do investors decide how much cash they should pay today for the opportunity for higher future consumption?

Perhaps the most fundamental principle in finance is that the value of an asset today is the sum of all the future cash flows that we expect the asset to produce in the future. For most assets, these cash flows are distributed in two forms: dividends or interest payments, which are made at regular intervals, and; the cash we expect to receive on the sale (or maturity) of the asset.

In order to entice an investor out of cash and into an investment, the investor must believe its future cash-flows will be larger than what he would otherwise earn on cash invested in Treasury bills. Each future cash flow on the investment is compared against the expected return on cash, which is forecast by the yield curve. So as a useful simplification, investors actually price an investment as the sum of its future cash-flows in excess of what they would otherwise earn on cash.

For practical purposes, the asset classes in Figure 1. can be divided into three fundamental groups. Stock-like assets, which include all global equity markets and real estate, have highly variable cash-flows. Bond-like assets, including inflation protected securities, have guaranteed cash-flows. The third category consists of assets with no cash-flows, such as commodities and gold. The nature of an asset’s cash-flows will dictate how it should react to different types of shocks.

With these simple concepts in mind, let’s turn our attention to how the four risks described above impact the price of investments by shocking investors’ expectations about future cash flows from investments versus future returns on cash itself. Importantly, the framework below ignores complex feedback dynamics that cause some types of risk to impact other types of risk. For simplicity, we also discuss risks as primarily affecting certain asset classes. While the forces we describe below are important drivers of asset returns, it is easier to understand the four types of risks in isolation. We spend some time at the end of this article describing their interactions.

Diversifiable Risk #1: Growth Risk

The prices of stock-like investments are primarily influenced by investors’ expectations about the size and timing of future cash-flows. Cash-flows from stocks are produced from corporate earnings. All things equal, when sales growth is strong, earnings growth is strong. In aggregate, corporate revenues are ultimately driven by economic growth. When economic growth exceeds expectations, revenues also exceed expectations, and this results in better-than-expected corporate cash-flows. When economic growth is weak, this dynamic flows in reverse, resulting in lower than expected cash-flows.

Stock prices are thus very sensitive to expectations about future economic growth. If a series of new data points leads investors to increase expectations about future economic growth, investors are likely to increase their expectations about future cash-flows. This should result in higher stock prices. On the other hand, where investors observe a series of underwhelming economic data, they will reduce their expectations about future cash flows, and price stocks lower.

Diversifiable Risk #2: Inflation Risk

The prices of bond-like investments, and hard assets like commodities and gold, are primarily impacted by changes in inflation expectations. Inflation impacts the cost of future consumption. If inflation is expected to be high, investors expect that they will have to pay much more in the future for important goods and services. That is, the price of consumption is expected to rise. If inflation is expected to be low, investors expect that the price of consumption is expected to remain relatively stable. Sometimes, investors expect negative inflation – deflation – in which case they expect prices in the future to fall.

Inflation affects the rate that investors require to hold cash rather than consume. If investors believe that prices will be much higher in the future, they have high incentives to consume today. As a result, they require a higher return on cash to offset their rational desire for immediate consumption. This higher return on cash will be reflected at each future point on the yield curve. In other words, all things equal high inflation means high interest rates. The opposite is also true: low inflation expectations typically result in low interest rates.

Recall however that asset prices do not change because of investor expectations. Prices at all times are consistent with investor expectations. Rather, asset prices change because of unexpected shifts in investor expectations that occur as a result of new information.

Bonds and hard assets would be expected to react in opposite ways to changes in inflation expectations. When a bond is issued, its interest payments are fixed at the rates that prevailed at the time. The size of these interest payments are known in advance, and do not change over the life of the bond. The price of a bond is simply the sum of its future interest payments, in excess of what an investor would expect to earn on cash over the same period.

When fixed interest payments on a bond are exactly in line with what an investor would expect to earn on cash over the same investment period, the bond trades at ‘par’. (We will, for now, ignore the fact that bond investors also require a premium return because they must either lock-up their savings for several years, or accept the possibility of having to sell the bond before it matures at a lower price). Now imagine that there is an upside inflation shock, such that investors become more concerned about higher costs of consumption in the future. Investors feel pressure to consume now rather than later, so holding onto cash becomes less attractive. As a result, higher yields on cash are required at each point in the future to entice savers to remain in cash.

Now the fixed interest payments on the bond are below what an investor could expect to earn on their cash over the same horizon. An investor would no longer be willing to price the bond at par. Rather, investors would only be willing to purchase the bond at a lower price, so that their expected return on the bond (relative to the price they pay) is once again attractive relative to the choice of holding cash.

In this way, the price of bonds is directly impacted by inflation shocks in either direction. Upside inflation shocks cause interest rates to rise, which makes the fixed interest payments on existing bonds less attractive, causing bond prices to fall. Downside inflation shocks cause future interest rates to fall, which makes the fixed interest payments on bonds relatively more attractive, pushing bond prices higher.

Bonds react positively to negative inflation shocks, but fall on rough times in periods of unexpectedly high inflation. Which prompts the question, what assets should offer protection against upside inflation shocks?

By their fundamental nature, inflation protected bonds, commodities and gold should produce strong returns during periods of unexpectedly high inflation. For this reason, they perform an important duty in portfolios, acting as ballast to falling bond prices in the event of upside inflation shocks. To understand why, and when each of these asset classes might be expected to flourish, we need to understand the three fundamental causes of inflation.

Inflation can be caused by a demand shock, a supply shock, or a monetary shock. A demand shock results when consumption growth is stronger than expected, and producers can’t keep up with demand, which causes the prices of goods and services to increase. This type of inflation is often broad-based, and directly impacts people’s daily consumption basket. This is picked up using measures of price increases such as the Consumer Price Index (CPI). Inflation protected bonds, such as Treasury Inflation Protected Securities are designed so that their interest payments are adjusted regularly to reflect changes in the CPI. As a result, this special type of bond becomes valuable during demand led inflation shocks, as investors seek ways to preserve their purchasing power.

A supply-led inflation shock occurs when a fundamental input to the economy – for example oil or iron ore – experiences an unexpected change in supply. For example, in the 1970s two Middle-Eastern conflicts – the Yom Kippur War in 1973, and the Iranian Revolution in 1979 – triggered interruptions in oil exports, causing major oil shortages in major industrial countries and triggering large increases in energy costs. On the other hand, rapid unexpected on-stream supply of unconventional petroleum in the United States as a result of ‘fracking’ technology may have contributed to the large drop in oil prices observed in 2014-2015. It’s clear that commodities do well during supply led inflation shocks.

Lastly, monetary inflation shocks occur because central banks of the world enact policies that have the goal of altering currency exchange rates. When a country’s currency exchange rate declines relative to other currencies, it costs that country more to import goods and services, while its exported goods and services get cheaper. When a country’s central bank acts to set exchange rates far below what might be warranted on the basis of economic competitiveness, investors may seek to preserve their global purchasing power by purchasing assets that are outside the reach of central banks. For several thousand years, gold has been a primary recipient of these capital flows. As a result, gold often does quite well during monetary led inflation shocks.

The Interplay Between Growth and Inflation

So far we have presented a framework where asset prices are impacted by unexpected shifts in expectations about either growth or inflation in isolation. We positioned stocks as being particularly sensitive to economic growth, while bonds and commodities are sensitive to inflation expectations. But in economics, few things happen in isolation.

The fact is, changes in expectations about growth are typically coincident with changes in expectations about inflation. Consider a situation where a confluence of unexpectedly negative economic data causes investors to reduce their expectations about future economic growth. Clearly this will impact expectations about corporate earnings, with predictable effects on stocks.

But lower growth rarely happens in isolation. Slower than expected growth means that there will not be as much demand for goods and services as companies were expecting. Companies may end up with a surplus of inventory, and have to lower prices to entice greater consumption. Lower than expected prices means a negative inflation shock. Lower than expected inflation means a downward revision to interest rates, which benefits bond prices.

On the other hand, lower growth may be the result of a large potential supply shock emanating from a primary economic input, such as a large spike in the prices of basic necessities like oil or food. The cost of basic necessities competes with discretionary consumption, so if consumers end up spending more at the gas station or the supermarket, they have less money left in their pocketbook for discretionary consumption. In this case, commodity prices (oil and food) will have been steadily rising as investors were adjusting stocks lower in anticipation of slower than expected economic growth.

You can see that changes in asset prices are driven by interactions between the forces of inflation and growth. Investors are constantly adjusting their expectations about these dynamics, and repricing asset prices accordingly. Moreover, each asset class responds in a predictable way to different combinations of shocks. But as we will now see, investors who are mindful of these relationships between asset pricing and economic shocks have the ability to diversify away the risks of potentially adverse economic outcomes.

Growth and Inflation Risks Can Be Diversified Away

Figure 1. above provides a theoretical framework for how a wide variety of assets should react to different types of economic shocks. You’ll note that stocks and bonds only really do well in certain economic environments. Specifically, portfolios of stocks and bonds thrive when growth is stronger than expected, and changes in inflation expectations are benign or decelerating.

Unfortunately, most investors’ portfolios are composed almost entirely of these two asset classes. Since the global economy can spend decades experiencing negative growth shocks and large inflation shocks in either direction, these traditional portfolios can struggle for long stretches of time during unfavorable regimes.

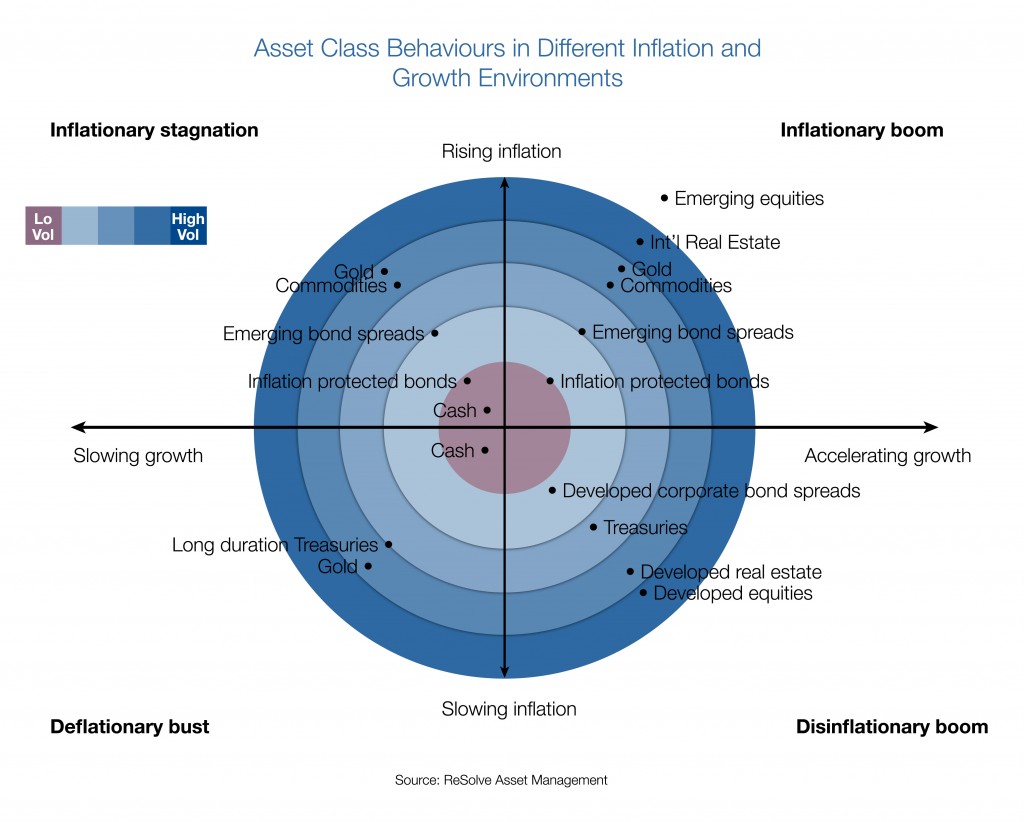

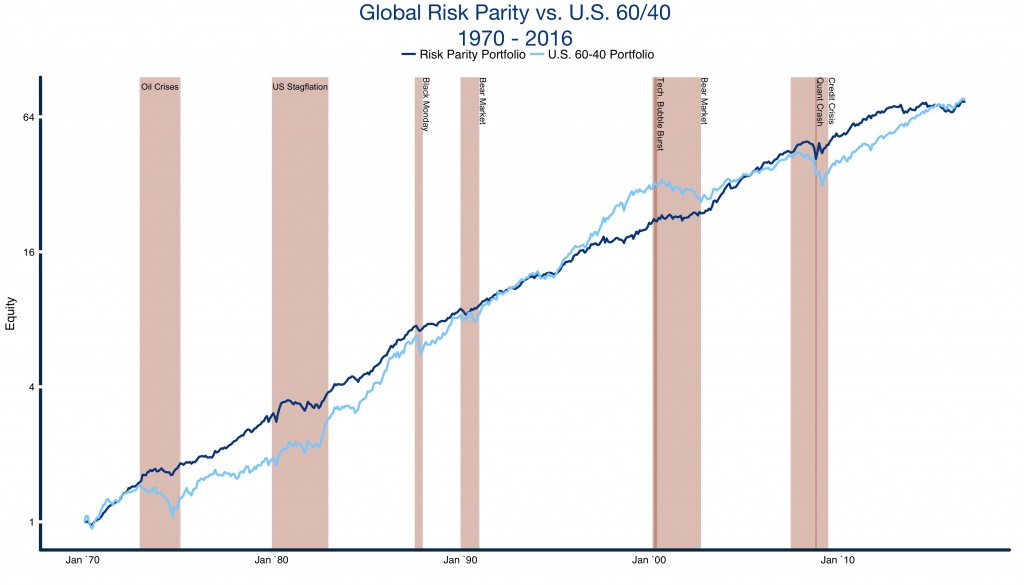

The following chart and table describe how a typical U.S. “balanced” portfolio (dark blue in the chart) consisting of 60% stocks and 40% intermediate Treasury bonds would have fared during major economic environments over the past half century. Pay special attention to the 1970s, where both stocks and bonds struggled under a stagflationary regime. Also note the extended periods of 20-30% losses, in some cases lasting several years, during the brutal bear markets of 1974, 1987, 2000 and 2008. These episodes are symptomatic of inadequate portfolio diversification.

Figure 2. Cumulative growth of U.S. 60/40 portfolio vs. Global Risk Parity portfolio across economic regimes.

Source: ReSolve Asset Management. Data from Global Financial Data. Simulated and hypothetical results. Please see disclaimer.

Sadly, investors in traditional portfolios of stocks and bonds endure unnecessary financial risk because they think too narrowly about diversification. Worse, this extra risk is not rewarded with excess returns, because it can be diversified away.

A truly diversified portfolio would hold assets that are designed to thrive in a wide variety of economic environments, such as the entire universe described in Figure 1. Of course, among these assets there are some that are quite volatile, and others that are much more stable. In order to maximize the diversification properties of all the assets, they must all contribute an equal amount of risk to the portfolio. This maximally diversified portfolio has a name: Global Risk Parity. Notice in Figure 2. how this diversified approach produces steady returns in virtually all market environments, with lower volatility, and relatively minor peak-to-trough losses (drawdowns).

It’s clear that shifts in inflation and growth expectations pose a meaningful risk to investors in any major asset class. Fortunately, it is possible to assemble a portfolio that neutralizes exposure to these risks. By expanding into assets that respond in predictably diverse ways to positive or negative shocks to growth and inflation expectations, and equalizing risk exposures, it is possible to manage economic uncertainty through diversification. In fact, this very concept is the primary feature of Global Risk Parity portfolios.

Undiversifiable risks

Undiversifiable Risk #1: Policy Risk

It is sometimes rational for investors to reprice assets even if there is no change in expectations about economic variables. In other words, assets can be repriced even if there is no change to investor expectations about growth or inflation.

Consider that a rational investor will only be enticed out of a safe cash position to invest in a risky asset, such as a stock or bond, if he expects to earn a higher return on that asset than he could earn from cash. Investors will pay a high premium for an asset when its expected return is substantially higher than that of cash over the term of the investment.

As a simplification, central banks are largely responsible for setting the return on cash. And through their communications, they not only set the expected returns on cash at the current moment, but they also can communicate their intentions about cash rates in the future. Sometimes – for example, when central bankers are concerned about the prospects of overheated inflation – they communicate that their intent is for cash rates to rise over the next few years. At other times, and for other reasons, they signal their intent for cash rates to go lower.

Consider a stock market index that is trading at $1000. Assume that at this price, the market is expected to produce a compound return of 7% over the next few years. Meanwhile, central banks have been communicating their intent for cash rates to remain below 5% for the foreseeable future. In this case, the current market price of $1000 is reflecting that, at equilibrium, investors are prepared to accept stock-market risk in return for at least a 2% premium return over cash.

Now imagine that the central bank signals that they are going to move their target for cash rates from 5% to 7% over the next few years. Critically, this move was not anticipated by the market. This may be because the possibility of a shift in policy was not well communicated by the central bank in previous announcements. Or perhaps the move is inconsistent with how the central bank has traditionally behaved in response to the type of economic conditions that currently prevail.

Whatever the reason, stock market investors are now faced with a very different economic equation. They can invest in risky stocks and expect to earn 7%, but with a chance of extreme losses in the short and intermediate term. Alternatively, they can invest in safe cash and expect to earn 7% with essentially no risk of loss.

Investors had previously signaled that they were willing to accept a 2% premium for investing in stocks over cash. Now they are faced with earning a 0% premium. The natural consequence is for investors to reprice the market lower so that, if investors were to purchase the market at the new lower price, they would expect to earn the same 2% excess return that they required before the rate shock. This might require that the market should be priced to $800, or $500.

This example highlights that unanticipated changes to expected future cash rates represents a very significant driver of asset class returns. Importantly, the market in the example above could be any market – stocks, bonds, REITs, etc., as all assets respond in the same way to this type of shock. This fact has profoundly important consequences. That’s because, since all risky assets respond in the same way to the same shock, this type of risk cannot be diversified away. In other words, all portfolios everywhere – no matter how diversified – will be impacted by this risk, and there is no costless way to hedge the risk away.

Undiversifiable Risk #2: Sentiment Risk

It is critical to understand that markets are nothing more than the collective expression of all investors’ fears and hopes at any particular time. Sometimes investors are optimistic and hopeful in aggregate, while at other times they are pessimistic and fearful. An investor who is fearful about economic uncertainty will require a larger potential return to entice them out of safe cash and into a risky investment. Greedy investors, on the other hand, will be willing to accept a high degree of risk for the chance to earn a small excess return.

This dynamic is complicated by the fact that investors’ feelings of hope and fear are to a very large extent informed by the market’s behavior itself. When the market rises, investors perceive that other investors are feeling more optimistic about the future, and this prompts feelings of optimism, greed and envy. Optimistic investors who are greedy for returns are more likely to move capital from cash into risky assets for the promise of greater returns. This in turn causes markets to rise further, bolstering aggregate confidence. When markets fall investors perceive that risks were larger than they thought, and this provokes feelings of pessimism and fear. Fearful investors are less likely to deploy cash assets into the market, and are more likely to move capital out of markets and into safe cash. This causes prices to fall, invoking more fear and commensurate selling.

A meaningful portion of changes in investor risk appetite stems from changes in expectations about growth and inflation. As a result, it is challenging to observe this type of risk in isolation. Moreover, when changes in risk appetite do manifest independent of genuine fundamental shifts in investor expectations about economic conditions, markets tend to normalize quickly. As a result, while this risk is real, and can’t effectively be diversified away, the practical effects of this risk are likely to be relatively small.

Setting Expectations

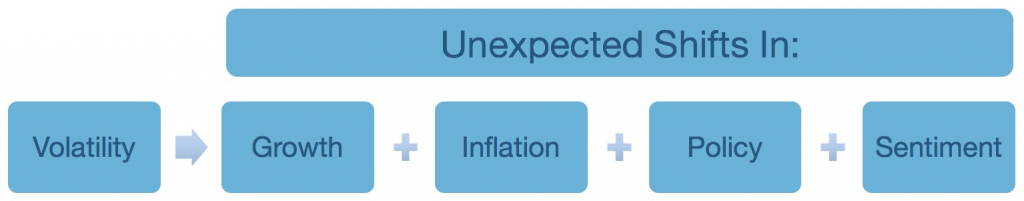

It is useful to decompose expected returns on risky assets into the returns that investors are guaranteed to receive on cash plus a premium that investors expect to receive for bearing market volatility. As we’ve seen, this volatility is derived from three fundamental sources, as illustrated in Figure 3.

Figure 3. Decomposition of Risk

Source: ReSolve Asset Management with reference to Balanced Asset Allocation by Alex Shahidi (Wiley, 2014)

What does this all mean for investors? First, investors in diversified portfolios should expect to be compensated for accepting the risk of unanticipated shifts in expectations about future cash rates. That’s because this risk affects all assets in the same direction, so it cannot be diversified away. Indeed, all investors everywhere are susceptible to this one source of risk.

Second, investors should not expect to be compensated for taking risks that can be easily neutralized through better diversification. For a humble investor with neutral views on the future, a diversified portfolio like Global Risk Parity almost always has a higher expected risk-adjusted return, with less exposure to major economic risks, than any other more concentrated portfolio.

Special thanks to Alex Shahidi whose book Balanced Asset Allocation does a superb job of articulating the concepts above. We would highly recommend the book to any investor seeking a better understanding of portfolio balance and risk parity.

Copyright © GestaltU