What do you see...

by Blaine Rollins, CFA, 361 Capital

Here is what I see:

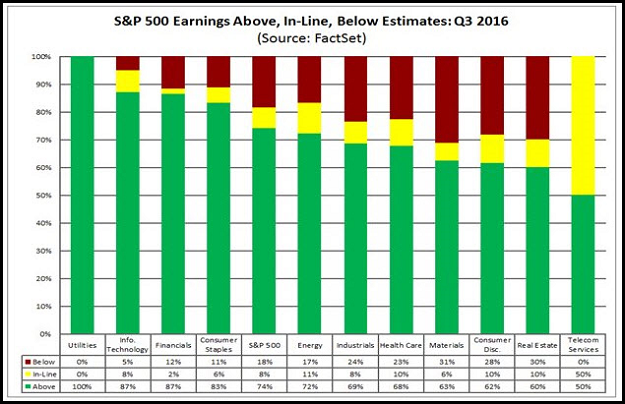

- Better-than-expected Q3 earnings: 74% beat rate so far.

- Mixed economic data: Q3 GDP helped by a big soybean export, Service PMI strong, but new durable goods orders weak.

- Rising price pressures in real estate and average wages.

- Basic metals prices are breaking higher.

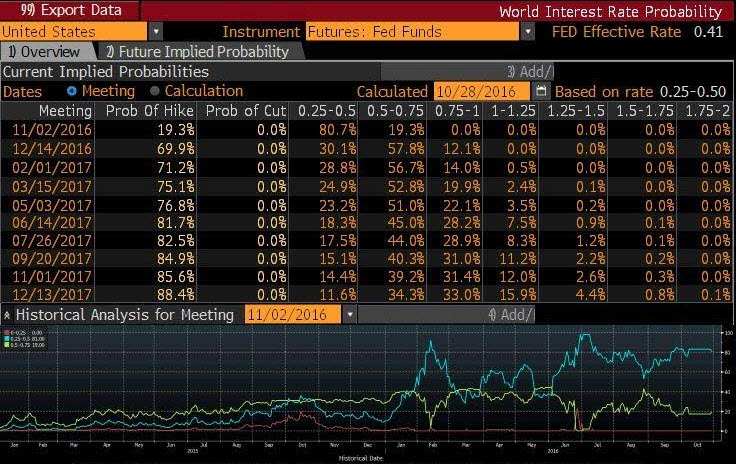

- The markets are betting on the Fed to pause on rates this week, but hike in December.

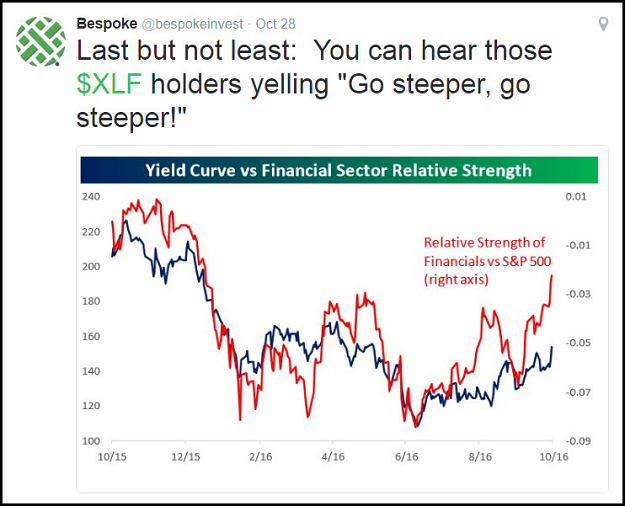

- Longer rates are setting new recent highs and yield curves are steepening.

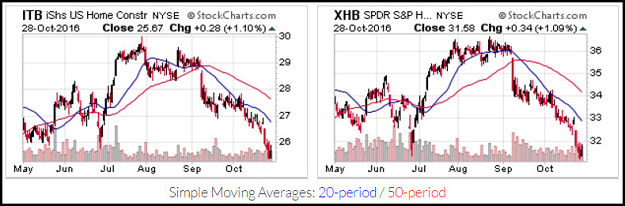

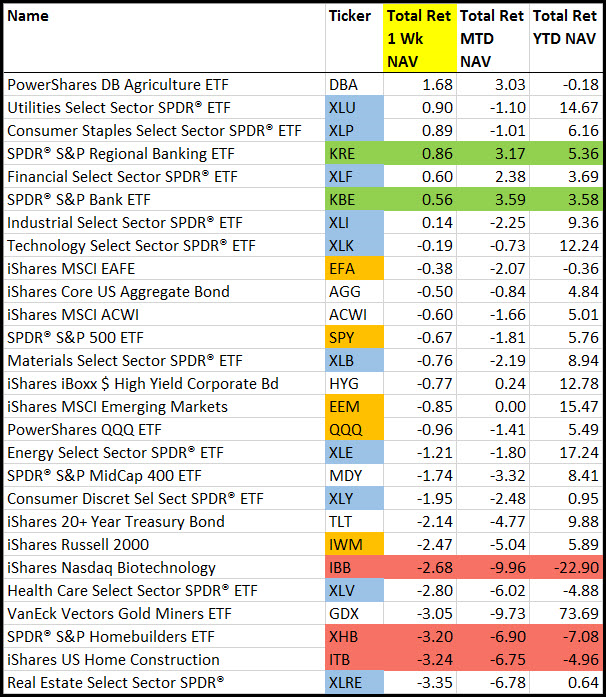

- Bank stocks like this move in rates. REITs and Housing stocks hate it.

- Small and Mid Cap stocks are underperforming Large Caps. Is this worry about risk or just a beat down of Consumer and Health Care stocks?

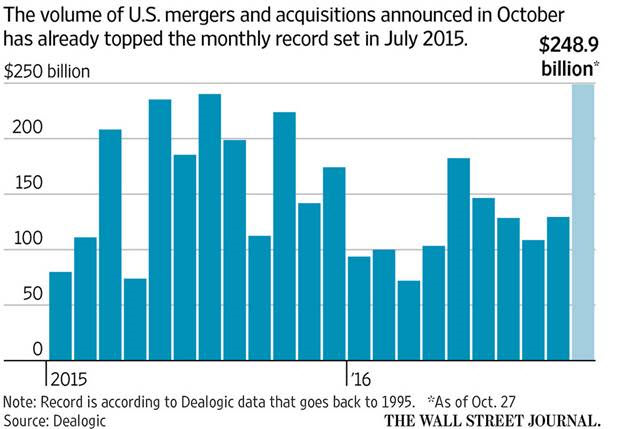

- Even more corporate M&A this weekend to end an already busy month: QCOM+NXPI, LVLT+CTL, TMHI going private, BHI+GE, HOG going private? BRCD selling itself?

- Want a sector to really scare investors? Just scream Healthcare in a room full of portfolio managers. This entire group is just one giant negative volatility alert.

- And unfortunately for the markets, former Congressman Weiner’s laptop and server. Once again, you could not dream up a more bizarre election race.

The big market news last week was the new level reached in the U.S. 10-year note yield…

The U.S. was not the only country to witness a jump in risk-free interest rates. Here is Germany’s 10-year yield…

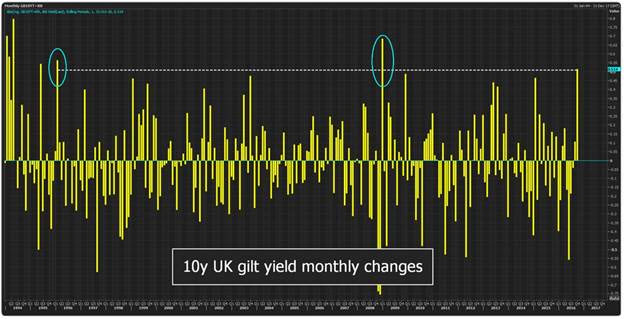

The U.K. also had an epic jump in 10-year yields. Wonder how many were watching Apple’s 20% price hike on future U.K. sales…

@ReutersJamie: UK bond yields up more than 50 bps in October. On course for biggest monthly rise since Jan 2009, second biggest in over 20 years.

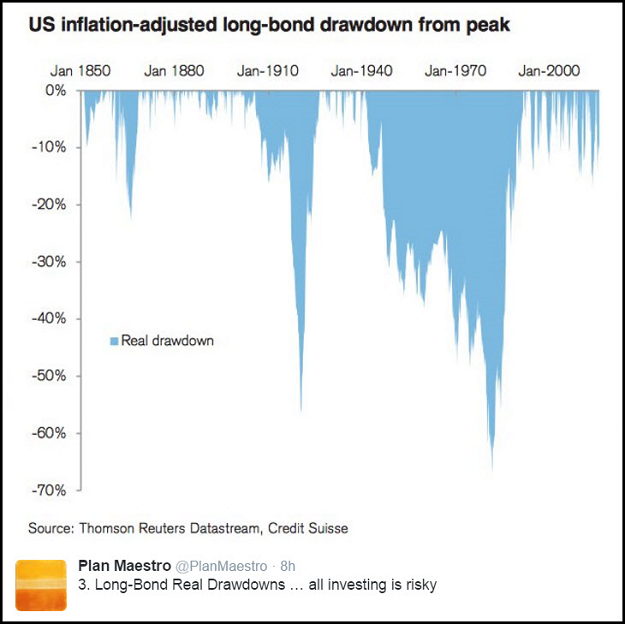

A very long look back at Bond market drawdowns…

Market betting on no Fed rate hike this week but odds at 70% for December…

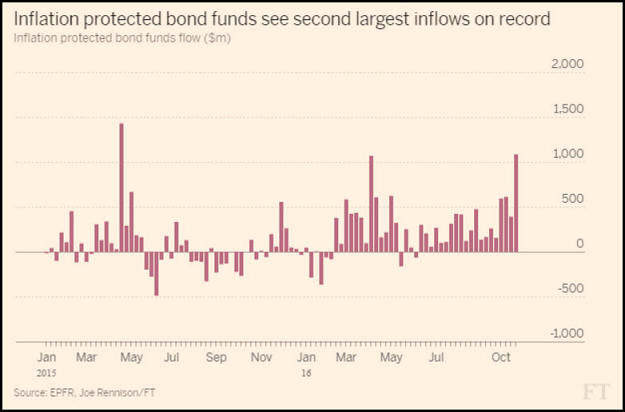

As regular Treasuries are being sold, TIPS are being bought…

A sell-off continued to reverberate across global sovereign debt markets on Friday, pushing yields on the debt higher at the end of a week when investors poured $1.1bn into inflation-protected bond funds, amid lingering fears that inflation will push interest rates higher.

The inflow is the second-largest since the start of 2007, according to EPFR, and the largest since April 2015 and the data chimed with the nervous feel to trade across the market.

Within equities, Financial stocks are enjoying the steepening in the yield curve…

While REIT investors just can’t handle the thought of higher funding costs…

Housing should benefit from the lack of supply and high apartment prices, but don’t tell that to the stocks…

U.S. equity breadth measures are beginning to slide across the board. Here are 52-week highs minus lows…

(@Callum_Thomas)

For the week, earnings and interest rates had a meaningful impact on sector returns. Healthcare broke down on pricing pressures while earnings and rising rates helped Financials…

Still so much cash floating around the system…

Beep Beep: “Still no sign of excessive leverage in the system,” said Roadrunner, the market’s biggest volatility trader. “Lot of pessimism still.” Investor cash levels remain near levels seen after the 9/11 attack. “You need the market to be over-leveraged and wildly bullish for a real bear market.” This extraordinary monetary experiment has pushed both asset prices and investor alarm higher. This odd combination leaves overvalued assets climbing a perpetual wall of worry. “But October set a record for M&A deals ($250bln in US), that’s what starts to happen at highs.”

(Eric Peters, Wknd Notes)

And here comes more cash…

Carlyle said it aimed to raise $100bn over the next four years, drawing on investor demand for returns after assets overseen by the US private equity group have shrunk for four straight quarters.

The ambitious target, disclosed on Wednesday on the company’s earnings call with analysts and investors, compares with the $169bn Carlyle oversees now, down from $188bn last year. The Washington DC-based group hopes to capitalise on investors turning to alternative investments that may help them generate returns that outstrip stocks and bonds.

Carlyle will seek to invest the new money across financial services, energy and natural resources, US real estate, global infrastructure and private equity fund-of-funds, among other things.

Amassing such firepower indicates that the company may be preparing for a market downturn that could then create buying opportunities. The company already has $54bn of dry powder, and has been putting new money to work cautiously at a time of volatility but still high valuations. It invested $1.6bn in equity in the three months that ended in September, the same amount as in 2015.

Following up from last week, the corporate weddings continue in full force…

This weekend saw announcements or work being done on:

- GE + Baker Hughes for $30b

- CenturyTel + Level3 for $34b

- Blackstone buying TMH for $6b

- Harley Davidson considering going private

- Brocade thinking about putting itself up for sale

(WSJ)

Another very big week completed for corporate earnings. One big one left this week…

@FactSet: 74% of $SPX companies have beaten EPS estimates for Q3, above 5-year average (67%).

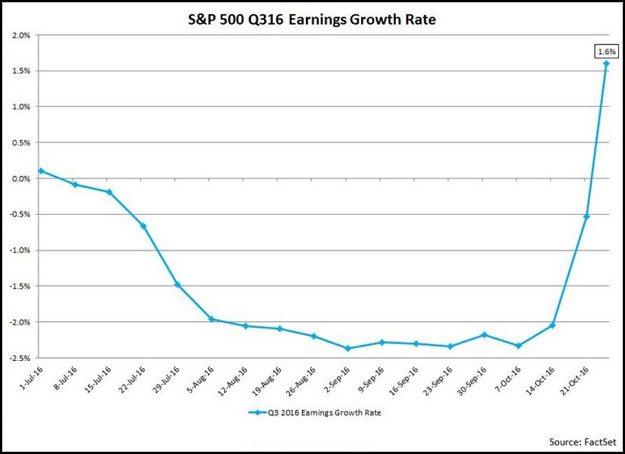

Analysts didn’t figure that S&P 500 earnings growth would be positive this Q3…

(Factset)

But as Caterpillar suggests, the outlook is still very cloudy…

“Economic weakness throughout much of the world persists and, as a result, most of our end markets remain challenged,” said Doug Oberhelman, Caterpillar’s outgoing chairman and chief executive.

“In North America, the market has an abundance of used construction equipment, rail customers have a substantial number of idle locomotives, and around the world there are a significant number of idle mining trucks…

Caterpillar also sees little signs of improvement next year, saying sales and revenues for 2017 will not be “significantly different” than 2016, which would make it the fifth straight year where it would not record sales growth.

“While we are seeing early signals of improvement in some areas, we continue to face a number of challenges. We remain cautious as we look ahead to 2017, but are hopeful as the year unfolds we will begin to see more positive momentum. Whether or not that happens, we are continuing to prepare for a better future,” said Mr Oberhelman.

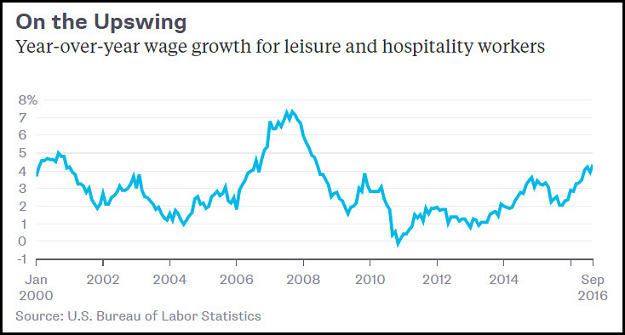

And Cheesecake Factory highlighted one of the economy’s growing concerns…

“Well, labor’s a big part of it. We’re at 5% wage rate inflation – we expect that the comp store sales for the year at 1% to 2%, as we’ve talked about, we’ve been managing through the industry labor pressure and continue to believe, as I said earlier, that we have pricing power in 2017,” Cheesecake Factory’s CFO Douglas Benn

The fight for cheap service labor grows…

The story of the labor market over the past several quarters is that employers looking to hire cheap service labor are having a harder and harder time. Compounding the problem is the fact that restaurants, retailers, logistics firms and distribution centers are fighting over a similar pool of workers. This has pushed wage growth for leisure and hospitality workers to an eight-year high of 4.3 percent.

This wage growth is becoming particularly painful for restaurants, which are struggling to pass along price increases to consumers. This is acute for restaurants because although they provide a service, their competitor (grocery stores) provides a good. The cost of the service would tend to rise with wage growth, even as the cost of the goods would fall because exchange rates and cheaper energy used to produce that food.

Remember when drug distribution stocks were a must own growth story? Increasing price wars have made them un-growth stocks…

There are early warning signs that the steady march upward of drug prices is slowing. That is bad news for drug makers and for all of the health-care companies that have profited from consistently higher prices.

The warning comes from drug distributor McKesson, which reported sales and revenue well short of analyst expectations. McKesson also announced a significant cut to the profit guidance for the full fiscal year, which ends in March.

McKesson and its rivals, Cardinal Health and AmerisourceBergen, are essentially middlemen, and their shares are generally steady performers. So Friday’s 20% decline in McKesson’s shares is quite dramatic, while its rivals’ shares also tumbled.

The selloff was part of a wider downturn in health-care stocks on Friday. Shares ofAbbVie, Amgen and Express Scripts were all down sharply.

John Hammergren, chief executive and chairman of McKesson, blamed the guidance cut, in part, on “further moderating branded pharmaceutical pricing trends compared to previous expectations.” Generic drug inflation is likewise cooling.

(WSJ)

(Schwab)

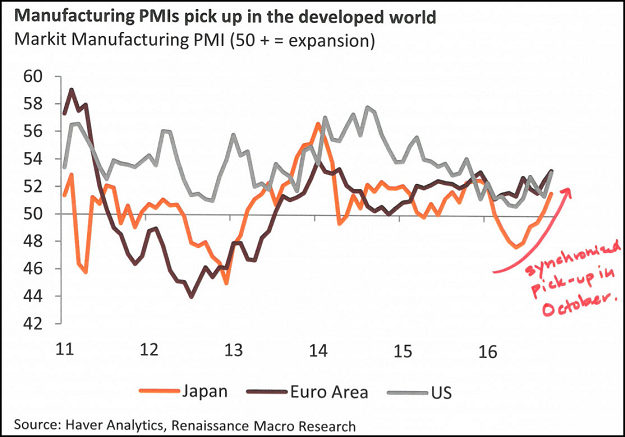

On the flip side, basic metals pricing is seeing rising prices…

RenMac shows that Global PMIs could justify the strengthening commodity prices…

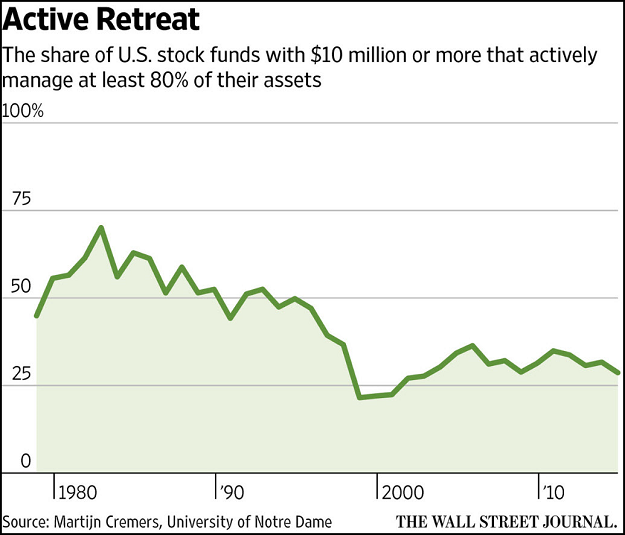

If closet indexing is truly three-quarters of active management, then it is no wonder why Mutual Fund outflows are hitting all-time highs. Either you pay someone to take risk or you go passive. There is no middle ground.

For years, many fund managers haven’t done much managing at all. Rather than painstakingly pick what they believe are the best stocks and avoid those they think are the worst, they shadow the market index against which their performance is evaluated. Here and there, they buy a bit more of this stock and a little less of that one, in what’s known as closet indexing.

But over time, you can’t beat the market by being the market, plus or minus a smidgen. After fees, often around 1% per year, plus trading costs, closet index funds seldom earn outperformance.

To call such chicken-hearted tweaks “active management” is an insult to the great swashbuckling stock pickers of the past like Peter Lynch of Fidelity Magellan or John Neff of Vanguard Windsor, who bought whatever they thought was cheap regardless of its arbitrary weight in a market index.

Not every fund manager can or should seek to stand out so far from the crowd. But, in a world where you can buy the entire stock market through passive index funds charging annual fees as low as as little as 0.03%, why hire an active manager for 30 times that cost unless he or she will be truly active?

(WSJ)

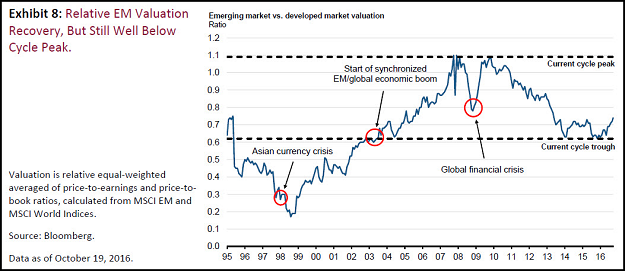

If you want to take a risk, Emerging Market equities still look like a good place to hunt…

On a common currency basis, EM equities have led developed markets by over 10 percentage points so far in 2016, the widest margin of outperformance since the peak of the last cycle. Valuations have correspondingly risen from their lows at the turn of the year, but crucially they remain undemanding in relative terms. Based on an unweighted average across price‐to‐earnings and price‐to‐book value ratios, EM equity multiples reached 1.09x developed market levels at their relative peak in late 2009, but after the protracted bear market of subsequent years that began 2016 at just 0.64x—a level similar to the early 2000s before the global credit, trade and commodity price boom of the pre‐crisis cycle. At 0.74x today, EM valuations have since recovered only around 20% of this relative de‐rating, and therefore still look moderate by historical comparison (Exhibit 8).

(U.S. Trust Capital Markets Outlook)

For the home team, Denver is leading the big city housing price bounce from the 2008 low…

But when compared to the same 20 cities, we have yet to catch up from the year 2000.

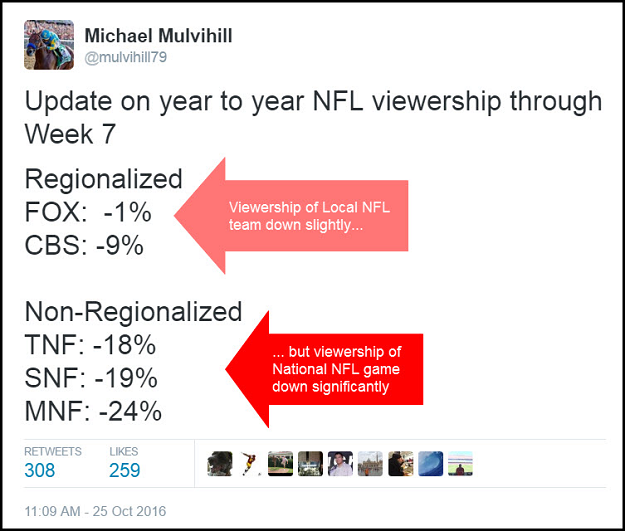

These NFL ratings tell me that viewers care about their home team, but they have no interest watching two losing records battle it out in primetime…

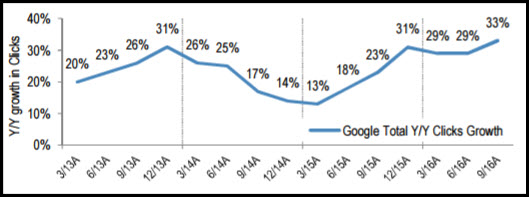

Back to earnings, it is amazing what Google has done with its core business growth…

On an earnings call with investors Thursday, Alphabet CFO Ruth Porat said the quarterly earnings were driven by growth in both search and YouTube.

“We had a great third quarter, with 20 percent revenue growth year on year, and 23 percent on a constant currency basis,” Porat said in a statement. “Mobile search and video are powering our core advertising business and we’re excited about the progress of newer businesses in Google and Other Bets.”

Advertising revenue for Google during the third quarter totaled $19.8 billion, up 18 percent from $16.8 billion last year. Aggregate paid clicks in the third quarter also increased, growing 33 percent year-over-year, while paid clicks on Google websites grew by 42 percent.

Aggregate cost-per-click decreased 11 percent, falling 13 percent on Google websites and 14 percent on Google network members’ websites.

(AdWeek)

Amazon had a weak reception to its earnings. But it looks like there will be some light at the end of this tunnel…

The Uber beer truck drove by our office this month. Crazy video if you haven’t seen it…

(Wired)

Finally, The Burridge Conference has a great lineup of speakers in a few weeks…

Come out to Boulder for the 2016 conference, where you can listen to experts in the financial markets, earn continuing education credits and enjoy lunch and a networking event in a fantastic venue.

Copyright © 361 Capital