by Jesse Felder, The Felder Report

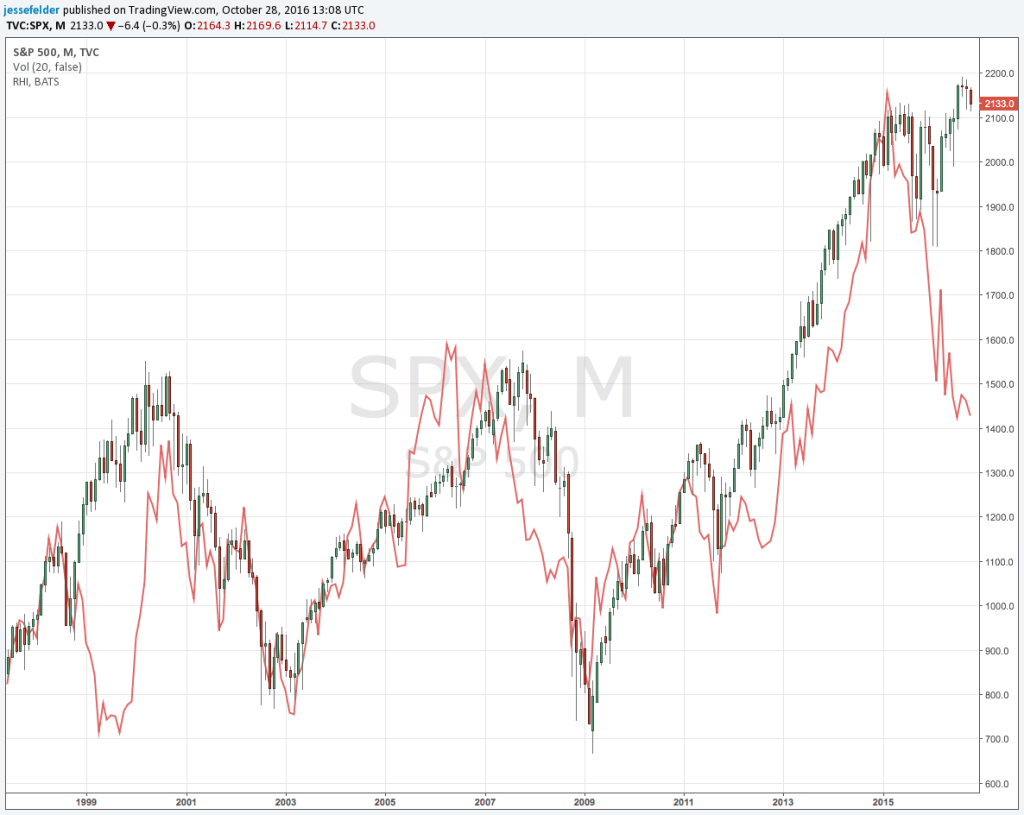

Robert Half is the largest staffing company in the country. It’s business and stock price are thus very good real time indicators of what’s going on in the broader jobs market and the economy, unlike the many lagging indicators economists like to focus on. A couple of weeks ago I tweeted the chart below. There is just a massive gap between the broader stock market (hope?) and Robert Half’s stock price (reality?) right now.

Last week, Robert Half announced earnings and thanks to my friend @skrisiloff we have a convenient summary of the company’s discussion during the conference call:

Didn’t get the lift we usually do in September and October

“Now, on the pace of deceleration, I’d say that July, we actually ended July stronger than we began it, we were encouraged by that. August wasn’t bad. But then September, where we usually start getting a sequential lift in September, we didn’t see the lift we typically get, instead, it was sequentially about flat. And then again, traditionally we get even more lift yet again in October and we didn’t see that lift either. So it’s essentially sequential flattening starting in July, rather than the lift we typically see in September and early October.”

Saw more softness in the accounting operations which would be consistent with softness in macro

“Well, I’d say Accountemps we saw more softness in the accounting operations positions and those are the ones that are typically more client demand sensitive, more client volume sensitive. So it’s consistent that if you were to see softness in accounting due to macro conditions you’d see it in accounting operations.”

All in all it sounds like this company is sending up a pretty clear warning for the economy and the markets right now.

Copyright © The Felder Report