by Reid Steadman, Managing Director, Equity Indices, S&P Dow Jones Indices

Passive investors do not buy and sell single securities, but they are often active in another way, in their search for indices that provide compelling return profiles. This is why I’m befuddled that a certain index – which is up 300% over the past 5 years – attracts so little attention.

I have a few theories why this is so. Here’s the simplest one: this index’s name convinces people that it is beyond comprehension. This is the name:

S&P 500 VIX Mid-Term Futures Inverse Daily Index

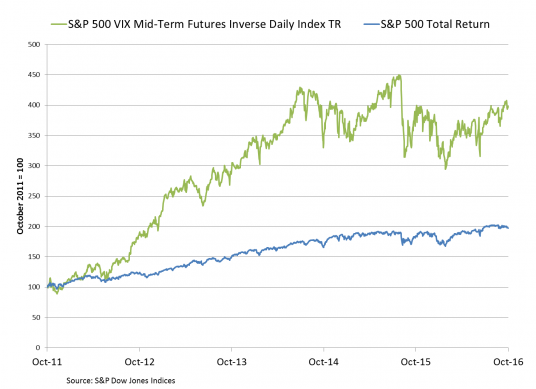

Now that you’ve digested this, here is the case, in one chart, for studying this index:

Despite this impressive record relative to the S&P 500, only $74 million tracks this index, all in a single exchange-traded note (“ETN”) launched in 2010. What gives?

The Strategy

Aside from the surface-level problem of the index name, another issue that inhibits use of this index is that it covers an asset class, volatility, which is out of many investors’ comfort zone. But the basics of this index are simpler than you would expect.

The essence of the S&P 500 VIX Mid-Term Futures Inverse Daily Index is that it takes a short position in futures contracts based on the CBOE Volatility Index, better known as VIX. Because investors buy VIX futures contracts to protect their portfolios against steep market declines, taking the other side of this transaction and shorting VIX futures is essentially selling insurance.

The economics of the car or home insurance markets are similar to those of the VIX futures market. Buyers of VIX futures contracts pay a premium – in the form of a roll cost – and sellers of VIX futures contracts collect this. Insurance providers and VIX futures sellers lose big time when disaster hits, but the proceeds accumulated during periods of calm can make systematic selling profitable, as the chart above shows.

The S&P 500 VIX Mid-Term Futures Inverse Daily Index shorts a specific set of futures, those that are four to seven months from expiration. This is where the “Mid-Term” comes from. An investor selling VIX futures is betting that the price of market insurance will not spike up in the months ahead, negating gains.

Yes, Volatile, but Less Volatile

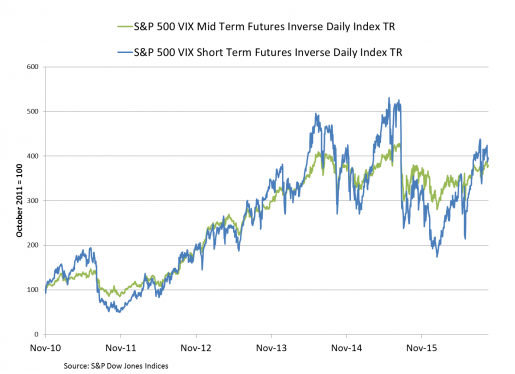

Another reason investors might shy away from the S&P 500 VIX Mid-Term Futures Inverse Daily Index is that it is volatile. Though it is true that this index is more volatile than the S&P 500, this index is much less volatile than a similar index, the S&P 500 VIX Short-Term Futures Inverse Daily Index, which has over $500 million tracking it in an ETN that trades on average 24.5 million shares a day.

The chart below shows the index histories for the Mid-Term and Short-Term indices since they became investable when ETNs launched in 2010. These indices have achieved close to the same return in this time frame, but the S&P 500 VIX Mid-Term Futures Inverse Daily Index took a smoother path.

Investors Should Care About This Index

So the index name and methodology provide an initial scare, but there is a good reason to settle down and take this index seriously. Over certain periods, the S&P 500 VIX Mid-Tem Futures Inverse Daily Index has allowed investors to collect a rather rich insurer’s premium. It is indeed subject to serious drawdowns, as the second chart in this post shows, but those declines are less severe than users of the more popular Short-Term Index experience. Because of this, the Mid-Term Index may be ideal for investors not seeking to buy or sell at every turn in the market, but those wanting to profit from longer-term trends in volatility.

This article is a publication of S&P Dow Jones Indices LLC. © S&P Dow Jones Indices LLC 2016. S&P® is a registered trademark of S&P Financial Services LLC. Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. S&P Dow Jones Indices LLC is not an investment advisor. This publication is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold a security, nor is it considered to be investment advice.

Copyright © S&P Dow Jones Indices