Is Responsible Investing Near a Tipping Point in North America?

by Fixed Income AllianceBernstein

October 31, 2016

With environmental, social and governance (ESG) concerns becoming more pervasive among investors, Europe has taken an early lead in ESG adoption. But North America may not be far behind.

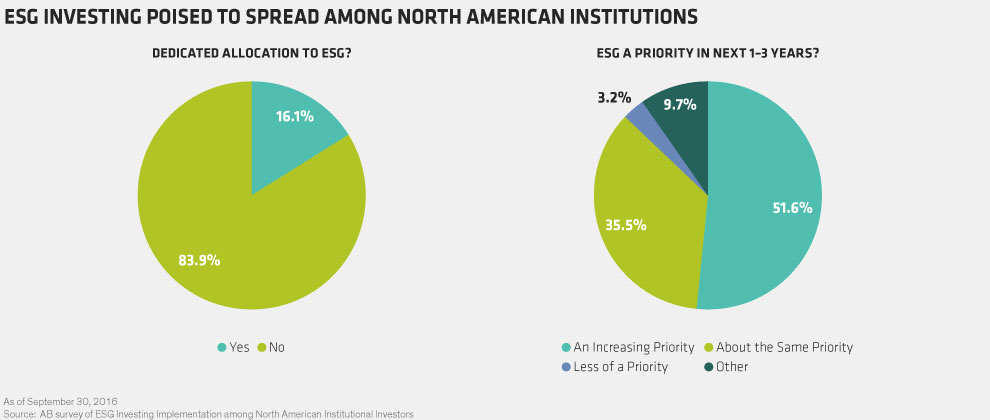

ESG investing may not be common in North America right now, but based on our recent ESG survey of more than 60 North American institutional asset allocators, it may be on the verge of joining the mainstream of investing.

Only 16% of respondents—professionals from retirement plans, endowments, foundations and gatekeepers encompassing roughly $500 billion in assets under management—said they currently have a specific ESG allocation. But when we asked them to consider the next one to three years, more than half of the respondents said that ESG considerations would become a bigger priority in manager selection.

Getting Ready to Follow in Europe’s Footsteps

Those intentions are good news if North American investors are to catch up with their European counterparts. Europe leads the global market for ESG investing, with more than half the world’s ESG assets. That’s according to the Global Sustainable Investment Alliance (GSIA), an international collaboration of membership-based sustainable-investment organizations.

If recent growth trends continue, North America may not be far behind Europe. In its second Global Sustainable Investment Review from 2014, GISA noted that the total market grew from $13.3 trillion to $21.4 trillion in the two years since the study began. Much of this increase can be traced to astounding growth in the two fastest-growing areas: the US (76% increase) and Canada (60%).

What Are They Waiting For?

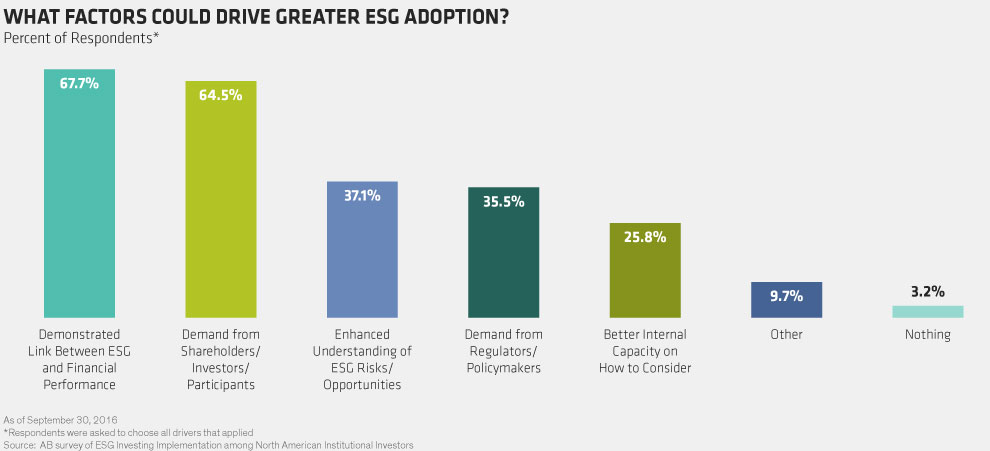

ESG investing appears to be gathering momentum, but some institutional investors still seem to be waiting before making a bigger commitment. What might spur them to give more consideration to ESG factors? The two biggest reasons cited were (1) a tighter link between ESG and company stock performance and (2) demand from shareholders, investors and participants.

The First-Mover Advantage to ESG Early Adopters

For investors who are taking a wait-and-see approach, it appears that the writing is on the wall: responsible investing is on the rise. Evidence is beginning to mount that investors are placing more emphasis on it—especially younger generations.

That trend is highlighted in a recent Spectrem Group study. It assessed the perceptions of socially responsible and impact investing among more than 3,000 investors with assets ranging from $100,000 to $25 million. Nearly half (49%) of millennials and 43% of Generation Xers with net worth of more than $1 million said social responsibility mattered when choosing an investment. The results weren’t as strong for older generations (just 34% for Baby Boomers and 27% for seniors), but that simply reinforces the point: the future favors ESG.

Millennials with net worth of less than $1 million were even more inclined toward social responsibility. Of those surveyed, 53% said social factors influenced their investment decisions. That’s more than Gen Xers (42%), Baby Boomers (41%) and seniors (39%).

Early adopters seem convinced that being ahead of the trend will bolster their reputations. Among investors who already had an allocation to ESG investing, enhanced reputation was cited as a potential benefit. This perception is consistent with the CFA Institute’s 2015 member survey; one-third of the respondents pointed to reputational benefits as a motivation for considering ESG issues.

ESG investing is clearly on the rise in North America, and conditions seem ripe for the trend to continue. As ESG becomes more widespread, institutional investors must tackle an inevitable question: What’s the best approach to ESG? There are pros and cons to each, which may be a good starting point for investors looking for an ESG strategy that’s the right fit.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein